Answered step by step

Verified Expert Solution

Question

1 Approved Answer

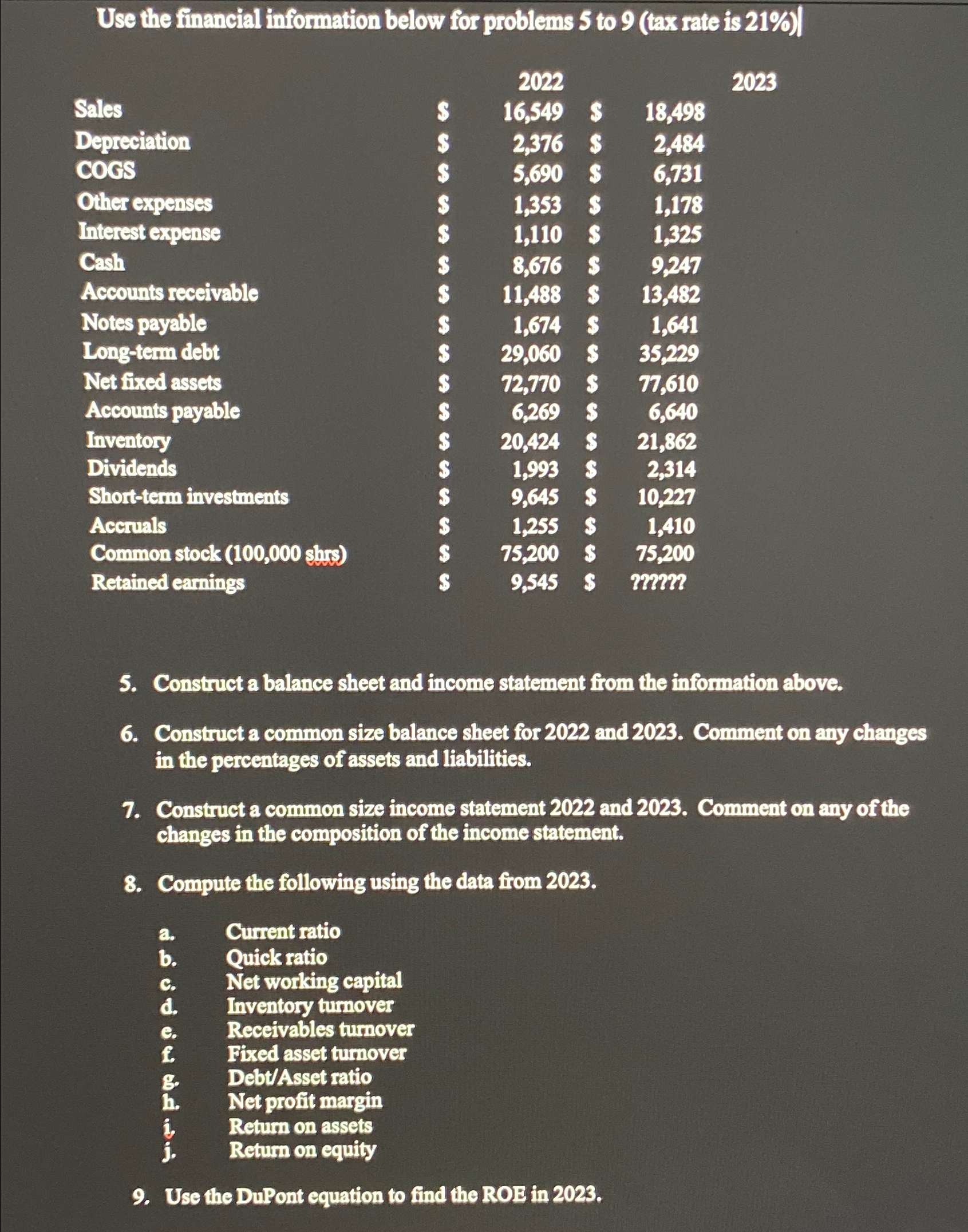

Use the financial information below for problems 5 to 9 ( tax rate is 2 1 % ) table [ [ , , 2

Use the financial information below for problems to tax rate is

tableSales$Depreciation$cocs$Other expenses,Interest expense,$Cash$Accounts receivable,$$Notes payable,$Longterm debt,Net fixed assets,SAccounts payable,Inventory$Dividends$Shortterm investments,$Accruals$$Common stock shrs$Retained earnings,$m

Construct a balance sheet and income statement from the information above.

Construct a common size balance sheet for and Comment on any changes in the percentages of assets and liabilities.

Construct a common size income statement and Comment on any of the changes in the composition of the income statement.

Compute the following using the data from

a Current ratio

b Quick ratio

c Net working capital

d Inventory turnover

e Receivables turnover

f Fixed asset turnover

g DebtAsset ratio

h Net profit margin

i Return on assets

j Return on equity

Use the DuPont equation to find the ROE in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started