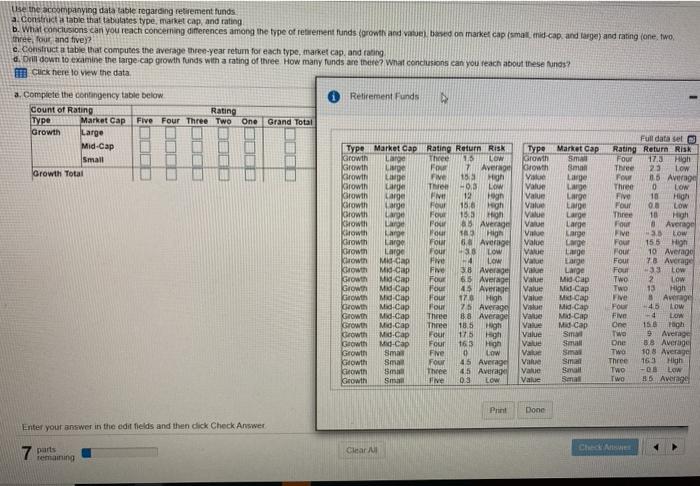

Use the accompanying data table regarding retirement funds a Constitutable tha tatutes type, market cap, and rating b. What conclusions can you reach concerning differences among the type of retirement funds growth and value based on market cap small trid.cap. and targe) and rating (one, two, three, four and five c. Construct a table that computes the average three-year return for each type, market cap, and rating d. Orill down to examine the targe cap growth funds with a rating of three How many funds are there? What conclusions can you reach about these funds TE Click here to view the data. Retirement Funds - One Grand Total 3. Complete the contingency table below count of Rating Rating Type Market Cap Five Four Three TWO Growth Large Mid-Cap Small Growth Total Market Cap Sma Sman Large Large Large Lage F Fow FOM Type Market Cap Rating Return Risk Growth Large Three 10 LOW Growth Four 7 Average Karowth Le Five 153 High Karowth Large TH 0.3 LOW Growth Large 12 an Karowth Large Four 15,6 High Crowth Large Four 15 Khigh || La Four 80 Average Karowth Lange Hour High Growth Large 6 Average Orowth Large Four 30 Low Chowth Mid-cap Five 4 Low Growth Mid-cap Five 38 Average Growth Mid Cap Four 65 Average Growth Mid Cap Four 45 A Growth Mid Cap Four High Growth Mid.cap Four 75 Average Growth Three 88 Average Growth Mid Cap Three 185 High Growth 175 High Geowth Mad-Cap Four 163 High Growth Sma Five 0 Low Growth Sma Four 45 Average Geowth Sma Three 45 Average Geowth Sma Five 03 Low Type Growth Growth Value Value Value Value V Vau Value Value Vale Value Value Value Value Value Value Value Value Full data set Rating Return RISK Four 17.3 High Three 23 Low Fow 5 Average Three 0 LOW Five 10 High Four 08 LOW Three 10 High 8 Average Five Low Four 155 High Four 10 Average Four 78 Average 33 Low TWO 2 Low TWO 13 High Five 8 Average Four 45 Low Five -4 LOW One 15 Bagh Two 9 Average One 38 Average Two 108 Average Three 163 High TWO - LOW TWO 15. Average Four Large Large Large Lage Large Large Mid Cap Mid-Cap Midcap Mid-Cap Mad-Cap Mid Cap Sma Small Smas Small Small Small 170 Mid-Cap Mid-cap Four Value Value Value Vahe Value Value Print Done Enter your answer in the edit fields and then click Check Answer 7 parts Clear Check remaining Use the accompanying data table regarding retirement funds a Constitutable tha tatutes type, market cap, and rating b. What conclusions can you reach concerning differences among the type of retirement funds growth and value based on market cap small trid.cap. and targe) and rating (one, two, three, four and five c. Construct a table that computes the average three-year return for each type, market cap, and rating d. Orill down to examine the targe cap growth funds with a rating of three How many funds are there? What conclusions can you reach about these funds TE Click here to view the data. Retirement Funds - One Grand Total 3. Complete the contingency table below count of Rating Rating Type Market Cap Five Four Three TWO Growth Large Mid-Cap Small Growth Total Market Cap Sma Sman Large Large Large Lage F Fow FOM Type Market Cap Rating Return Risk Growth Large Three 10 LOW Growth Four 7 Average Karowth Le Five 153 High Karowth Large TH 0.3 LOW Growth Large 12 an Karowth Large Four 15,6 High Crowth Large Four 15 Khigh || La Four 80 Average Karowth Lange Hour High Growth Large 6 Average Orowth Large Four 30 Low Chowth Mid-cap Five 4 Low Growth Mid-cap Five 38 Average Growth Mid Cap Four 65 Average Growth Mid Cap Four 45 A Growth Mid Cap Four High Growth Mid.cap Four 75 Average Growth Three 88 Average Growth Mid Cap Three 185 High Growth 175 High Geowth Mad-Cap Four 163 High Growth Sma Five 0 Low Growth Sma Four 45 Average Geowth Sma Three 45 Average Geowth Sma Five 03 Low Type Growth Growth Value Value Value Value V Vau Value Value Vale Value Value Value Value Value Value Value Value Full data set Rating Return RISK Four 17.3 High Three 23 Low Fow 5 Average Three 0 LOW Five 10 High Four 08 LOW Three 10 High 8 Average Five Low Four 155 High Four 10 Average Four 78 Average 33 Low TWO 2 Low TWO 13 High Five 8 Average Four 45 Low Five -4 LOW One 15 Bagh Two 9 Average One 38 Average Two 108 Average Three 163 High TWO - LOW TWO 15. Average Four Large Large Large Lage Large Large Mid Cap Mid-Cap Midcap Mid-Cap Mad-Cap Mid Cap Sma Small Smas Small Small Small 170 Mid-Cap Mid-cap Four Value Value Value Vahe Value Value Print Done Enter your answer in the edit fields and then click Check Answer 7 parts Clear Check remaining