Question

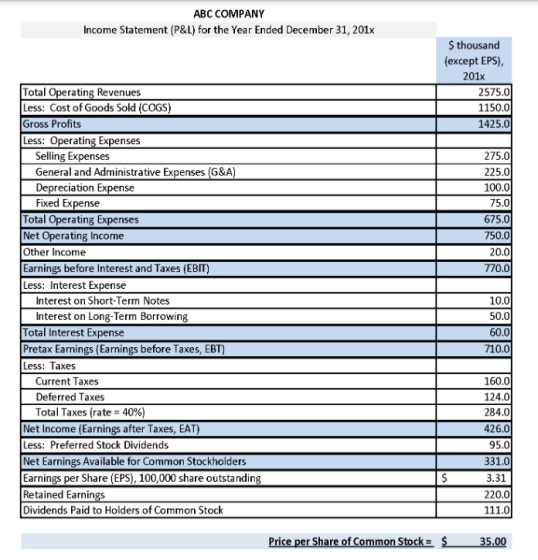

Use the example Income Statement (P&L), the information in this week's resources, and your own experiences to help you answer and discuss the following: Summarize

Use the example Income Statement (P&L), the information in this week's resources, and your own experiences to help you answer and discuss the following:

Summarize the "above the line" results by describing the relationship between Total Operating Revenues and COGS, and discuss how changes in either or both areas influence a company's Gross Profits.

Identify the controllable expenses that are "below the line" and define the elements included in each expense area.

Explain the potential influence of internal and external environmental factors on a company's Net Operating Income.

Which expense category has the most influence on Total Operating Expenses in the above example? Explain.

Describe and present one measure that could be taken to reduce the controllable expenses reflected in the example P&L.

ABC COMPANY Income Statement (P&L) for the Year Ended December 31, 201x Total Operating Revenues Less: Cost of Goods Sold (COGS) Gross Profits Less: Operating Expenses Selling Expenses General and Administrative Expenses (G&A) Depreciation Expense Fixed Expense Total Operating Expenses Net Operating Income Other Income Earnings before Interest and Taxes (EBIT) Less: Interest Expense Interest on Short-Term Notes Interest on Long-Term Borrowing Total Interest Expense Pretax Earnings (Earnings before Taxes, EBT) Less: Taxes Current Taxes Deferred Taxes Total Taxes (rate=40%) Net Income (Earnings after Taxes, EAT) Less: Preferred Stock Dividends Net Earnings Available for Common Stockholders Earnings per Share (EPS), 100,000 share outstanding Retained Earnings Dividends Paid to Holders of Common Stock $ thousand (except EPS), 201x $ Price per Share of Common Stock $ 2575.0 1150.0 1425.0 275.0 225.0 100.0 75.0 675.0 750.0 20.0 770.0 10.0 50.0 60.0 710.0 160.0 124.0 284.0 426.0 95.0 331.0 3.31 220.0 111.0 35.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started