Answered step by step

Verified Expert Solution

Question

1 Approved Answer

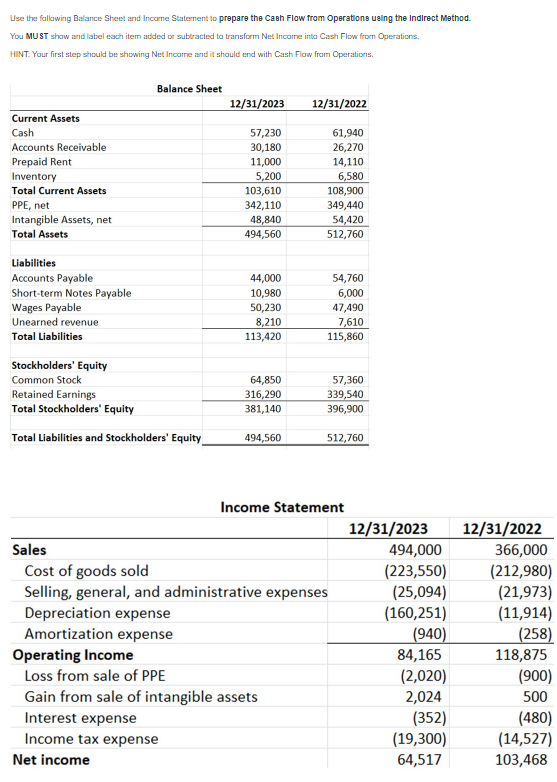

Use the following Balance Sheet and Income Statement to prepare the Cash Flow from Operations using the Indirect Method. You MUST show and label

Use the following Balance Sheet and Income Statement to prepare the Cash Flow from Operations using the Indirect Method. You MUST show and label each item added or subtracted to transform Net Income into Cash Flow from Operations. HINT: Your first step should be showing Net Income and it should end with Cash Flow from Operations. Balance Sheet 12/31/2023 12/31/2022 Current Assets Cash 57,230 61,940 Accounts Receivable 30,180 26,270 Prepaid Rent 11,000 14,110 Inventory 5,200 6,580 Total Current Assets 103,610 108,900 PPE, net 342,110 349,440 Intangible Assets, net 48,840 54,420 Total Assets 494,560 512,760 Liabilities Accounts Payable 44,000 54,760 Short-term Notes Payable 10,980 6,000 Wages Payable 50,230 47,490 Unearned revenue 8,210 7,610 Total Liabilities 113,420 115,860 Stockholders' Equity Common Stock 64,850 57,360 Retained Earnings 316,290 339,540 Total Stockholders' Equity 381,140 396,900 Total Liabilities and Stockholders' Equity 494,560 512,760 Income Statement 12/31/2023 12/31/2022 Sales 494,000 366,000 Cost of goods sold (223,550) (212,980) Selling, general, and administrative expenses (25,094) (21,973) Depreciation expense (160,251) (11,914) Amortization expense (940) (258) Operating Income 84,165 118,875 Loss from sale of PPE (2,020) (900) Gain from sale of intangible assets 2,024 500 Interest expense (352) (480) Income tax expense (19,300) (14,527) Net income 64,517 103,468

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started