Question

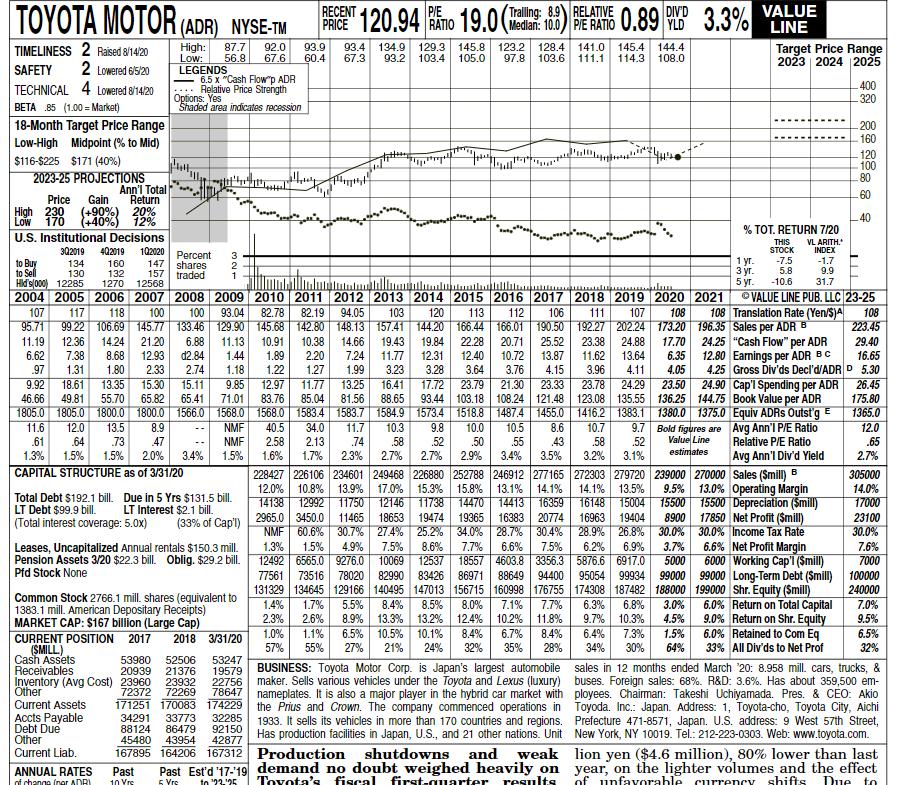

Use the dividend discount model to value a share of Toyotas stock (ticker symbol: TM) as of December 31, 2021. In your application of this

Use the dividend discount model to value a share of Toyota’s stock (ticker symbol: TM) as of December 31, 2021. In your application of this model, use the data provided on the most recent Toyota Value Line report (history of their annual dividend payments, forecasts of future annual dividend payments, past and forecasted growth rates in dividends, and Value Line’s estimate of Toyota’s equity beta). Given all the dividend data (historic and forecasted) presented in the Value Line report, explain, in one sentence, the logic you used to estimate the expected future constant growth rate in dividends in perpetuity (g). Since Toyota is a non-US firm, dividends per share on Value Line are referred to as Gross Dividends Declared per ADR. On direction on how to access Value line report, explain in one sentence, the logic you to estimate the expected future constant growth rate in dividend in perpetuity(g)

OR DR NYSEm DIV'D PRICE" 120,94 RATIO 19.0 (Median: 10.0) PIE RATIO 0.89 YLD PACE" 120,94 Ano 19.0 ( 100) E ANE 0.89 PD 3.3% PIE Tralling: 8.9 RELATIVE VALUE LINE TIMELINESS 2 Raised a/14/20 2 Lowered 65/20 TECHNICAL 4 Lowered 8'14/20 High: Low: LEGENDS 6.5 x "Cash Flow"p ADR Relative Price Strength Options: Yes Shaded area indicates recession 87.7 56.8 92.0 67.6 134.9 129.3 93.2 103.4 145.8 123.2 97.8 105.0 144.4 108.0 93.9 93.4 67.3 128.4 103.6 141.0 111.1 145.4 114.3 Target Price Range 2023 2024 |2025 60.4 SAFETY 400 320 BETA 85 (1.00 = Market) 18-Month Target Price Range 200 160 Low-High Midpoint (% to Mid) 120 100 80 $116-$225 $171 (40%) 2023-25 PROJECTIONS Ann'l Total Return (+90%) 20% u' Y 60 Price Gain High 230 Low 170 40 % TOT. RETURN 7/20 U.S. Institutional Decisions THIS STOCK VL ARITH. INDEX 302019 402019 102020 Percent 147 shares 157 traded 1 yr. . 5 yr. -7.5 5.8 -10.6 to Buy to Self Hid's(000) 12285 134 130 160 132 1270 -1.7 9.9 12568 31.7 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 OVALUE LINE PUB. LLC 23-25 108 Translation Rate (Yen/S)A 99.22 106.69 145.77 133.46 129.90 145.68 142.80 148.13 157.41 144.20 166.44 166.01 190.50 192.27 202.24 173.20 196.35 Sales per ADR B 24.25 "Cash Flow" per ADR 12.80 Earnings per ADR BC 107 117 118 100 100 93.04 82.78 82.19 94.05 103 120 113 112 106 111 107 108 108 95.71 223.45 12.36 11.13 22.28 20.71 10.72 11.19 14.24 21.20 6.88 10.91 10.38 14.66 19.43 19.84 25.52 23.38 24.88 17.70 29.40 6.62 7.38 8.68 12.93 d2.84 1.44 1.89 2.20 7.24 11.77 12.31 12.40 13.87 11.62 13.64 6.35 16.65 .97 1.31 1.80 2.33 2.74 1.18 1.22 1.27 1.99 3.23 3.28 3.64 3.76 4.15 3.96 4.11 4.05 4.25 Gross Div'ds Decl'd/ADR D 5.30 24.90 Cap'l Spending per ADR 93.44 103.18 108.24 121.48 123.08 135.55 136.25 144.75 Book Value per ADR 1805.0 1805.0 1800.0 1800.0 1566.0 1568.0 1568.0 1583.4 1583.7 1584.9 1573.4 1518.8 1487.4 1455.0 1416.2 1383.1 1380.0 1375.0 Equiv ADRS Outst'g E 9.7 Bold figures are Avg Ann'l P/E Ratio Relative P/E Ratio 9.92 18.61 13.35 15.30 15.11 9.85 12.97 11.77 13.25 16.41 17.72 23.79 21.30 23.33 23.78 24.29 23.50 26.45 46.66 49.81 55.70 65.82 65.41 71.01 83.76 85.04 81.56 88.65 175.80 1365.0 11.6 12.0 13.5 8.9 NMF 40.5 34.0 11.7 10.3 9.8 10.0 10.5 8.6 10.7 12.0 NMF 1.5% Value Line estimates .61 .64 73 47 2.58 2.13 74 .58 .52 .50 .55 43 .58 .52 .65 1.3% 1.5% 1.5% 2.0% 3.4% 1.6% 1.7% 2.3% 2.7% 2.7% 2.9% 3.4% 3.5% 3.2% 3.1% Avg Ann'I Div'd Yleld 2.7% CAPITAL STRUCTURE as of 3/31/20 228427 226106 234601 249468 226880 252788 246912 277165 272303 279720239000 270000 Sales (Smill) B 305000 12.0% 10.8% 13.9% 17.0% 15.3% 15.8% 13.1% 14.1% 12146 18653 NMF 60.6% 30.7% 274% 25.2% 34.0% 28.7% 30.4% 13.0% Operating Margin 15500 Depreciation ($mill) 17850 Net Profit (Smill) 28.9% 26.8% 30.0% 30.0% Income Tax Rate 6.6% Net Profit Margin 6000 Working Cap'I ($mill) 99000 Long-Term Debt (Smil) 14.1% 13.5% 9.5% 14.0% Total Debt $192.1 bill. Due in 5 Yrs $131.5 bill. LT Debt $99.9 bill. (Total interest coverage: 5.0x) 14138 12992 11750 11738 14470 14413 16359 16148 15004 15500 LT Interest $2.1 bill. (33% of Capi) 17000 23100 30.0% 2965.0 3450.0 11465 19474 19365 16383 20774 16963 19404 8900 6.9% 12492 6565.0 9276.0 10069 12537 18557 4603.8 3356.3 5876.6 6917.0 95054 99934 1.3% 1.5% 4.9% 7.5% 8.6% 7.7% 6.6% 7.5% 6.2% 3.7% 7.6% Leases, Uncapitalized Annual rentals $150.3 mill. Pension Assets 3/20 $22.3 bill. Oblig. $29.2 bill. Pfd Stock None 5000 7000 86971 88649 94400 131329 134645129166 140495147013 156715 160998 176755 174308 187482 188000 199000 Shr. Equity (Smill 77561 73516 78020 82990 83426 99000 100000 240000 Common Stock 2766.1 mill. shares (equivalent to 1383.1 mill. American Depositary Receipts) MARKET CAP: $167 billion (Large Cap) 6.0% Return on Total Capital 9.0% Return on Shr. Equity 6.0% Retained to Com Eq 1.4% 1.7% 5.5% 8.4% 8.5% 8.0% 7.1% 7.7% 6.3% 6.8% 3.0% 7.0% 8.9% 13.3% 13.2% 6.5% 10.5% 10.1% 2.3% 2.6% 12.4% 10.2% 11.8% 9.7% 10.3% 4.5% 9.5% 6.4% 1.0% 57% 1.1% 8.4% 6.7% 8.4% 7.3% 1.5% 6.5% CURRENT POSITION 2017 (SMILL) Cash Assets Receivables Inventory (Avg Cost) 23960 Other Current Assets 2018 3/31/20 55% 27% 21% 24% 32% 35% 28% 34% 30% 64% 33% All Div'ds to Net Prof 32% 52506 21376 23932 72372 72269 171251 170083 174229 53980 20939 53247 19579 22756 sales in 12 months ended March '20: 8.958 mill. cars, trucks, & maker. Sells various vehicles under the Toyota and Lexus (luxury) buses. Foreign sales: 68%. R&D: 3.6%. Has about 359,500 em- 78647 nameplates. It is also a major player in the hybrid car market with ployees. Chairman: Takeshi Uchiyamada. Pres. & CEO: Akio the Prius and Crown. The company commenced operations in Toyoda. Inc.: Japan. Address: 1, Toyota-cho, Toyota City, Aichi 1933. It sells its vehicles in more than 170 countries and regions. Prefecture 471-8571, Japan. U.S. address: 9 West 57th Street, Has production facilities in Japan, U.S., and 21 other nations. Unit New York, NY 10019. Tel.: 212-223-0303. Web: www.toyota.com. BUSINESS: Toyota Motor Corp. is Japan's largest automobile Accts Payable Debt Du Other Current Liab. 34291 88124 45480 33773 86479 43954 32285 92150 42877 167895 164206 167312 Production shutdowns and weak lion yen ($4.6 million), 80% lower than last ANNUAL RATES of change (nor ADRI Past Est'd '17-'19 demand no doubt weighed heavily on 5 Yre year, on the lighter volumes and the effect Due to Past Toyota's fiscal first-quarter results of unfavorable currency shifts 10 Vre to 23.'25 321

Step by Step Solution

3.44 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

In disunted sh flw DF vlutin tehniques the vlue f the stk is estimte...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started