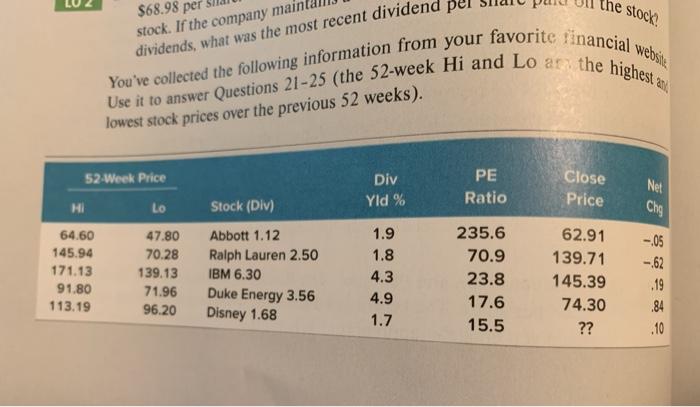

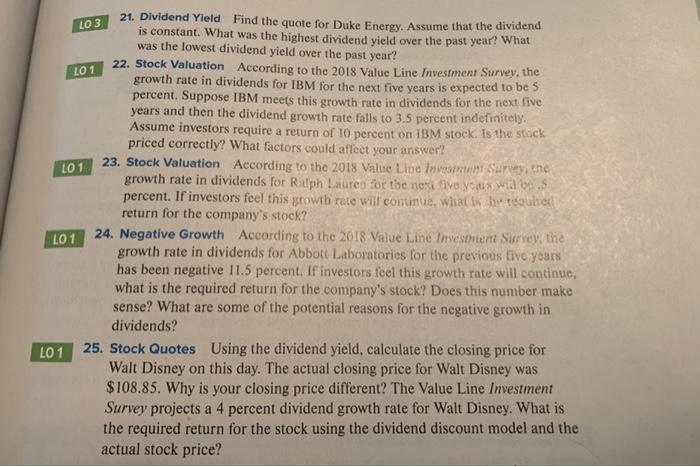

Use it to answer Questions 21-25 (the 52-week Hi and Loan the highest 2. You've collected the following information from your favorite financial website LUZ $68.98 per stock stock. If the company maint dividends, what was the most recent dividen lowest stock prices over the previous 52 weeks). 52 Week Price Div Yld % PE Ratio Close Price Net HI Lo Stock (DIV) Chi -.05 -62 64.60 145.94 171.13 91.80 113.19 47.80 70.28 139.13 71.96 96.20 Abbott 1.12 Ralph Lauren 2.50 IBM 6.30 Duke Energy 3.56 Disney 1.68 1.9 1.8 4.3 4.9 1.7 235.6 70.9 23.8 17.6 15.5 62.91 139.71 145.39 74.30 ?? .19 .84 .10 LO3 L01 L01 LO1 21. Dividend Yield Find the quote for Duke Energy. Assume that the dividend is constant. What was the highest dividend yield over the past year? What was the lowest dividend yield over the past year? 22. Stock Valuation According to the 2018 Value Line Investment Survey, the growth rate in dividends for IBM for the next five years is expected to be 5 percent. Suppose IBM meets this growth rate in dividends for the next five years and then the dividend growth rate falls to 3.5 percent indefinitely. Assume investors require a return of 10 percent on iBM stock. Is the stock priced correctly? What factors could affect your answer? 23. Stock Valuation According to the 2018 Value Line Investment Saru, the growth rate in dividends for Ralph Laureo for the next five years will be percent. If investors feel this growth rate will continue, what the required return for the company's stock? 24. Negative Growth According to the 2018 Value Line Investment Survey, the growth rate in dividends for Abbott Laboratories for the previous five years has been negative 11.5 percent. If investors feel this growth rate will continue, what is the required return for the company's stock? Does this number make sense? What are some of the potential reasons for the negative growth in dividends? 25. Stock Quotes Using the dividend yield, calculate the closing price for Walt Disney on this day. The actual closing price for Walt Disney was $108.85. Why is your closing price different? The Value Line Investment Survey projects a 4 percent dividend growth rate for Walt Disney. What is the required return for the stock using the dividend discount model and the actual stock price? LO 1