use roll number (14084) where needed

use roll number (14084) where needed

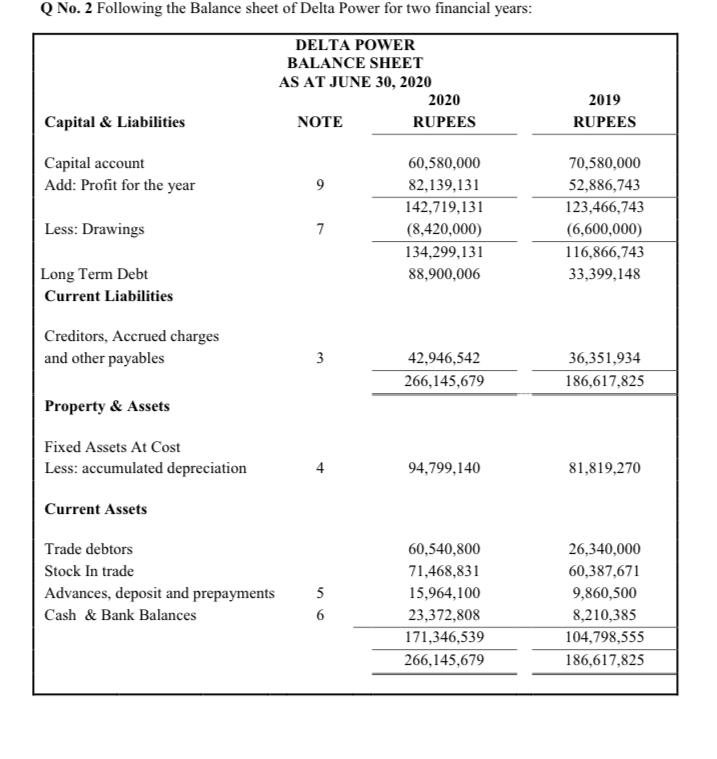

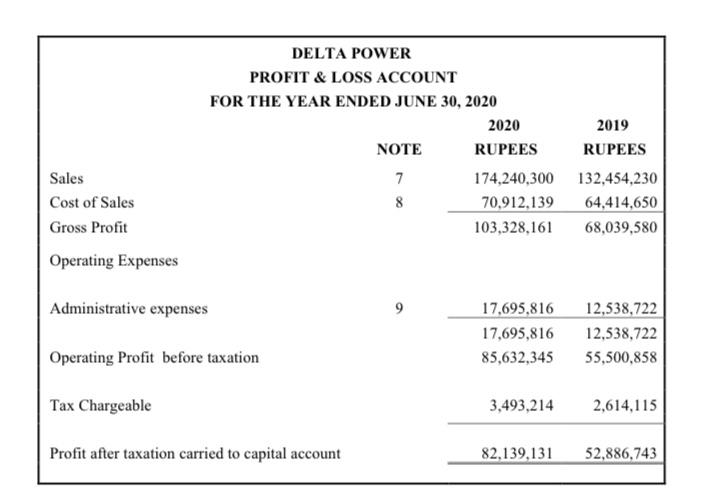

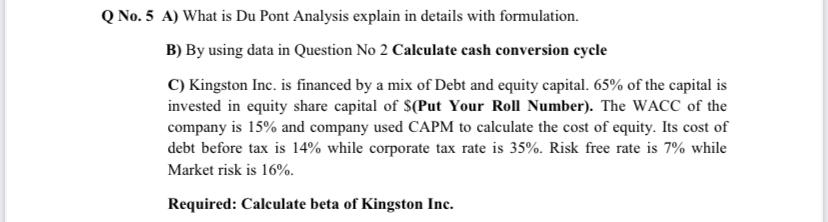

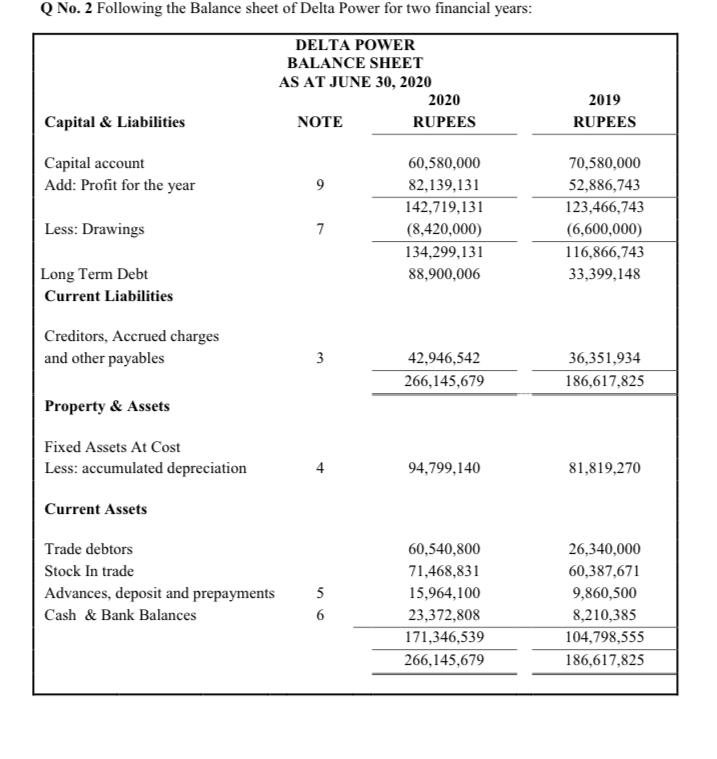

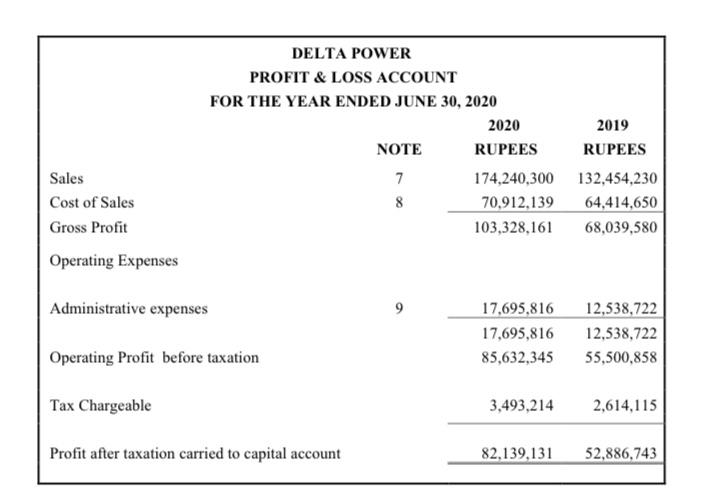

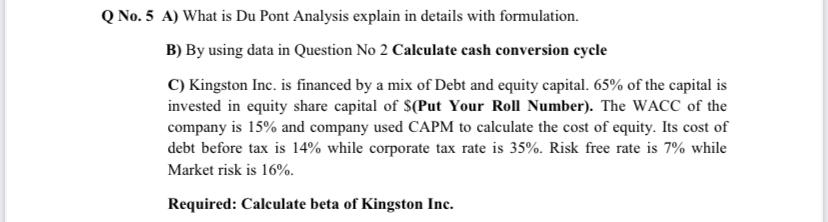

Q No. 2 Following the Balance sheet of Delta Power for two financial years: DELTA POWER BALANCE SHEET AS AT JUNE 30, 2020 2020 NOTE RUPEES 2019 RUPEES Capital & Liabilities Capital account Add: Profit for the year 9 60,580,000 82,139,131 142,719,131 (8,420,000) 134,299,131 88,900,006 70,580,000 52,886,743 123,466,743 (6,600,000) 116,866,743 33,399,148 Less: Drawings 7 Long Term Debt Current Liabilities Creditors, Accrued charges and other payables 3 3 42,946,542 266,145,679 36,351,934 186,617,825 Property & Assets Fixed Assets At Cost Less: accumulated depreciation 4 94,799,140 81,819,270 Current Assets Trade debtors Stock In trade Advances, deposit and prepayments Cash & Bank Balances 5 5 6 60,540,800 71,468,831 15,964,100 23,372,808 171,346,539 266,145,679 26,340,000 60,387,671 9,860,500 8,210,385 104,798,555 186,617,825 DELTA POWER PROFIT & LOSS ACCOUNT FOR THE YEAR ENDED JUNE 30, 2020 2020 2019 NOTE RUPEES RUPEES 7 174,240,300 132,454,230 8 70,912,139 64,414,650 103,328,161 68,039,580 Sales Cost of Sales Gross Profit Operating Expenses Administrative expenses 9 17,695,816 17,695,816 85,632,345 12,538,722 12,538,722 55,500,858 Operating Profit before taxation Tax Chargeable 3,493,214 2,614,115 Profit after taxation carried to capital account 82,139,131 52.886,743 Q No. 5 A) What is Du Pont Analysis explain in details with formulation. B) By using data in Question No 2 Calculate cash conversion cycle C) Kingston Inc. is financed by a mix of Debt and equity capital. 65% of the capital is invested in equity share capital of $(Put Your Roll Number). The WACC of the company is 15% and company used CAPM to calculate the cost of equity. Its cost of debt before tax is 14% while corporate tax rate is 35%. Risk free rate is 7% while Market risk is 16%. Required: Calculate beta of Kingston Inc. Q No. 2 Following the Balance sheet of Delta Power for two financial years: DELTA POWER BALANCE SHEET AS AT JUNE 30, 2020 2020 NOTE RUPEES 2019 RUPEES Capital & Liabilities Capital account Add: Profit for the year 9 60,580,000 82,139,131 142,719,131 (8,420,000) 134,299,131 88,900,006 70,580,000 52,886,743 123,466,743 (6,600,000) 116,866,743 33,399,148 Less: Drawings 7 Long Term Debt Current Liabilities Creditors, Accrued charges and other payables 3 3 42,946,542 266,145,679 36,351,934 186,617,825 Property & Assets Fixed Assets At Cost Less: accumulated depreciation 4 94,799,140 81,819,270 Current Assets Trade debtors Stock In trade Advances, deposit and prepayments Cash & Bank Balances 5 5 6 60,540,800 71,468,831 15,964,100 23,372,808 171,346,539 266,145,679 26,340,000 60,387,671 9,860,500 8,210,385 104,798,555 186,617,825 DELTA POWER PROFIT & LOSS ACCOUNT FOR THE YEAR ENDED JUNE 30, 2020 2020 2019 NOTE RUPEES RUPEES 7 174,240,300 132,454,230 8 70,912,139 64,414,650 103,328,161 68,039,580 Sales Cost of Sales Gross Profit Operating Expenses Administrative expenses 9 17,695,816 17,695,816 85,632,345 12,538,722 12,538,722 55,500,858 Operating Profit before taxation Tax Chargeable 3,493,214 2,614,115 Profit after taxation carried to capital account 82,139,131 52.886,743 Q No. 5 A) What is Du Pont Analysis explain in details with formulation. B) By using data in Question No 2 Calculate cash conversion cycle C) Kingston Inc. is financed by a mix of Debt and equity capital. 65% of the capital is invested in equity share capital of $(Put Your Roll Number). The WACC of the company is 15% and company used CAPM to calculate the cost of equity. Its cost of debt before tax is 14% while corporate tax rate is 35%. Risk free rate is 7% while Market risk is 16%. Required: Calculate beta of Kingston Inc

use roll number (14084) where needed

use roll number (14084) where needed