Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**use the direct method to prepare the cash flows from the operations section of the statement of cash flows for 2021** You have been asked

**use the direct method to prepare the cash flows from the operations section of the statement of cash flows for 2021**

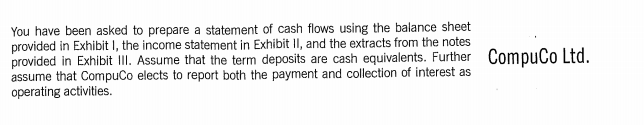

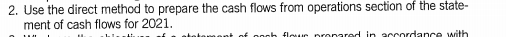

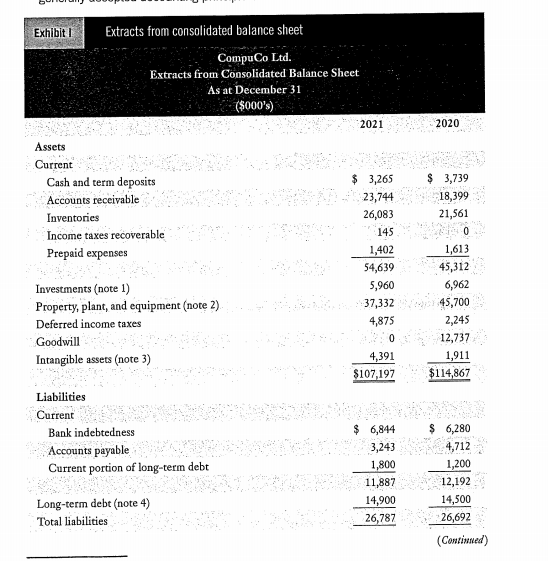

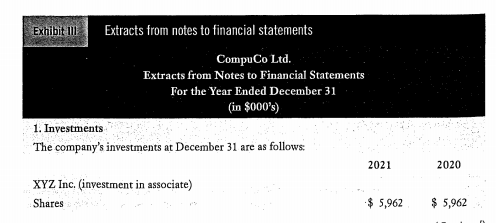

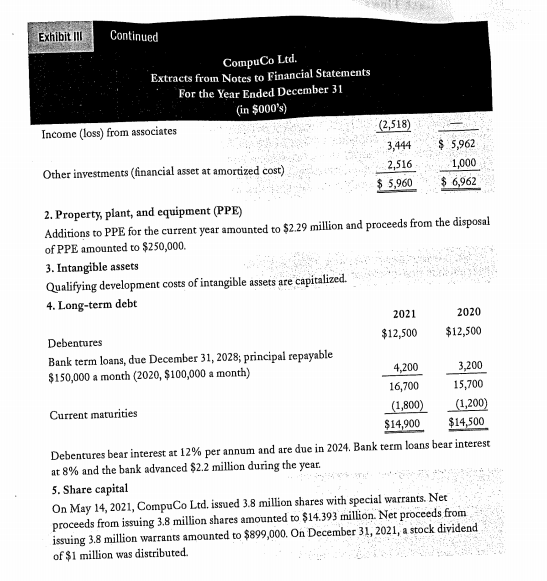

You have been asked to prepare a statement of cash flows using the balance sheet provided in Exhibit I, the income statement in Exhibit II, and the extracts from the notes provided in Exhibit IlI. Assume that the term deposits are cash equivalents. Further CompuCo Ltd. assume that CompuCo elects to report both the payment and collection of interest as operating activities. 2. Use the direct method to prepare the cash flows from operations section of the state- ment of cash flows for 2021. ExhibitI Extracts from consolidated balance sheet CompuCo Ltd. Extracts from Consolidated Balance Sheet As at December 31 ($000's) 2021 2020 Assets Current Cash and term deposits Accounts receivable Inventories Income taxes recoverable Prepaid expenses 3,265 3,739 18,399 21,561 1,613 45,312 6,962 45,700 2,245 12,737 1,911 $107197$114867 23,744 26,083 145 1,402 54,639 5,960 37,332 4,875 Investments (note 1) Property, plant, and equipment (note 2) Deferred income taxes Goodwill Intangible assets (note 3) 4,391 Liabilities Current Bank indebtedness Accounts payable Current portion of long-term debt $ 6,844 3,243 6,280 4,712 1,200 12,192 14,500 26,692 (Continned) Long-term debt (note 4) Total labilities 11,887 14,900 26,787 EkhibtaContinued CompuCo Ltd. Extracts from Consolidated Balance Sheet As at December 31 ($000's) 2021 2020 Shareholders' equity Share capital (Note 5) Retained earnings Total shareholders' equity 62,965 25,210 88,175 $107.197 $114867 79,257 1,153 80,410 EExtracts from consolidated income statement CompuCo Ltd. Extracts from the Consolidated Income Statement For the Years Ended December 31 (in $000's) 2021 2020 Revenue $ 89,821 68,820 446 erating 1,310 91,131 Interest 69,266 Operating General and administrative De 62,355 12,482 11,709 76,766 13,039 10,220 12,737 1,289 394 114,445 (23,314) preciation and amortization Goodwill write-off Interest ,521 Loss on sale of property, plant, and equipment 88,067 Income (loss) before income from associates and income taxes Income (loss) from associates (Note 1) Income (loss) before income taxes Recovery of income taxes Net loss (18,801) (25,832) (18,801) 5,161 s7 S(13,640) 2,775 S230513640) Exhibit IlExtracts from notes to financial statements CompuCo Ltd. Extracts from Notes to Financial Statements For the Year Ended December 31 (in $000's) 1. Investments The company's investments at December 31 are as follows: 2021 2020 XYZ Inc. investment in associate) Shares 5,962 5,962 Exhibit III Continued CompuCo Ltd. Extracts from Notes to Financial Statements For the Year Ended December 31 (in $000's) Income (loss) from associates Other investments (inancial asset at amortized cost) 2. Property, plant, and equipment (PPR) (2,518) 3,444 5,962 25161,000 $ 560$ 6962 e current year amounted to $229 million and proceeds from the disposal of PPE amounted to $250,000. 3. Intangible assets Qualifying development costs of intangible assets are capitalized. 4. Long-term debt 2021 2020 $12,500$12,500 Bank term loans, due December 31, 2028, principal repayable $150,000 a month (2020, $100,000 a month) 3,200 15,700 (,800) (1,200) 4,200 16,700 Current maturities $14,900 $14,500 Debentures bear interest at 12% per annum and are due in 2024, Bank term loans bear interest at 8% and the bank advanced $2.2 million during the year. 5. Share capital On May 14, 2021, CompuCo Ltd. issued 3.8 million shares with special warrants. Net proceeds from issuing 3.8 million shares amounted to $14.393 million. Net proceeds from issuing 3.8 million warrants amounted to $899,000. On December 31, 2021, a stock dividend of $1 million was distributed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started