Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following Balance Sheet and Income Statement to calculate your Cash flow Operations using the indirect method Use the following Balance Sheet and Income

Use the following Balance Sheet and Income Statement to calculate your Cash flow Operations using the indirect method

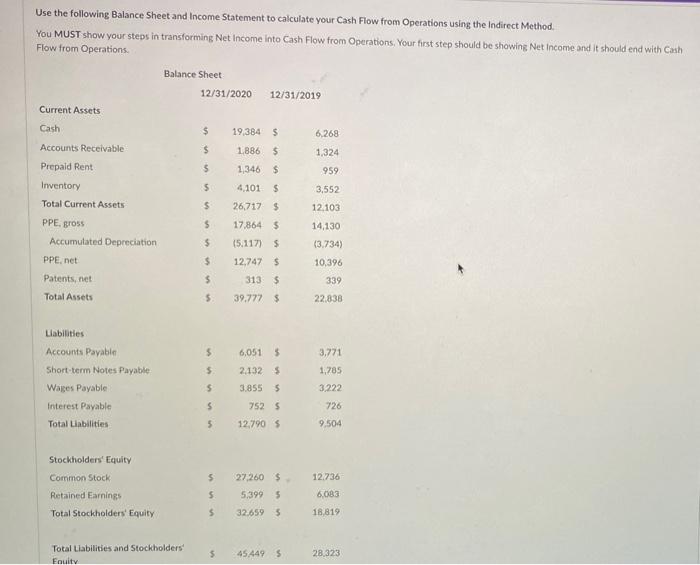

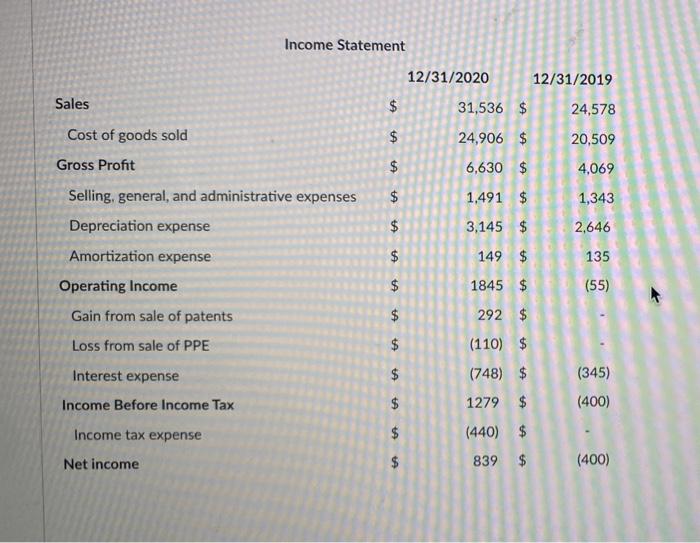

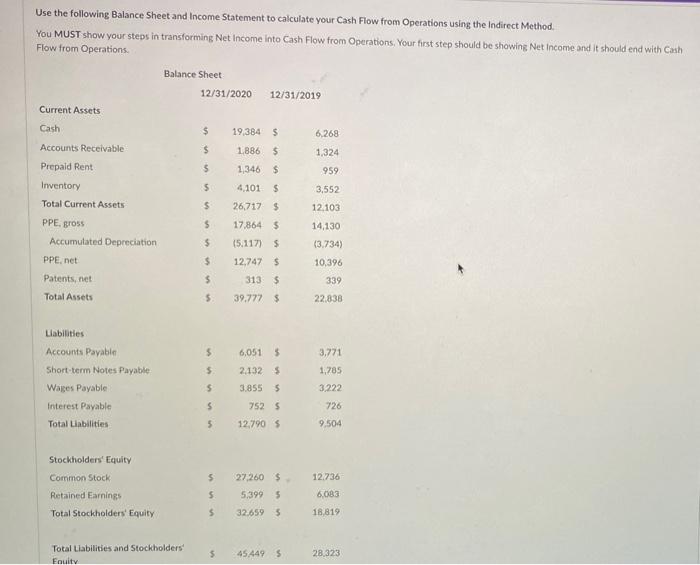

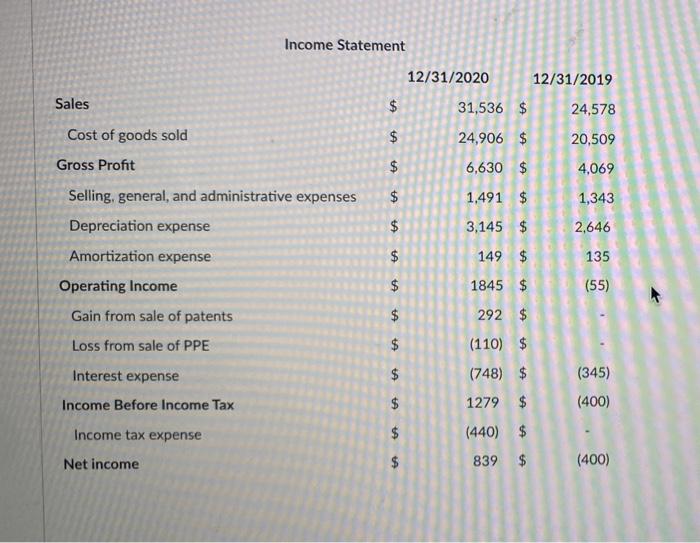

Use the following Balance Sheet and Income Statement to calculate your Cash Flow from Operations using the Indirect Method. You MUST show your steps in transforming Net Income into Cash Flow from Operations. Your first step should be showing Net Income and it should end with Cash Flow from Operations Balance Sheet 12/31/2020 12/31/2019 Current Assets Cash $ 6,268 19,384 5 1886 $ $ Accounts Receivable Prepaid Rent 1.324 959 5 1,346 $ 4.101 $ 5 3,552 Inventory Total Current Assets $ 26,717 $ 12.103 17.864 $ $ $ PPE. gross Accumulated Depreciation PPE.net Patents, net (5.117) $ 12,747 $ 14,130 13.734) 10,396 $ $ 313 $ 339 Total Assets 5 39.777 $ 22,838 Liabilities $ 6,051 5 3,771 $ 2.132 5 1,285 Accounts Payable Short-term Notes Payable Wages Payable Interest Payable Total Liabilities S 3.855 5 3.222 726 $ 7525 5 12,790 $ 9.504 5 12.736 Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity 27.260 $ 5,399 5 5 6,083 18,819 5 32.659 $ Total Liabilities and Stockholders Enuity 45.449 $ 28.323 $ Income Statement 12/31/2020 12/31/2019 Sales 31,536 $ 24,578 Cost of goods sold $ 24,906 $ 20,509 Gross Profit $ 6,630 $ 4,069 Selling, general, and administrative expenses $ 1.491 $ 1,343 Depreciation expense $ 3,145 $ 2,646 Amortization expense $ 149 $ 135 Operating Income $ 1845 $ Gain from sale of patents 292 $ Loss from sale of PPE (110) $ Interest expense $ (748) $ (345) Income Before Income Tax 1279 $ (400) Income tax expense $ (440) $ Net income $ 839 $ (400) $ ta (55) ta $ $ $ $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started