Answered step by step

Verified Expert Solution

Question

1 Approved Answer

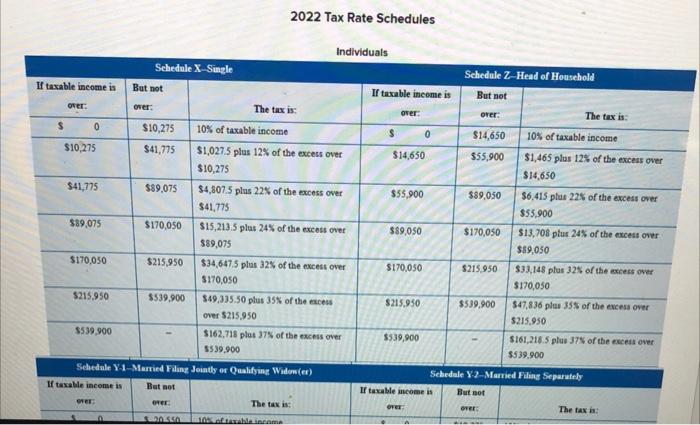

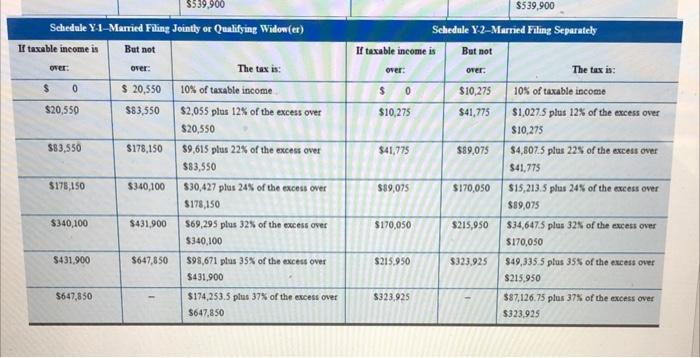

use tax schedule 2022 Required information [The following information applies to the questions displayed below] Demarco and Janine Jackson have been married for 20 years

use tax schedule 2022

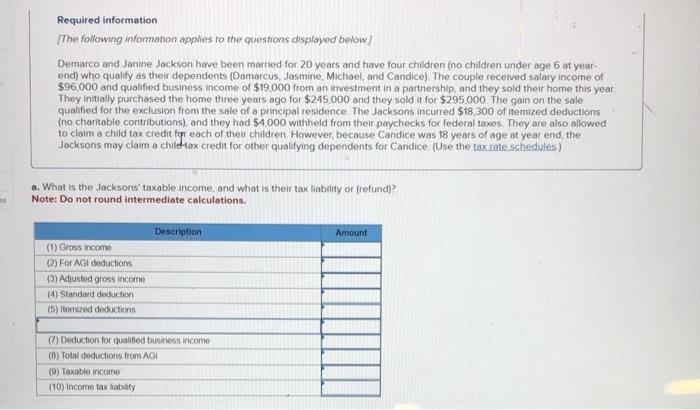

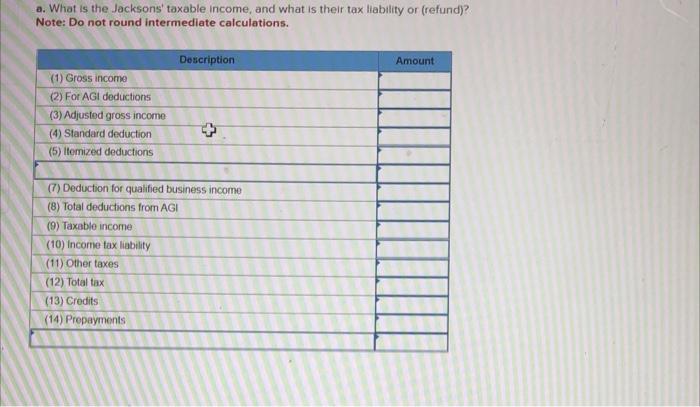

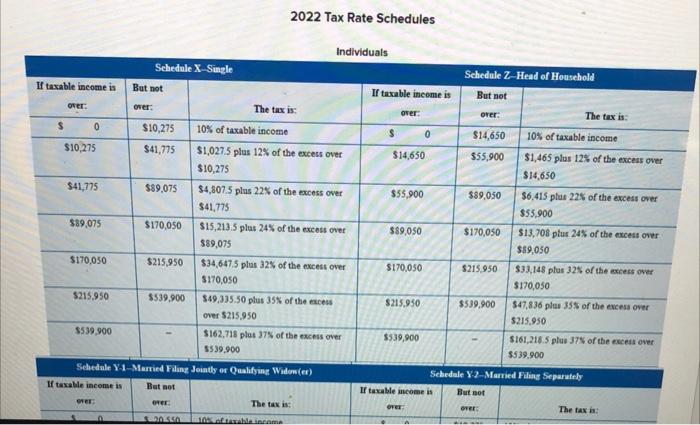

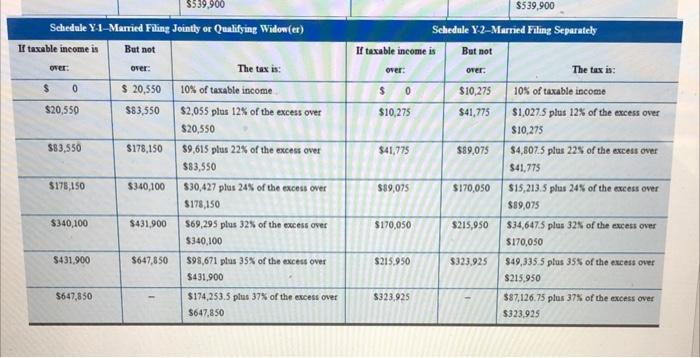

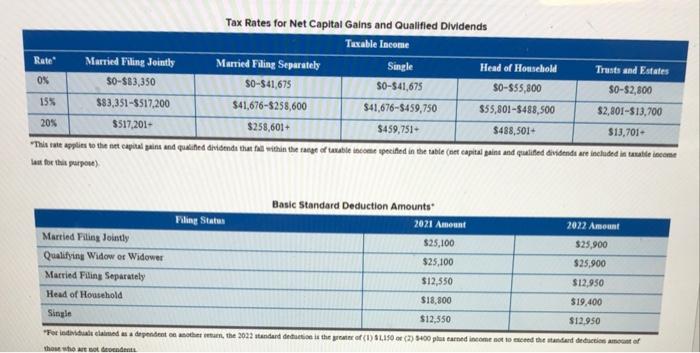

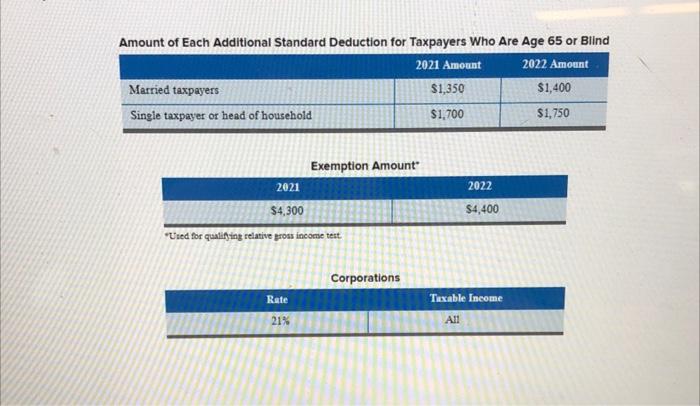

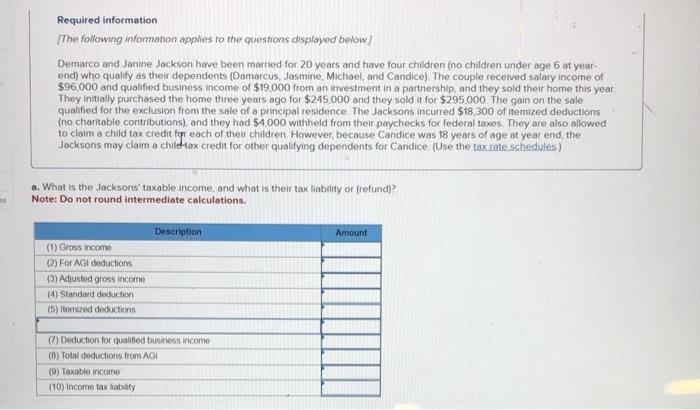

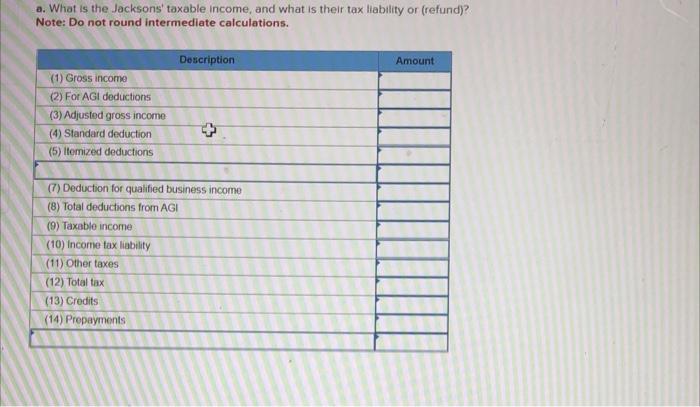

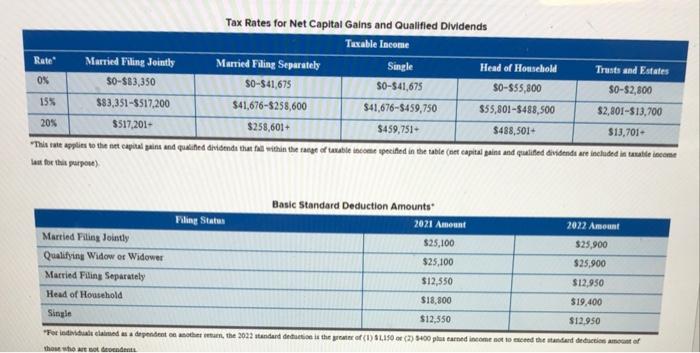

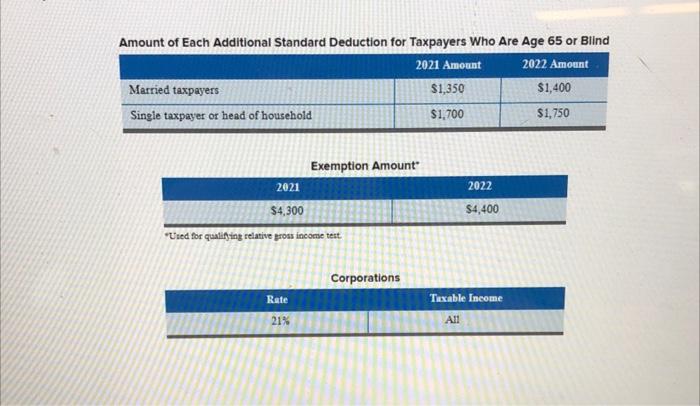

Required information [The following information applies to the questions displayed below] Demarco and Janine Jackson have been married for 20 years and have four children (no children under age 6 at year- end) who qualify as their dependents (Damarcus, Jasmine, Michael, and Candice). The couple received salary income of $96,000 and qualified business income of $19,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $245,000 and they sold it for $295,000. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $18,300 of itemized deductions (no charitable contributions), and they had $4,000 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice was 18 years of age at year end, the Jacksons may claim a child-tax credit for other qualifying dependents for Candice. (Use the tax rate schedules) a. What is the Jacksons' taxable income, and what is their tax liability or (refund)? Note: Do not round intermediate calculations. es Description Amount (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itomized deductions (7) Deduction for qualified business income (8) Total deductions from AGI (9) Taxable income (10) Income tax sabaty a. What is the Jacksons' taxable income, and what is their tax liability or (refund)? Note: Do not round intermediate calculations. Description Amount (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Deduction for qualified business income (8) Total deductions from AGI (9) Taxable income (10) Income tax liability (11) Other taxes (12) Total tax (13) Credits (14) Prepayments If taxable income is over: S 0 $10,275 $41,775 $39,075 $170,050 $215,950 Schedule X-Single If taxable income is over But not over: $10,275 $41,775 $89,075 $170,050 $215,950 $539,900 $539,900 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) But not over: The tax is: $20.550 10% of taxable income 2022 Tax Rate Schedules Individuals The tax is 10% of taxable income $1,027.5 plus 12% of the excess over $10,275 $4,807.5 plus 22% of the excess over $41,775 $15,213.5 plus 24% of the excess over $89,075 $34,647.5 plus 32% of the excess over $170,050 $49,335.50 plus 35% of the excess over $215,950 $162,718 plus 37% of the excess over $539,900 If taxable income is over: $ Schedule Z-Head of Household But not over: $14,650 $55,900 $89,050 $170,050 $215,950 $539,900 Schedule Y-2-Married Filing Separately But not Over: 0 $14,650 $55,900 $89,050 $170,050 $215,950 $539,900 If taxable income is Over: The tax is: 10% of taxable income $1,465 plus 12% of the excess over $14,650 $6,415 plus 22% of the excess over $55,900 $13,708 plus 24% of the excess over $89,050 $33,148 plus 32% of the excess over $170,050 $47,836 plus 35% of the excess over $215,950 $161,218.5 plus 37% of the excess over $539,900 The tax is: $539,900 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) But not over: The tax is: $ 20,550 10% of taxable income $83,550 $2,055 plus 12% of the excess over $20,550 $178,150 $9,615 plus 22% of the excess over $83,550 $340,100 $30,427 plus 24% of the excess over $178,150 $431,900 $69,295 plus 32% of the excess over $340,100 $647,850 $98,671 plus 35% of the excess over $431,900 $174,253.5 plus 37% of the excess over $647,850 If taxable income is over: $ 0 $20,550 $83,550 $178,150 $340,100 $431,900 $647,850 $539,900 Schedule Y-2-Married Filing Separately But not over: $10,275 10% of taxable income $41,775 $1,027.5 plus 12% of the excess over $10,275 $89,075 $4,807.5 plus 22% of the excess over $41,775 $170,050 $15,213.5 plus 24% of the excess over $89,075 $215,950 $34,647.5 plus 32% of the excess over $170,050 $323,925 $49,335.5 plus 35% of the excess over $215,950 $87,126.75 plus 37% of the excess over $323.925 If taxable income is over: $ 0 $10,275 $41,775 $89,075 $170,050 $215,950 $323,925 The tax is: Tax Rates for Net Capital Gains and Qualified Dividends Taxable Income Married Filing Jointly Married Filing Separately Single $0-$41,675 Head of Household $0-$55,800 Trusts and Estates $0-$2,800 $0-$83,350 $0-$41,675 15% $83,351-$517,200 $41,676-$459,750 $55,801-8488,500 $2,801-$13,700 $41,676-8258,600 $258,601+ 20% $517,201 $459,751+ $488,501+ $13,701+ "This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified dividends are included in taxable income last for this purpose) Basic Standard Deduction Amounts Filing Status 2021 Amount 2022 Amount Married Filing Jointly $25,100 $25,900 Qualifying Widow or Widower $25,100 $25,900 Married Filing Separately $12,550 $12,950 Head of Household $18,800 $19,400 Single $12,550 $12,950 "For individuals claimed as a dependent on another return, the 2022 standard deduction is the greater of (1) SL150 or (2) $400 plus earned income not to exceed the standard deduction amount of those who are not dependents Rate" 0% Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Blind 2021 Amount 2022 Amount Married taxpayers $1,350 $1,400 Single taxpayer or head of household $1,700 $1,750 Exemption Amount" 2021 $4,300 *Used for qualifying relative gross income test. Corporations Rate 21% 2022 $4,400 Taxable Income All

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started