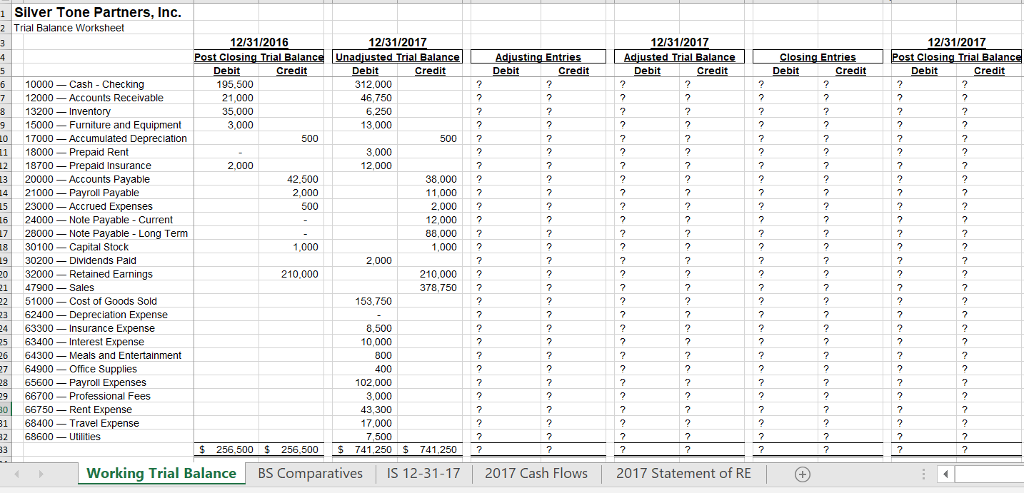

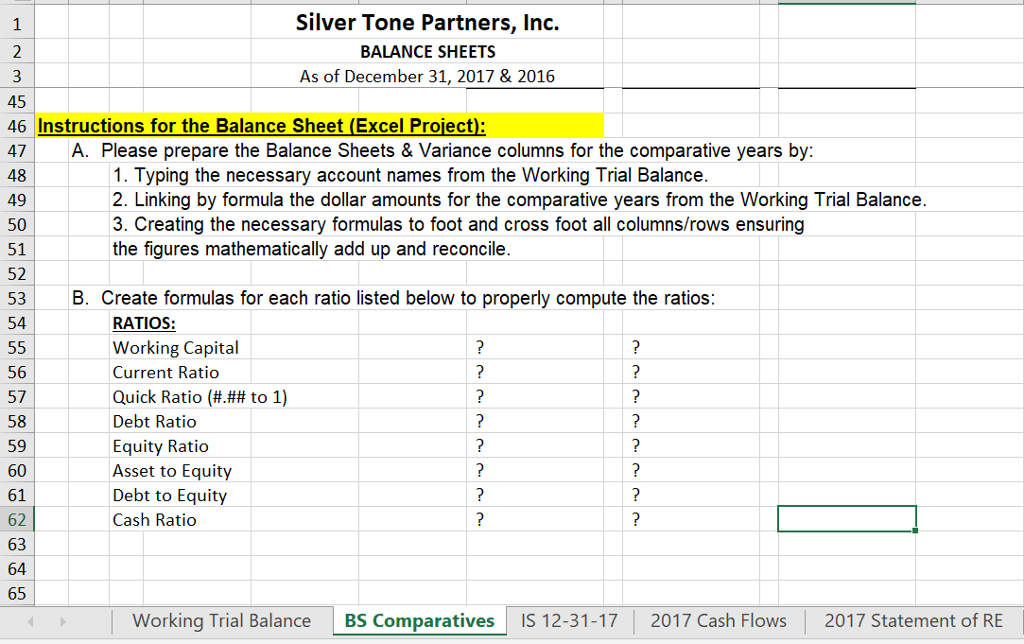

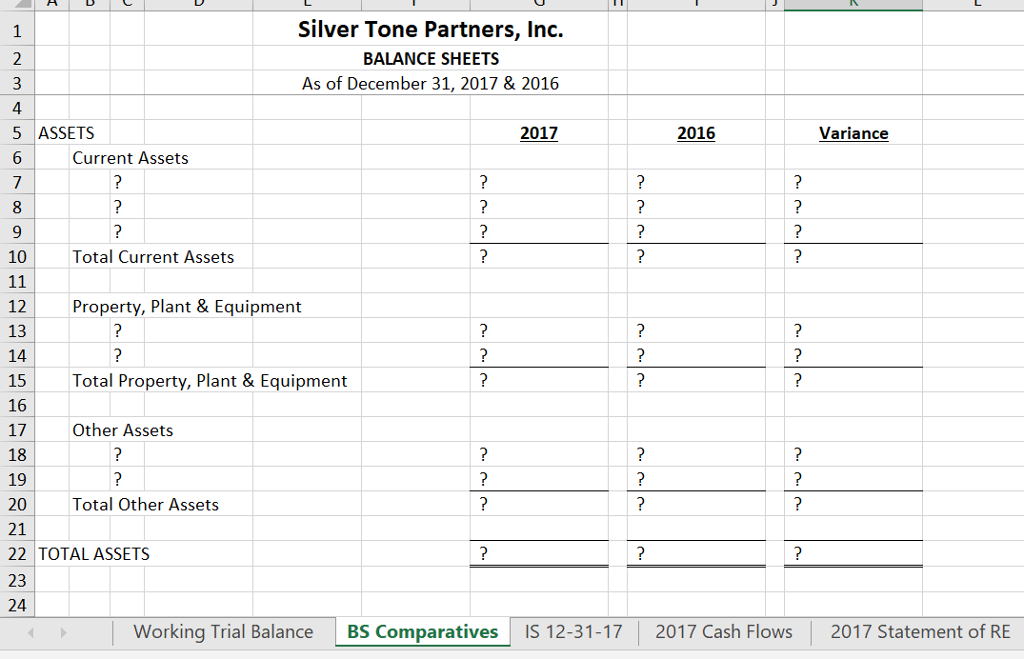

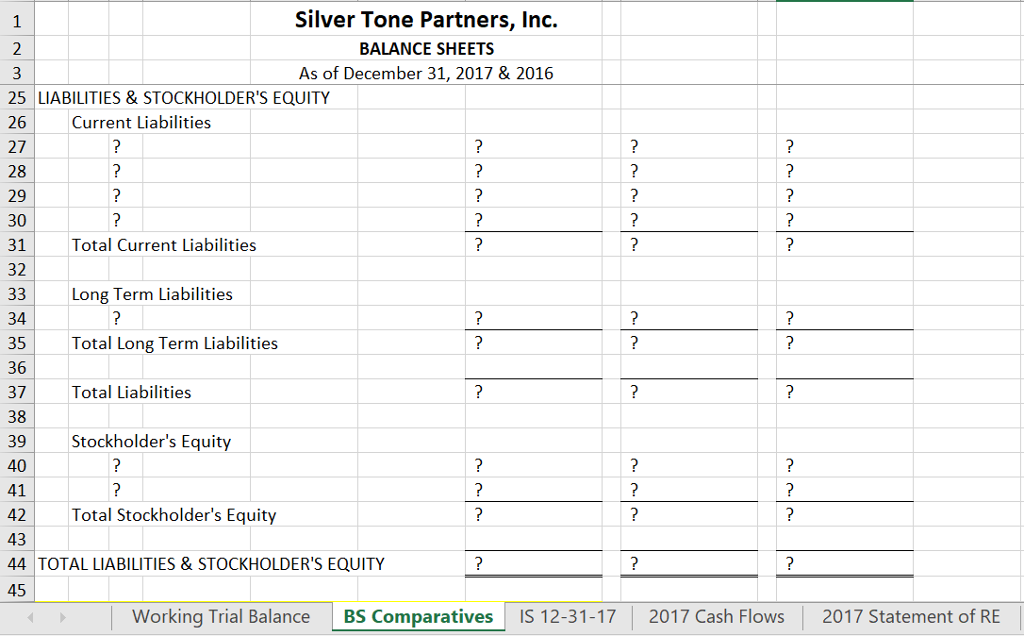

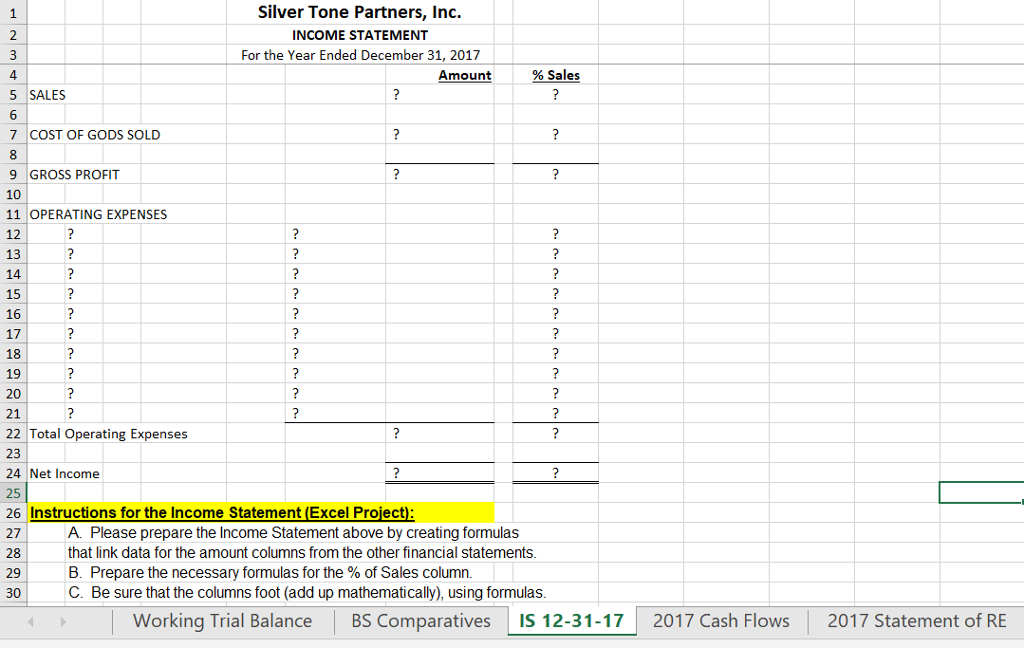

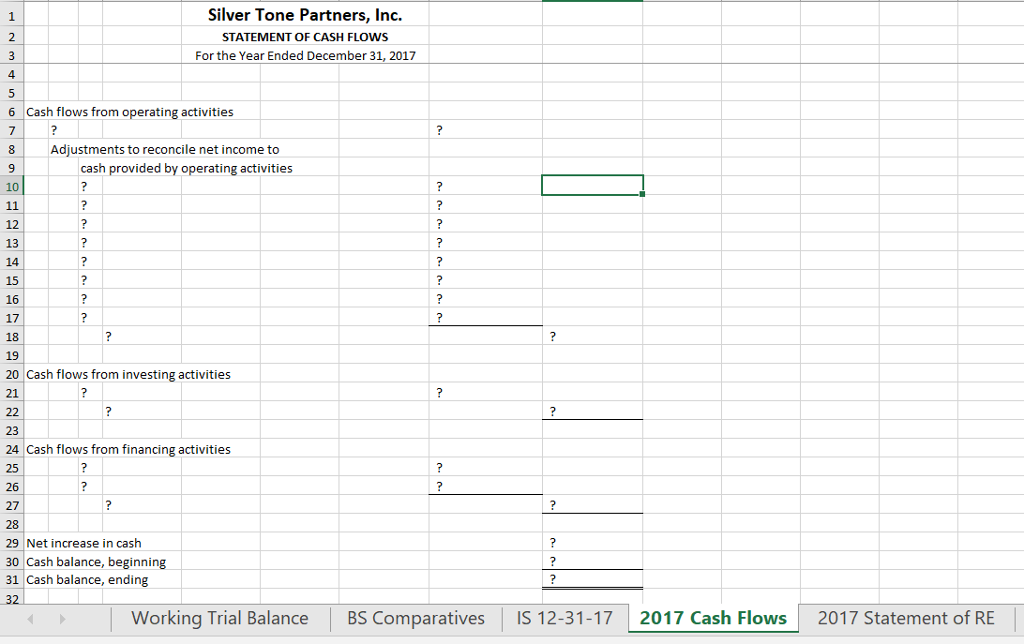

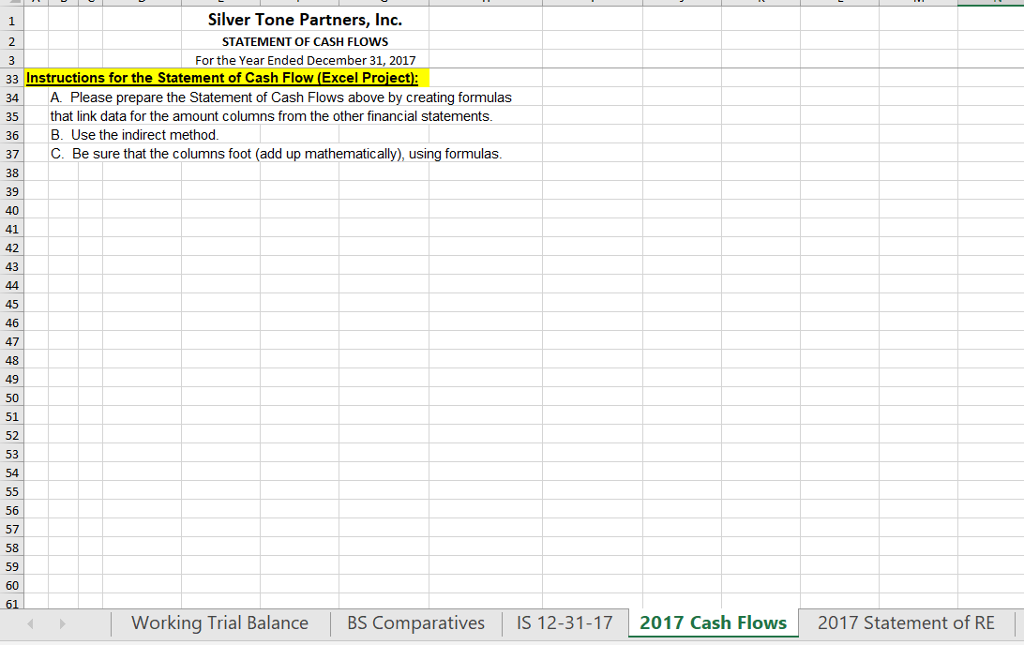

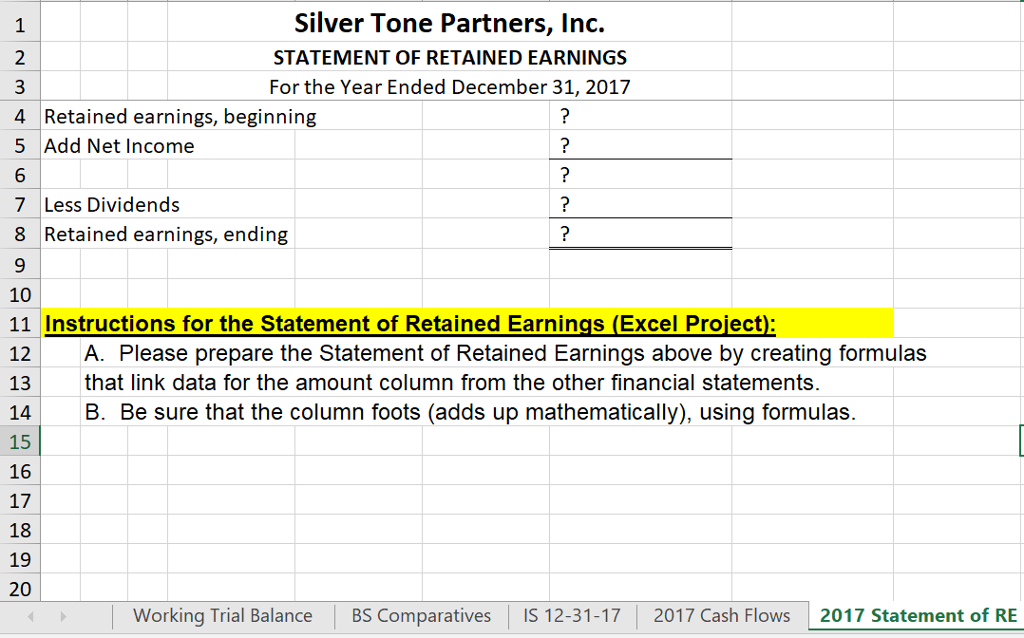

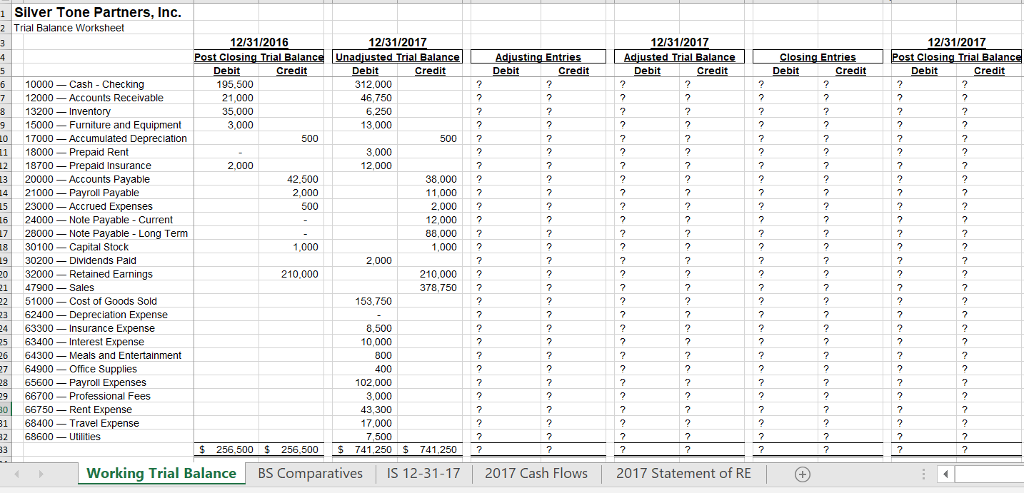

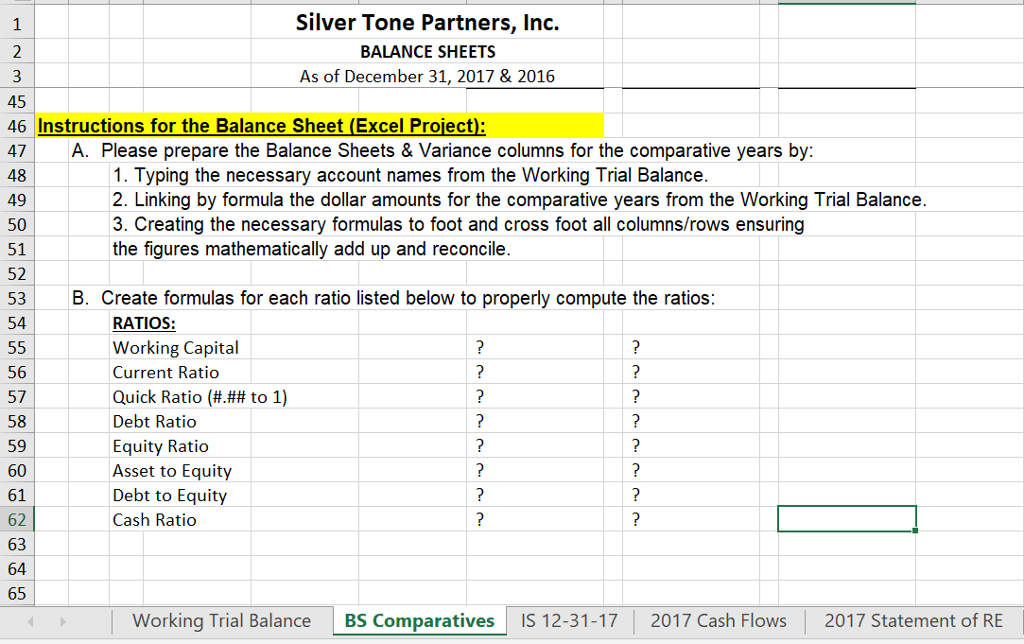

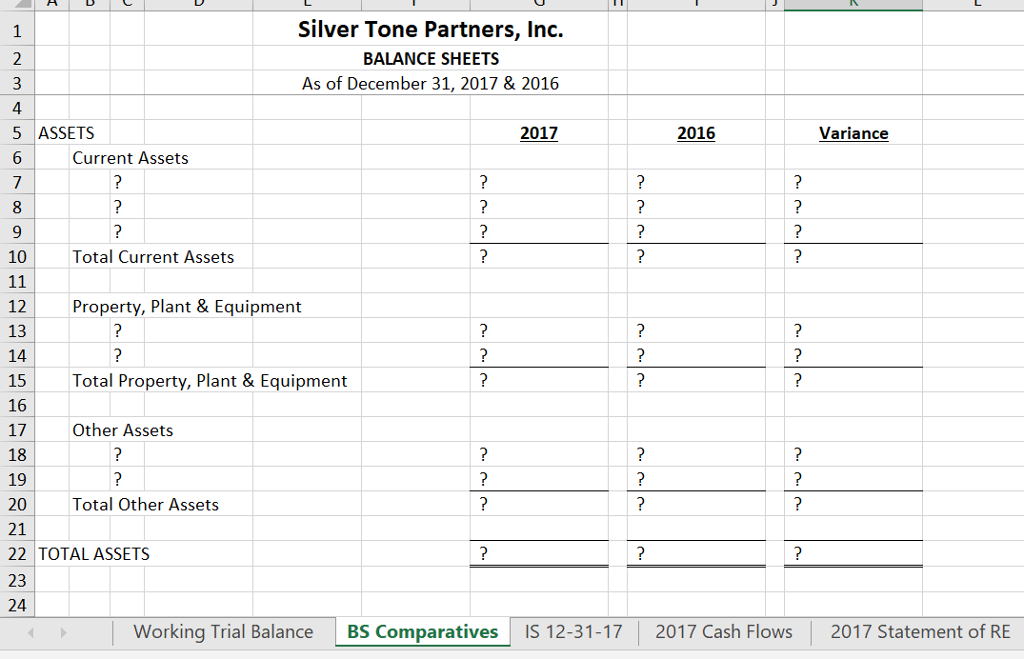

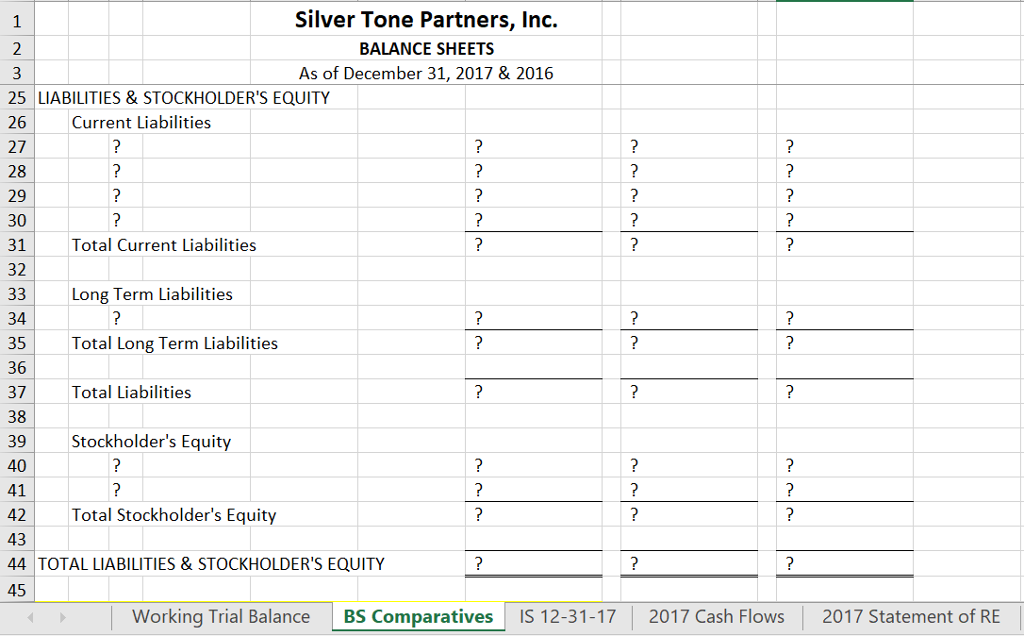

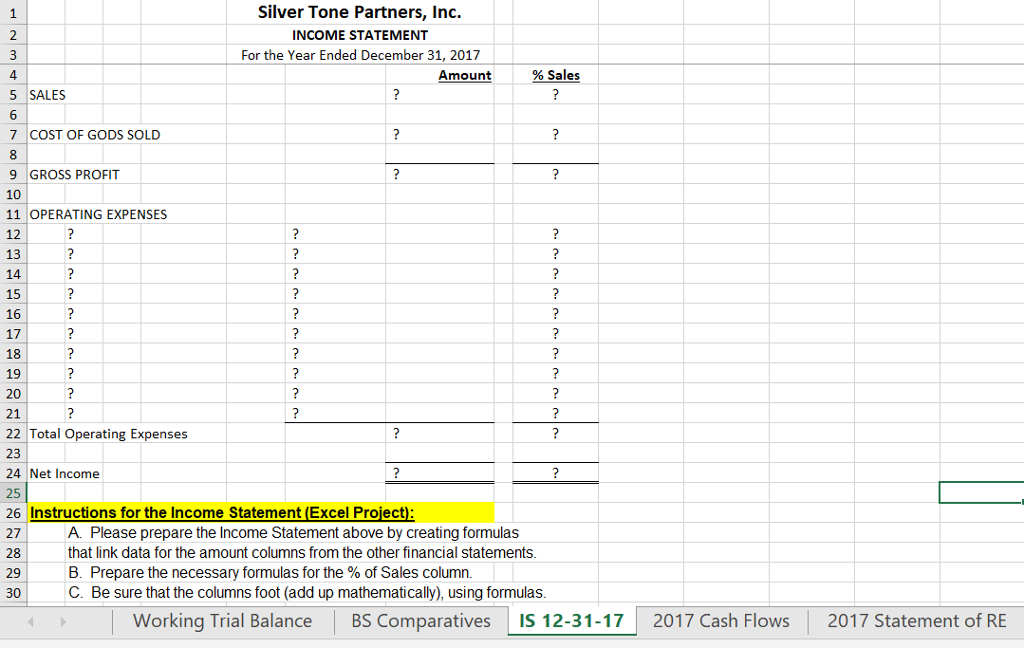

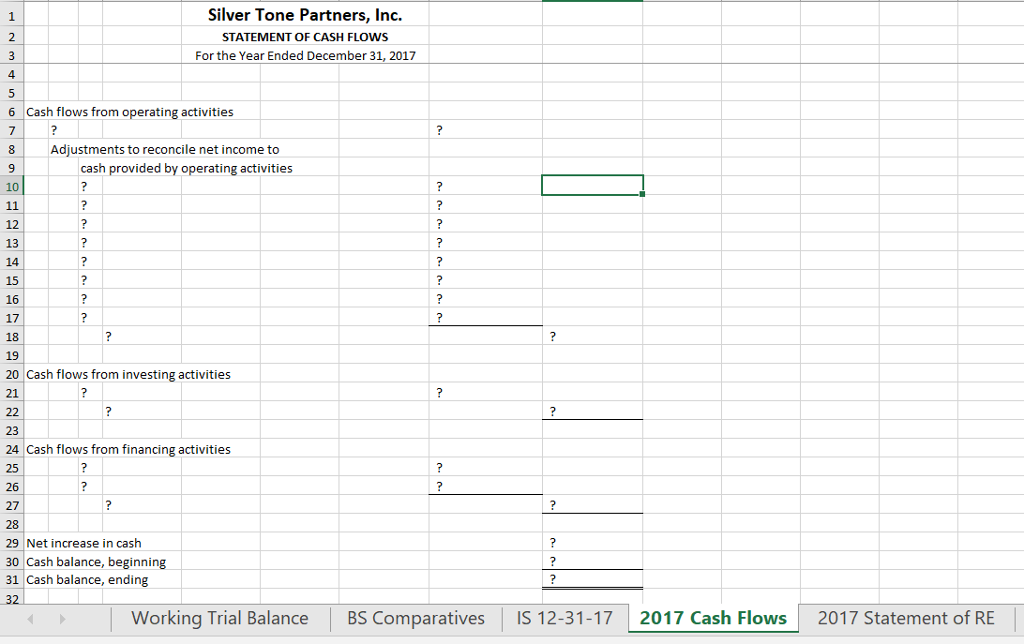

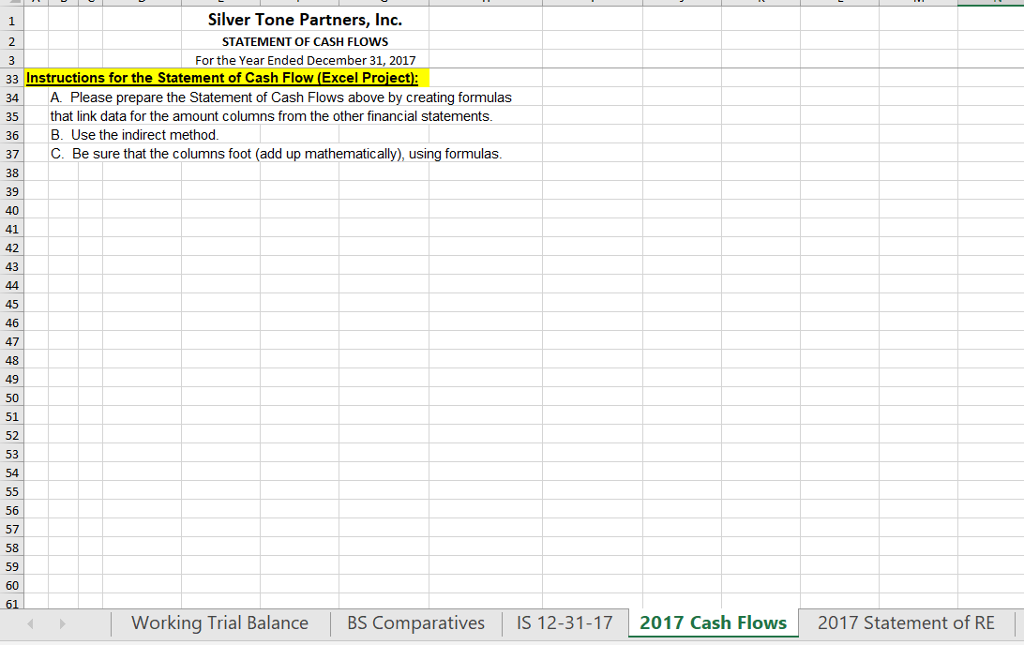

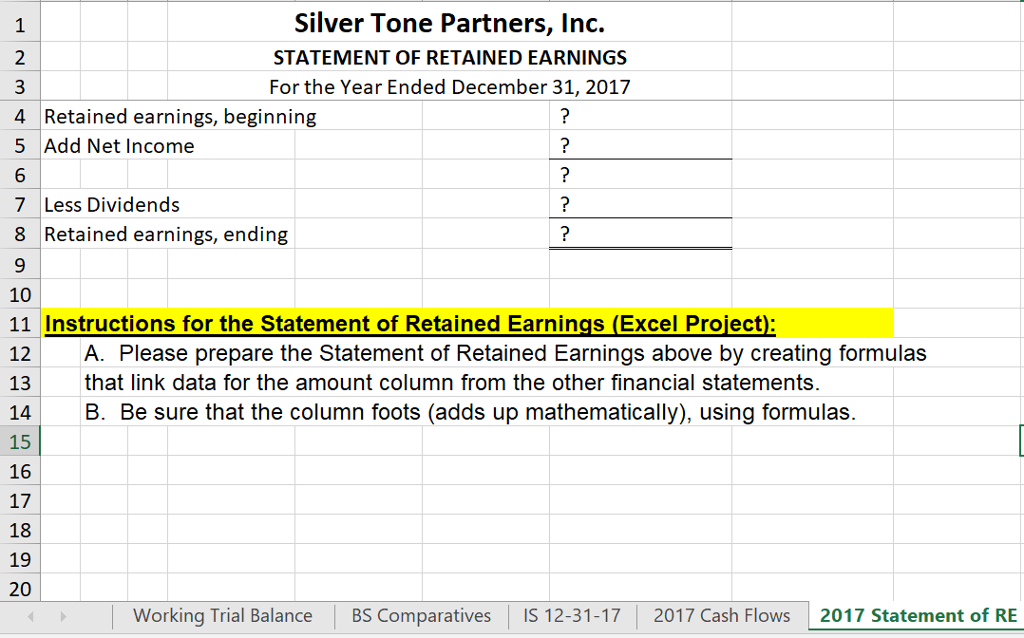

Use the excel files to complete the instructions listed on each of the following five tabs: the Working Trial Balance tab, the BS Comparatives tab, the IS 12-31-17 tab, the 2017 Cash Flows tab, and the 2017 Statement of RE tab.

A FEW ITEMS TO NOTE for the Working Trial Balance tab:

If there are no debits or credits for any particular account in the Adjusting Entries or Closing Entries columns, delete the question marks from the appropriate cells and leave those cells blank.

Under the Adjusted T/B and Post Closing T/B columns, each account should have just one entry. For example, under Adjusted T/B, Accounts Payable should have a blank Debit column and some amount in the Credit column. Under Post Closing T/B, Accounts Payable should have a blank Debit column and some amount in the Credit column. If an account has no balance in either the Debit or Credit column, indicate no balance by formatting the cell to show $0 as a dash in the cell of that accounts normal balance. For example, if Accounts Payable has a balance of $0, the normal balance for A/P is a credit balance, so the Credit column should show a dash.

The cell values for the Adjusted T/B, Closing Entries, and Post Closing T/B debit and credit columns should be made with formulas. Do not type the values into these cells.

You SHOULD type the values into the Adjustments debit and credit columns.

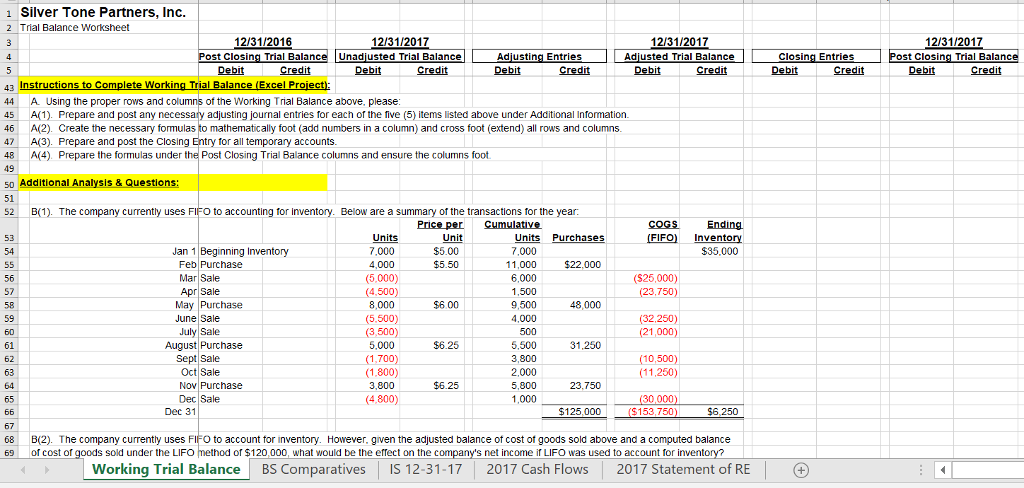

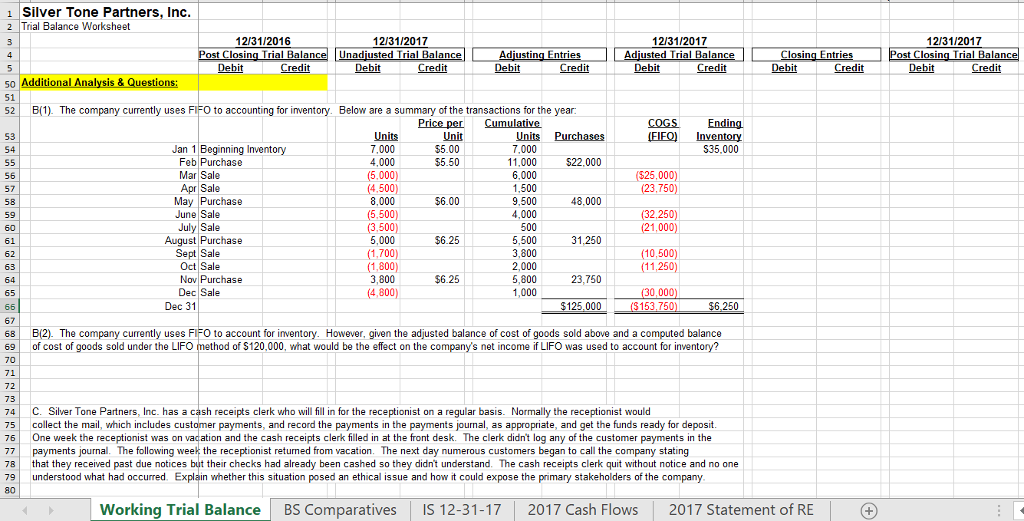

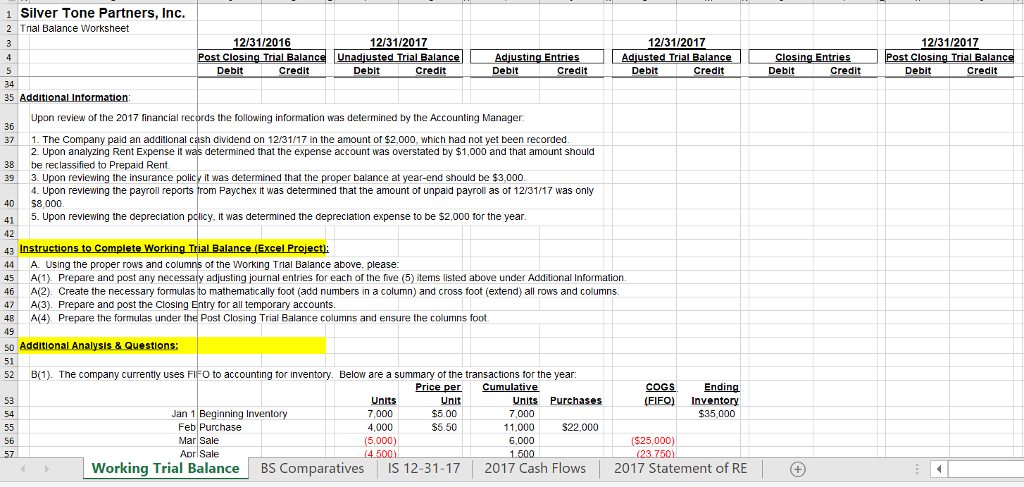

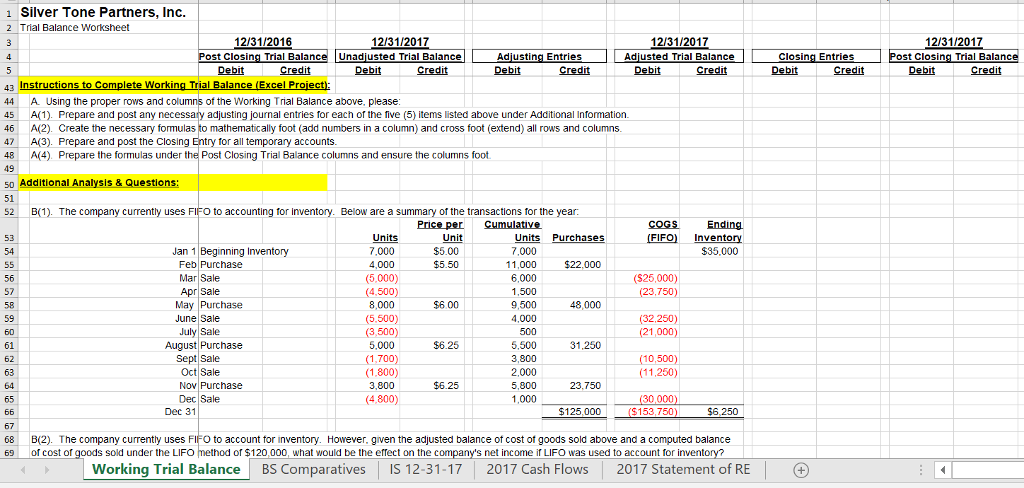

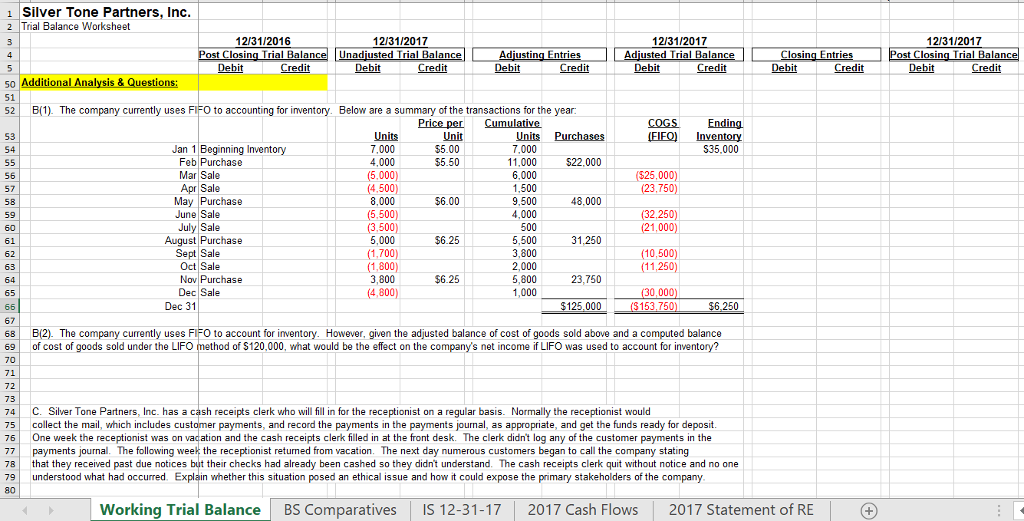

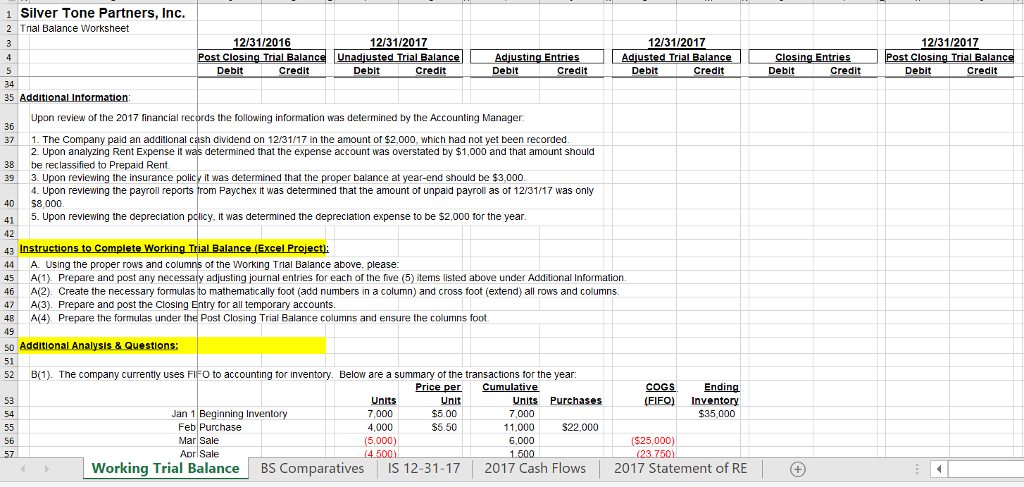

1 Silver Tone Partners, Inc. 2 Trial Balance Worksheet 12/31/2016 12/31/2017 12/31/2017 12/31/2017 P ost Closing Trial Balance Unadjusted Trial Balance lAdjusting EntriesAdiusted Trial BalanceClosing Entries Post Closing Trial Balance of the Working Trial Balance above, please 44 A Using the proper rows and c 45 A1) Prepare and post 46 A(2). Create the necessary formulas to mathematically foot (add numbers in a column) and cross foot (extend) all rows and columns. 47A3). Prepare and post the Closing Entry for all temporary accounts. 48A(4) Prepare the formulas under the Post Closing Trial Balance columns and ensure the columns foot 49 s0 Additional Analysis 51 52 B(1). The company currently uses FIFO to accounting for inventory. Below are a summary of the transactions for the year ny necessary adjusting journal entries for eac h of the tive (5) items listed above under Additional Intormation uestio COGS Ending (FIFO) Inventory $35.000 Units Purchases Units 7,000 4,000 (5,000) 4,500 8,000 (5,500) 3,500 5,000 1,700 (1,800) 3,800 (4,800) Unit $5.00 $5.50 53 Jan 1 Beginning Inventory 7,000 11,000 6,000 1,500 9,500 4,000 500 5,500 3,800 2,000 5,800 1,000 $22,000 Feb Purchase Mar Sale Apr Sale May Purchase June Sale July Sale 56 57 ($25,000) 750 48,000 59 60 61 (32,250) 21,000 August Purchase $6.25 31,250 Sept Sale Oct Sale Nov Purchase Dec Sale 10,500 (11,250) 64 $6.25 23.750 Dec 31 $125,000 68 B(2). The company currently uses FiFo to account for inventory. However. given the adjusted balance of cost of goods sold above and a computed balance 69 of cost of sold under the LIFO of $120,000, what would be the effect on the c net income if LIFO was used to account for i Working Trial Balance BS Comparatives IS 12-31-17 2017 Cash Flows 2017 Statement of RE G 1 Silver Tone Partners, Inc. 2 Trial Balance Worksheet 12/31/2016 12/31/2017 12/31/2017 12/31/2017 P ost Closing Trial Balance Unadjusted Trial Balance lAdjusting EntriesAdiusted Trial BalanceClosing Entries Post Closing Trial Balance of the Working Trial Balance above, please 44 A Using the proper rows and c 45 A1) Prepare and post 46 A(2). Create the necessary formulas to mathematically foot (add numbers in a column) and cross foot (extend) all rows and columns. 47A3). Prepare and post the Closing Entry for all temporary accounts. 48A(4) Prepare the formulas under the Post Closing Trial Balance columns and ensure the columns foot 49 s0 Additional Analysis 51 52 B(1). The company currently uses FIFO to accounting for inventory. Below are a summary of the transactions for the year ny necessary adjusting journal entries for eac h of the tive (5) items listed above under Additional Intormation uestio COGS Ending (FIFO) Inventory $35.000 Units Purchases Units 7,000 4,000 (5,000) 4,500 8,000 (5,500) 3,500 5,000 1,700 (1,800) 3,800 (4,800) Unit $5.00 $5.50 53 Jan 1 Beginning Inventory 7,000 11,000 6,000 1,500 9,500 4,000 500 5,500 3,800 2,000 5,800 1,000 $22,000 Feb Purchase Mar Sale Apr Sale May Purchase June Sale July Sale 56 57 ($25,000) 750 48,000 59 60 61 (32,250) 21,000 August Purchase $6.25 31,250 Sept Sale Oct Sale Nov Purchase Dec Sale 10,500 (11,250) 64 $6.25 23.750 Dec 31 $125,000 68 B(2). The company currently uses FiFo to account for inventory. However. given the adjusted balance of cost of goods sold above and a computed balance 69 of cost of sold under the LIFO of $120,000, what would be the effect on the c net income if LIFO was used to account for i Working Trial Balance BS Comparatives IS 12-31-17 2017 Cash Flows 2017 Statement of RE G