Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the end of year price, dividend data (dividend paid during year), and annual returns provided below for the common stocks of Norvell and

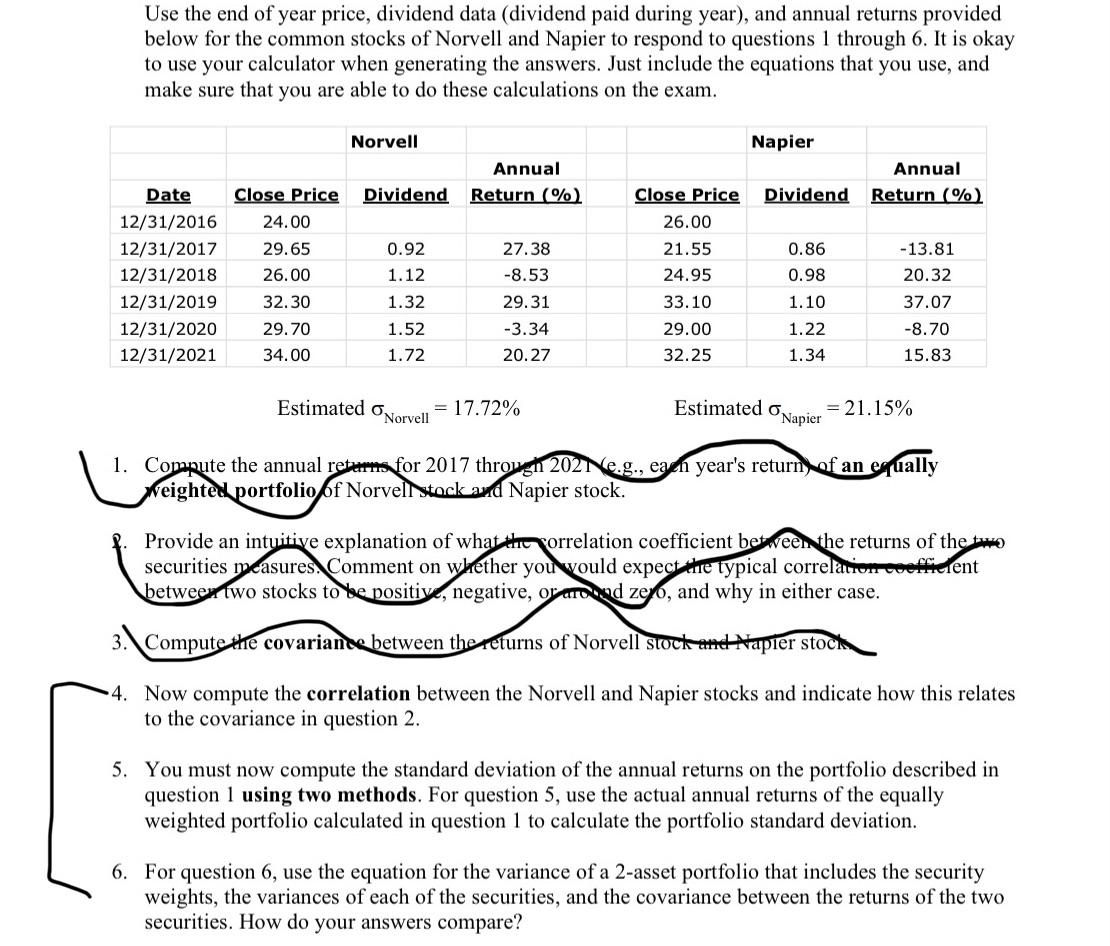

Use the end of year price, dividend data (dividend paid during year), and annual returns provided below for the common stocks of Norvell and Napier to respond to questions 1 through 6. It is okay to use your calculator when generating the answers. Just include the equations that you use, and make sure that you are able to do these calculations on the exam. Date 12/31/2016 12/31/2017 12/31/2018 Close Price 24.00 29.65 26.00 12/31/2019 32.30 12/31/2020 29.70 12/31/2021 34.00 Norvell Dividend 0.92 1.12 1.32 1.52 1.72 Annual Return (%) 27.38 -8.53 29.31 -3.34 20.27 Close Price 26.00 21.55 24.95 33.10 29.00 32.25 Napier Dividend Estimated 0.86 0.98 1.10 1.22 1.34 Annual Return (%) Estimated Norvell = 17.72% 1. Compute the annual returns for 2017 through 2021 e.g., each year's return of an equally Weighted portfolio of Norvell stock and Napier stock. Napier -13.81 20.32 37.07 -8.70 15.83 = 21.15% Provide an intuitive explanation of what the correlation coefficient between the returns of the to securities measures Comment on whether you would expect the typical correlation coefficient between two stocks to be positive, negative, or around zero, and why in either case. 3. Compute the covariance between the returns of Norvell stock and Napier stock 4. Now compute the correlation between the Norvell and Napier stocks and indicate how this relates to the covariance in question 2. 5. You must now compute the standard deviation of the annual returns on the portfolio described in question 1 using two methods. For question 5, use the actual annual returns of the equally weighted portfolio calculated in question 1 to calculate the portfolio standard deviation. 6. For question 6, use the equation for the variance of a 2-asset portfolio that includes the security weights, the variances of each of the securities, and the covariance between the returns of the two securities. How do your answers compare?

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started