Question

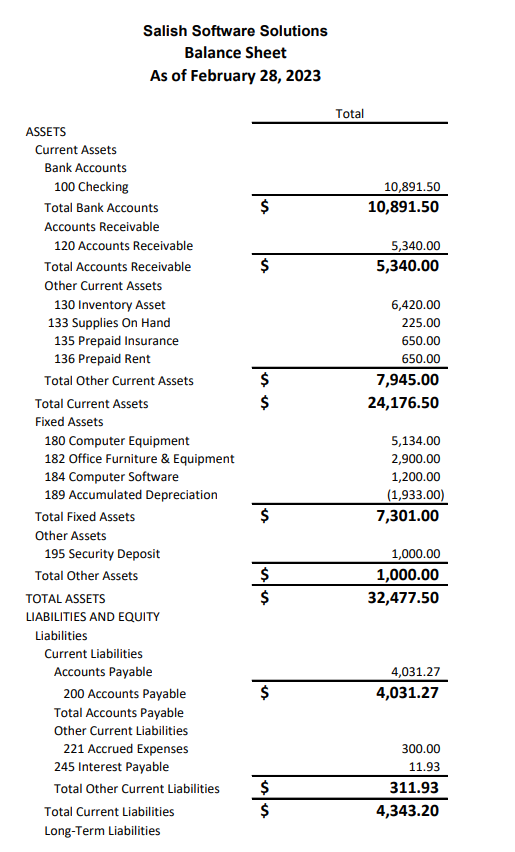

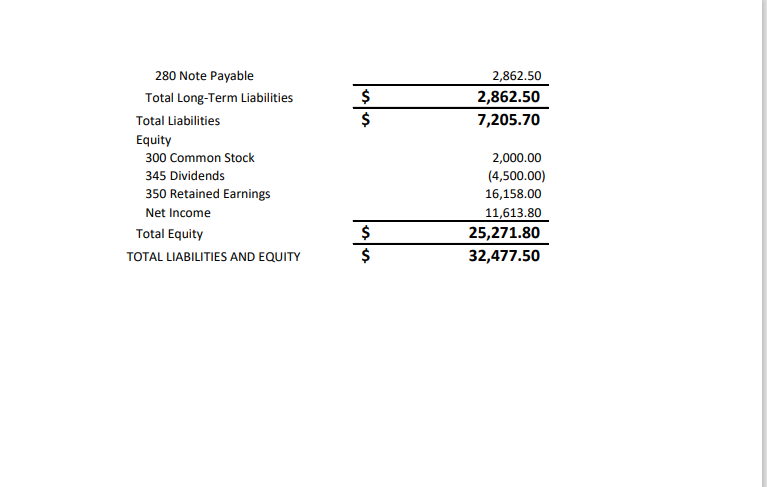

use Salish Software Solutions company reports and ratio formula chart provided in this module. Salish Software Solutions company Balance Sheet at February 28, 2023 and

use Salish Software Solutions company reports and ratio formula chart provided in this module.

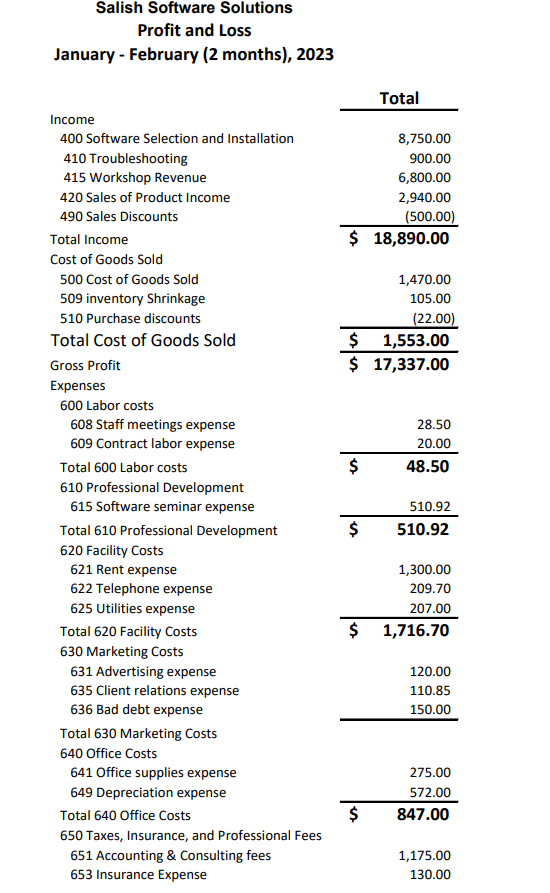

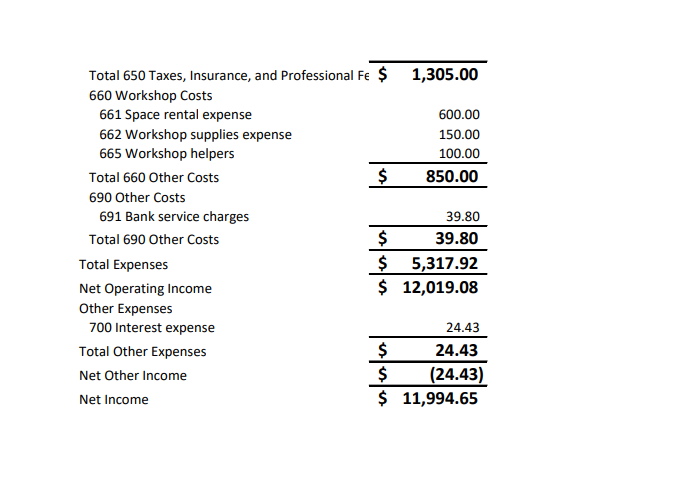

Salish Software Solutions company Balance Sheet at February 28, 2023 and Profit & Loss for January 1 2023 - February 28, 2023 reports provided.

Financial ratios listed on ratio formulas chart.

Salish Software Solutions reports for this assignment are below

balance Sheet As of February 28, 2023:

profit and loss

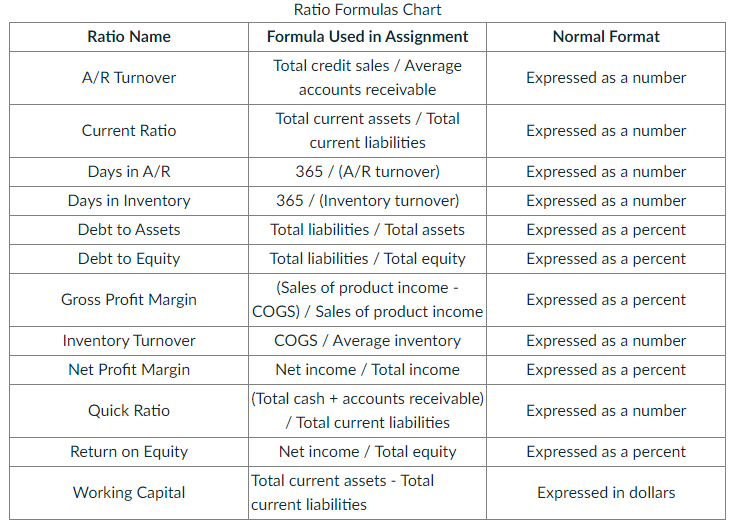

Ratio Formulas Chart

1.What is the A/R Turnover?

Assume credit sales for 2-month period total $17,195

Hint:

You are using Salish Software Solutions operating data (Profit and Loss data) for two months. To get an annual rate, you'll need to multiply the two month credit sales amount by six (6).

Since this is the first year of operations for Salish Software Solutions use the ending (February 28th) Accounts Receivable balance instead of averages

2. What is the current ratio?

round 2 decimal places, for example 1.226 is entered as 1.23.

3. What is Days in A/R?

Round answer to 2 decimals.

4. What is Days in Inventory?

Round answer to 2 decimals

5.What is Debt to Assets?

Express as %, round to 1 decimal place

6. What is Debt to Equity?

Express as %, round to 1 decimal place

7. What is Gross Profit Margin?

Express as %, round to 1 decimal place

8. What is inventory turnover?

Hint:

You are using your Salish Software Solutions operating data (Profit and Loss data) for two months. To get an annual rate, you'll need to multiply the appropriate Profit and Loss amount by six (6).

Since this is the first year of operations for Salish Software Solutions, use the ending (February 28th) Inventory balance instead of averages.

9.What is Net Profit Margin?

Express as %, round to 1 decimal place

10. What is the quick ratio?

Round to 2 decimal places

11. What is Return on Equity

Express as %, round to 1 decimal place

12.What is working capital?

Round to whole amount without cents

Salish Software Solutions Ralaneo Choot \begin{tabular}{lrr} 280 Note Payable & & 2,862.50 \\ \cline { 2 - 3 } Total Long-Term Liabilities & $ & 2,862.50 \\ \cline { 2 - 3 } Total Liabilities & $ & 7,205.70 \\ Equity & & 2,000.00 \\ 300 Common Stock & (4,500.00) \\ 345 Dividends & 16,158.00 \\ 350 Retained Earnings & & 11,613.80 \\ Net Income & $5,271.80 \\ Total Equity & $ & 32,477.50 \end{tabular} Salish Software Solutions Profit and Loss January - February (2 months), 2023 \begin{tabular}{lrr} Total 650 Taxes, Insurance, and Professional Fe & $ & 1,305.00 \\ 660 Workshop Costs & 600.00 \\ 661 Space rental expense & 150.00 \\ 662 Workshop supplies expense & 100.00 \\ 665 Workshop helpers & $ & 850.00 \\ \hline Total 660 Other Costs & & 39.80 \\ 690 Other Costs & $ & 39.80 \\ 691 Bank service charges & $ & 5,317.92 \\ Total 690 Other Costs & $ & 12,019.08 \end{tabular} Other Expenses 700 Interest expense Total Other Expenses Net Other Income Net Income \begin{tabular}{rr} & 24.43 \\ \hline$ & 24.43 \\ \hline$ & (24.43) \\ \hline$ & 11,994.65 \end{tabular} Ratio Formulas Chart \begin{tabular}{|c|c|c|} \hline Ratio Name & Formula Used in Assignment & Normal Format \\ \hline A/R Turnover & Totalcreditsales/Averageaccountsreceivable & Expressed as a number \\ \hline Current Ratio & Totalcurrentassets/Totalcurrentliabilities & Expressed as a number \\ \hline Days in A/R & 365 / (A/R turnover) & Expressed as a number \\ \hline Days in Inventory & 365 / (Inventory turnover) & Expressed as a number \\ \hline Debt to Assets & Totalliabilities/Totalassets & Expressed as a percent \\ \hline Debt to Equity & Total liabilities / Total equity & Expressed as a percent \\ \hline Gross Profit Margin & (Salesofproductincome-COGS)/Salesofproductincome & Expressed as a percent \\ \hline Inventory Turnover & COGS / Average inventory & Expressed as a number \\ \hline Net Profit Margin & Net income / Total income & Expressed as a percent \\ \hline Quick Ratio & (Totalcash+accountsreceivable)/Totalcurrentliabilities & Expressed as a number \\ \hline Return on Equity & Net income / Total equity & Expressed as a percent \\ \hline Working Capital & Totalcurrentassets-Totalcurrentliabilities & Expressed in dollars \\ \hline \end{tabular} Salish Software Solutions Ralaneo Choot \begin{tabular}{lrr} 280 Note Payable & & 2,862.50 \\ \cline { 2 - 3 } Total Long-Term Liabilities & $ & 2,862.50 \\ \cline { 2 - 3 } Total Liabilities & $ & 7,205.70 \\ Equity & & 2,000.00 \\ 300 Common Stock & (4,500.00) \\ 345 Dividends & 16,158.00 \\ 350 Retained Earnings & & 11,613.80 \\ Net Income & $5,271.80 \\ Total Equity & $ & 32,477.50 \end{tabular} Salish Software Solutions Profit and Loss January - February (2 months), 2023 \begin{tabular}{lrr} Total 650 Taxes, Insurance, and Professional Fe & $ & 1,305.00 \\ 660 Workshop Costs & 600.00 \\ 661 Space rental expense & 150.00 \\ 662 Workshop supplies expense & 100.00 \\ 665 Workshop helpers & $ & 850.00 \\ \hline Total 660 Other Costs & & 39.80 \\ 690 Other Costs & $ & 39.80 \\ 691 Bank service charges & $ & 5,317.92 \\ Total 690 Other Costs & $ & 12,019.08 \end{tabular} Other Expenses 700 Interest expense Total Other Expenses Net Other Income Net Income \begin{tabular}{rr} & 24.43 \\ \hline$ & 24.43 \\ \hline$ & (24.43) \\ \hline$ & 11,994.65 \end{tabular} Ratio Formulas Chart \begin{tabular}{|c|c|c|} \hline Ratio Name & Formula Used in Assignment & Normal Format \\ \hline A/R Turnover & Totalcreditsales/Averageaccountsreceivable & Expressed as a number \\ \hline Current Ratio & Totalcurrentassets/Totalcurrentliabilities & Expressed as a number \\ \hline Days in A/R & 365 / (A/R turnover) & Expressed as a number \\ \hline Days in Inventory & 365 / (Inventory turnover) & Expressed as a number \\ \hline Debt to Assets & Totalliabilities/Totalassets & Expressed as a percent \\ \hline Debt to Equity & Total liabilities / Total equity & Expressed as a percent \\ \hline Gross Profit Margin & (Salesofproductincome-COGS)/Salesofproductincome & Expressed as a percent \\ \hline Inventory Turnover & COGS / Average inventory & Expressed as a number \\ \hline Net Profit Margin & Net income / Total income & Expressed as a percent \\ \hline Quick Ratio & (Totalcash+accountsreceivable)/Totalcurrentliabilities & Expressed as a number \\ \hline Return on Equity & Net income / Total equity & Expressed as a percent \\ \hline Working Capital & Totalcurrentassets-Totalcurrentliabilities & Expressed in dollars \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started