Answered step by step

Verified Expert Solution

Question

1 Approved Answer

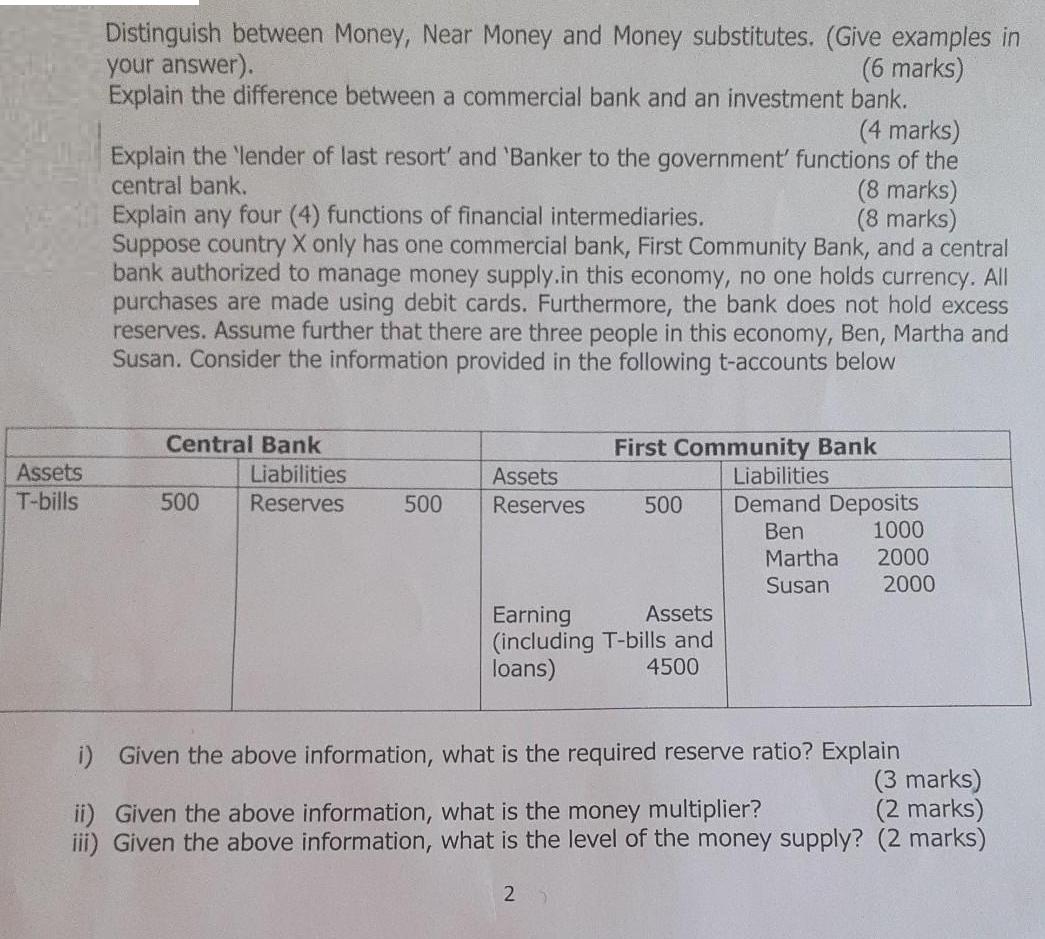

Assets T-bills Distinguish between Money, Near Money and Money substitutes. (Give examples in your answer). (6 marks) Explain the difference between a commercial bank

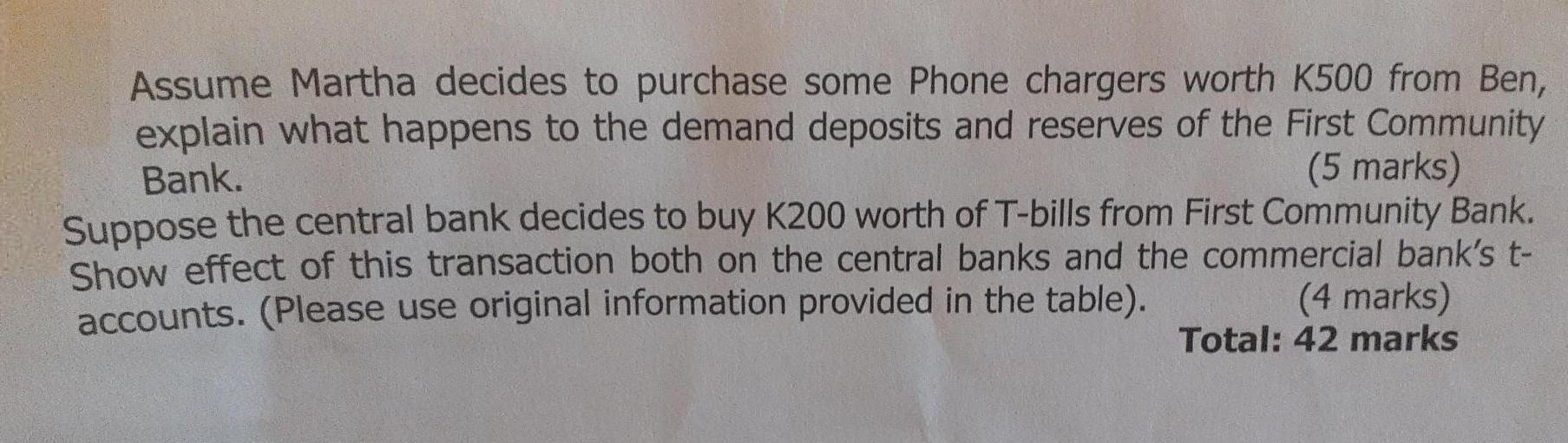

Assets T-bills Distinguish between Money, Near Money and Money substitutes. (Give examples in your answer). (6 marks) Explain the difference between a commercial bank and an investment bank. (4 marks) Explain the 'lender of last resort' and 'Banker to the government' functions of the central bank. (8 marks) (8 marks) Explain any four (4) functions of financial intermediaries. Suppose country X only has one commercial bank, First Community Bank, and a central bank authorized to manage money supply.in this economy, no one holds currency. All purchases are made using debit cards. Furthermore, the bank does not hold excess reserves. Assume further that there are three people in this economy, Ben, Martha and Susan. Consider the information provided in the following t-accounts below Central Bank Liabilities 500 Reserves 500 Assets Reserves First Community Bank Liabilities 500 Assets Earning (including T-bills and loans) 4500 25 Demand Deposits Ben 1000 Martha 2000 Susan 2000 i) Given the above information, what is the required reserve ratio? Explain (3 marks) ii) Given the above information, what is the money multiplier? (2 marks) iii) Given the above information, what is the level of the money supply? (2 marks) Assume Martha decides to purchase some Phone chargers worth K500 from Ben, explain what happens to the demand deposits and reserves of the First Community Bank. (5 marks) Suppose the central bank decides to buy K200 worth of T-bills from First Community Bank. Show effect of this transaction both on the central banks and the commercial bank's t- (4 marks) accounts. (Please use original information provided in the table). Total: 42 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the provided images and your request you are interested in the following tasks i Understanding the required reserve ratio ii Calculating the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started