Answered step by step

Verified Expert Solution

Question

1 Approved Answer

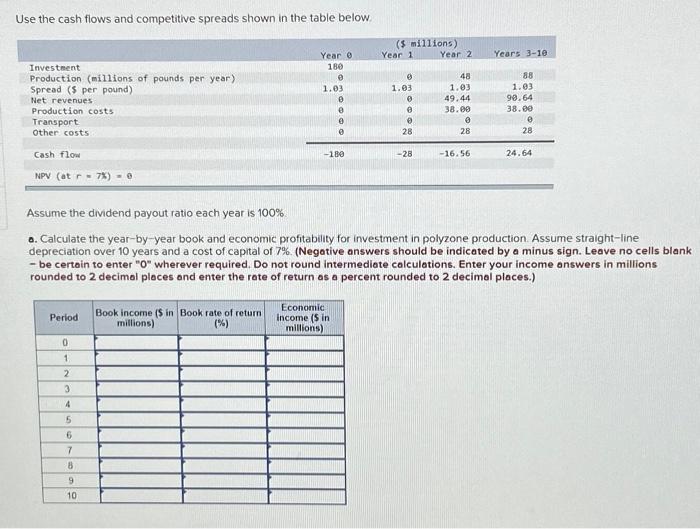

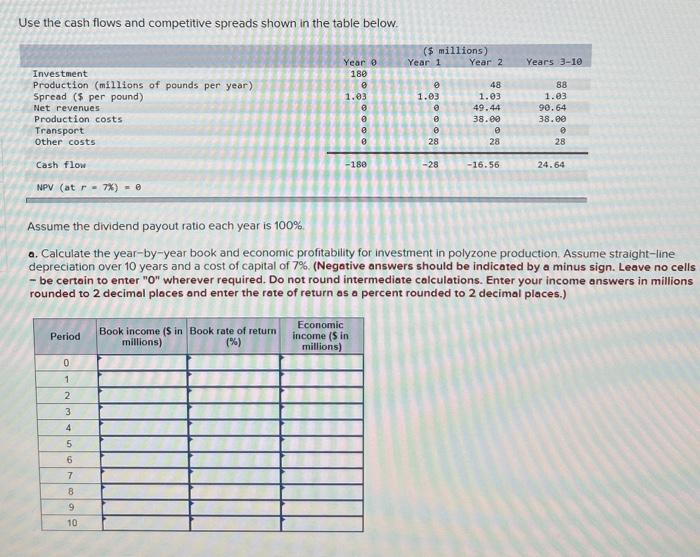

Use the cash flows and competitive spreads shown in the table below. Investment Production (millions of pounds per year) Spread ($ per pound) Net revenues

Use the cash flows and competitive spreads shown in the table below. Investment Production (millions of pounds per year) Spread ($ per pound) Net revenues Production costs Transport Other costs Cash flow NPV (at r= 7%) = 0 Period 0 1 2 3 4 5 6 7 8 9 10 Year 0 180 0 1.03 0 Book income ($ in Book rate of return millions) (%) 0 0 0 -180 Economic income ($ in millions) ($ millions) Year 1 0 1.03 0 0 0 28 -28 Year 2 48 1.03 49.44 38.00 0 28 -16.56 Assume the dividend payout ratio each year is 100% a. Calculate the year-by-year book and economic profitability for investment in polyzone production. Assume straight-line depreciation over 10 years and a cost of capital of 7%. (Negative answers should be indicated by a minus sign. Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter your income answers in millions rounded to 2 decimal places and enter the rate of return as a percent rounded to 2 decimal places.) Years 3-10 88 1.03 90.64 38.00 28 24.64

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started