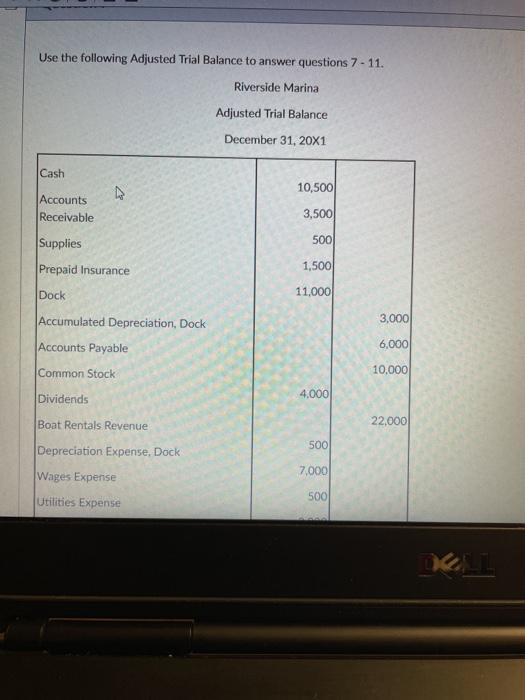

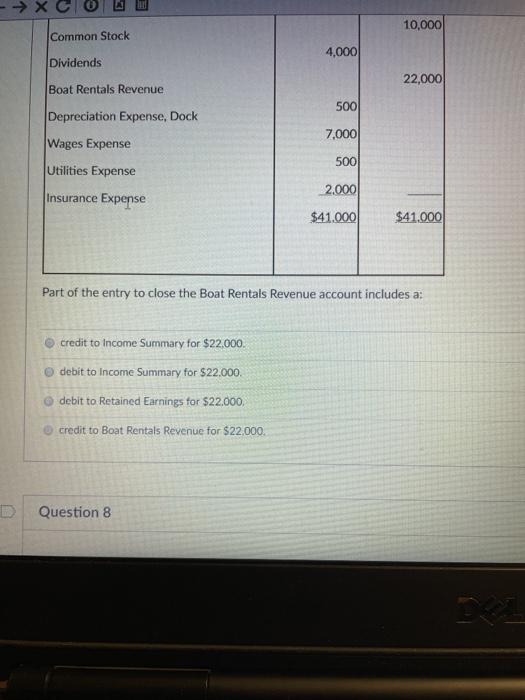

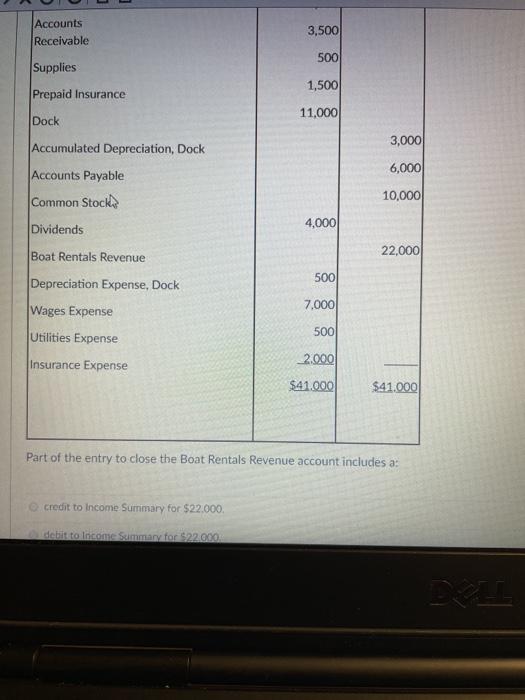

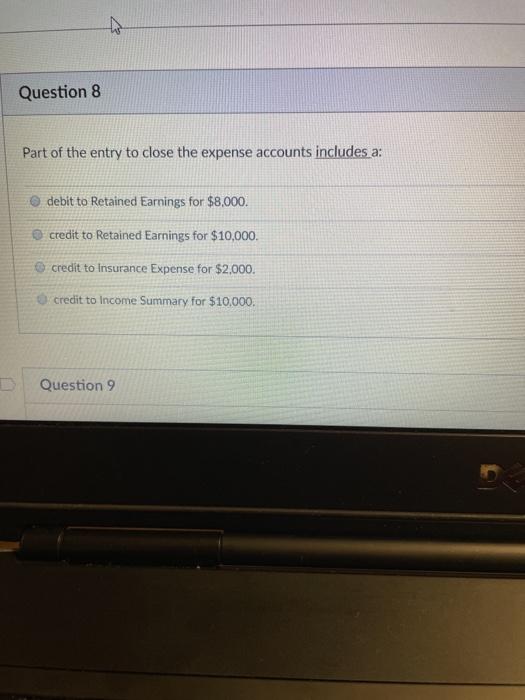

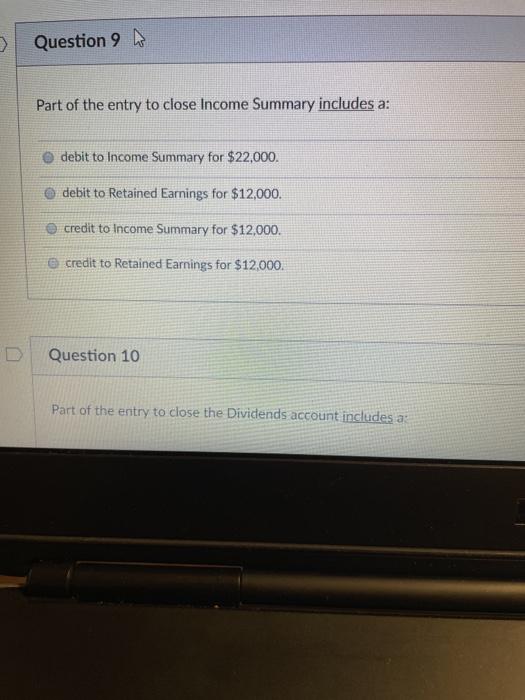

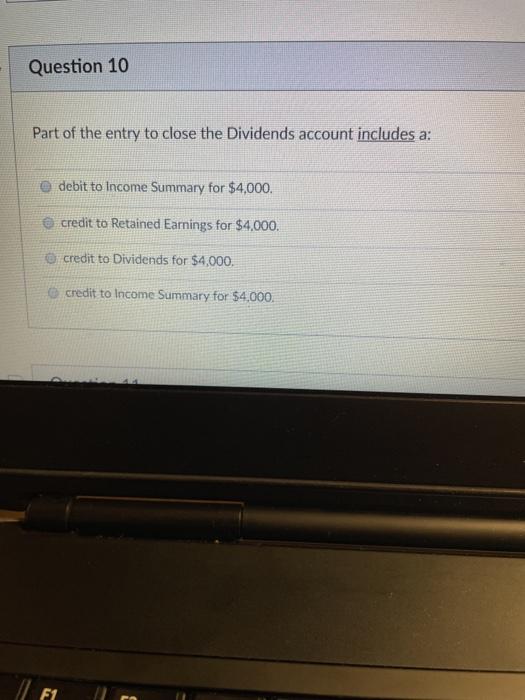

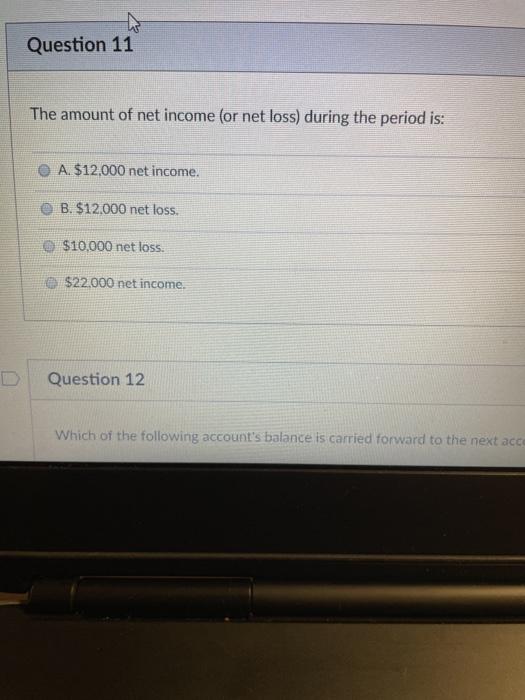

Use the following Adjusted Trial Balance to answer questions 7 - 11. Riverside Marina Adjusted Trial Balance December 31, 20X1 Cash 10,500 Accounts Receivable 3,500 Supplies 500 Prepaid Insurance 1,500 Dock 11,000 Accumulated Depreciation, Dock 3,000 Accounts Payable 6,000 Common Stock 10,000 Dividends 4.000 Boat Rentals Revenue 22.000 500 Depreciation Expense, Dock 7,000 Wages Expense Utilities Expense 500 10,000 Common Stock 4,000 Dividends 22,000 Boat Rentals Revenue 500 Depreciation Expense, Dock 7.000 Wages Expense 500 Utilities Expense Insurance Expense 2,000 $41.000 $41.000 Part of the entry to close the Boat Rentals Revenue account includes a: credit to Income Summary for $22.000. debit to Income Summary for $22.000 debit to Retained Earnings for $22.000, credit to Boat Rentals Revenue for $22.000. D Question 8 Accounts Receivable 3,500 500 Supplies 1,500 Prepaid Insurance 11,000 Dock 3,000 6,000 Accumulated Depreciation, Dock Accounts Payable Common Stock 10,000 Dividends 4,000 Boat Rentals Revenue 22,000 500 Depreciation Expense, Dock 7.000 Wages Expense 500 Utilities Expense Insurance Expense __2.000 $41.000 $41.000 Part of the entry to close the Boat Rentals Revenue account includes a: credit to Income Summary for $22.000 debito lncome Summary for $22.000 Question 8 Part of the entry to close the expense accounts includes a: debit to Retained Earnings for $8,000. credit to Retained Earnings for $10,000. credit to Insurance Expense for $2.000. credit to Income Summary for $10,000. Question 9 Question 9 Part of the entry to close Income Summary includes a: debit to Income Summary for $22,000. debit to Retained Earnings for $12,000. credit to Income Summary for $12,000. credit to Retained Earnings for $12,000. D Question 10 Part of the entry to close the Dividends account includes a: Question 10 Part of the entry to close the Dividends account includes a: debit to Income Summary for $4,000, credit to Retained Earnings for $4,000. credit to Dividends for $4,000. credit to Income Summary for $4.000. I FI Question 11 The amount of net income (or net loss) during the period is: A. $12,000 net income. B. $12.000 net loss. $10,000 net loss $22.000 net income. Question 12 Which of the following account's balance is carried forward to the next acce