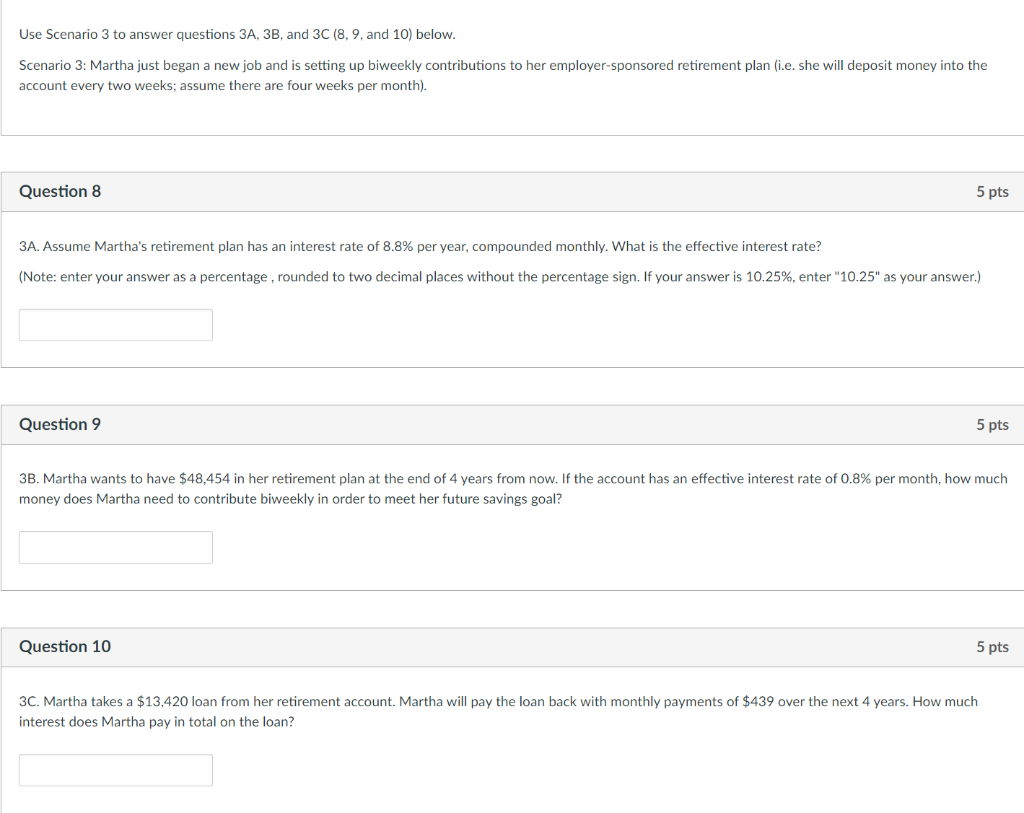

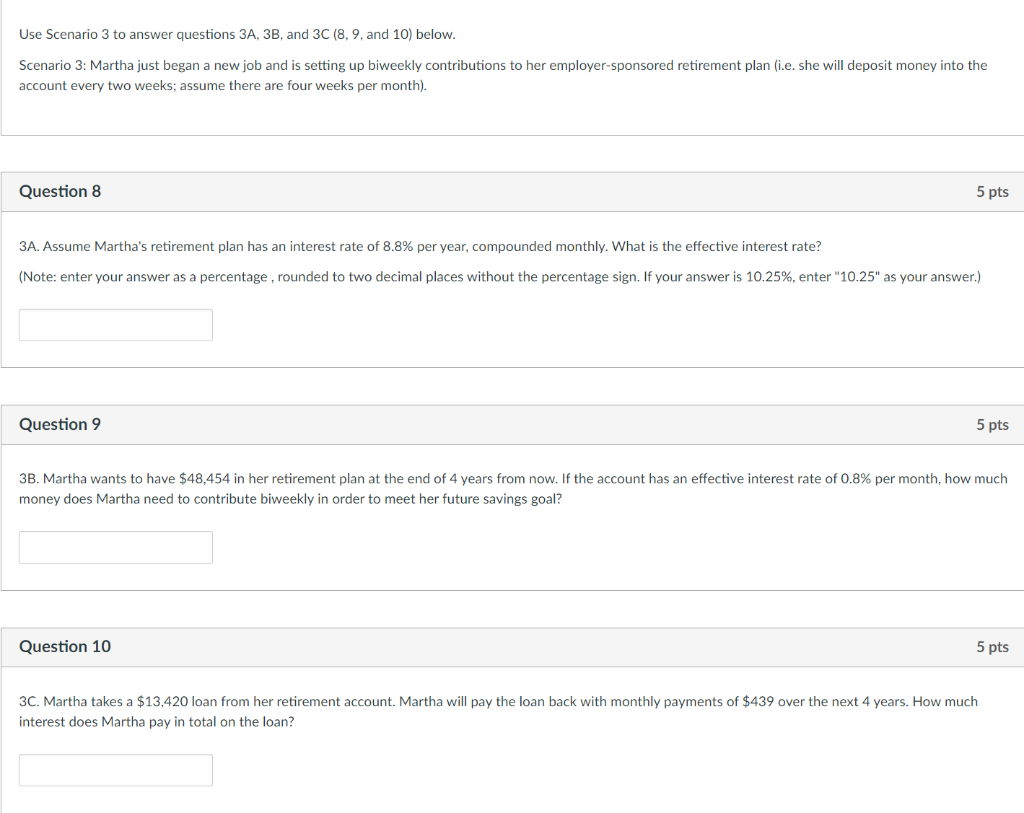

Use Scenario 3 to answer questions 3A, 3B, and 3C (8, 9, and 10) below. Scenario 3: Martha just began a new job and is setting up biweekly contributions to her employer-sponsored retirement plan (i.e. she will deposit money into the account every two weeks; assume there are four weeks per month). Question 8 5 pts 3A. Assume Martha's retirement plan has an interest rate of 8.8% per year, compounded monthly. What is the effective interest rate? (Note: enter your answer as a percentage, rounded to two decimal places without the percentage sign. If your answer is 10.25%, enter "10.25" as your answer.) Question 9 5 pts 3B. Martha wants to have $48,454 in her retirement plan at the end of 4 years from now. If the account has an effective interest rate of 0.8% per month, how much money does Martha need to contribute biweekly in order to meet her future savings goal? Question 10 5 pts 3C. Martha takes a $13,420 loan from her retirement account. Martha will pay the loan back with monthly payments of $439 over the next 4 years. How much interest does Martha pay in total on the loan? Use Scenario 3 to answer questions 3A, 3B, and 3C (8, 9, and 10) below. Scenario 3: Martha just began a new job and is setting up biweekly contributions to her employer-sponsored retirement plan (i.e. she will deposit money into the account every two weeks; assume there are four weeks per month). Question 8 5 pts 3A. Assume Martha's retirement plan has an interest rate of 8.8% per year, compounded monthly. What is the effective interest rate? (Note: enter your answer as a percentage, rounded to two decimal places without the percentage sign. If your answer is 10.25%, enter "10.25" as your answer.) Question 9 5 pts 3B. Martha wants to have $48,454 in her retirement plan at the end of 4 years from now. If the account has an effective interest rate of 0.8% per month, how much money does Martha need to contribute biweekly in order to meet her future savings goal? Question 10 5 pts 3C. Martha takes a $13,420 loan from her retirement account. Martha will pay the loan back with monthly payments of $439 over the next 4 years. How much interest does Martha pay in total on the loan