Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following data for questions 22 thru 27: The Litton Company has established standards as follows based on a plan to produce and

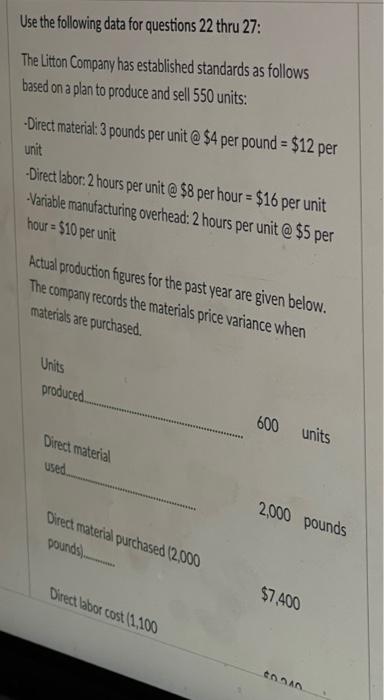

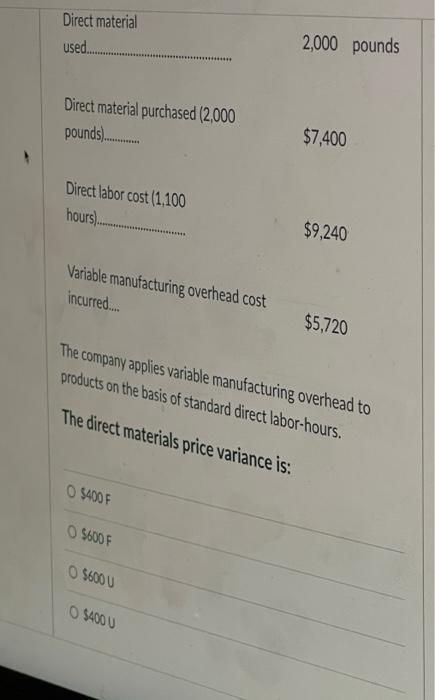

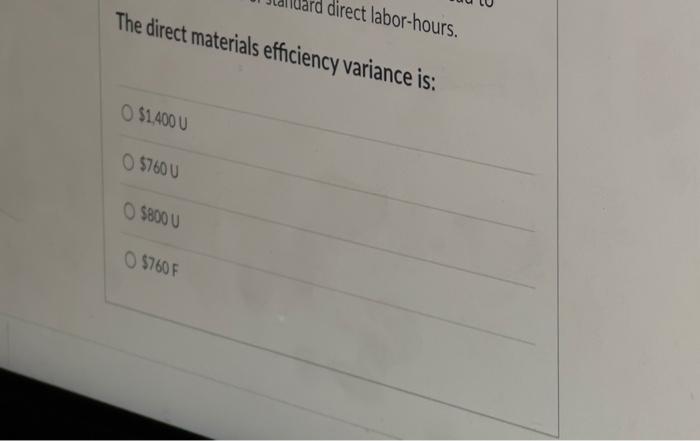

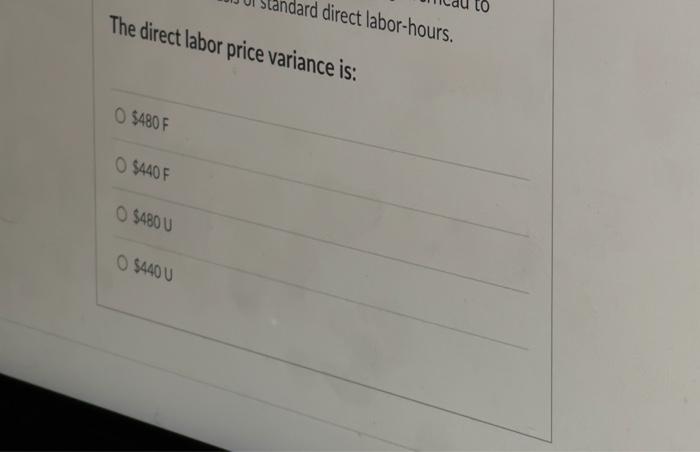

Use the following data for questions 22 thru 27: The Litton Company has established standards as follows based on a plan to produce and sell 550 units: -Direct material: 3 pounds per unit @ $4 per pound = $12 per unit -Direct labor: 2 hours per unit @ $8 per hour = $16 per unit -Variable manufacturing overhead: 2 hours per unit @ $5 per hour-$10 per unit Actual production figures for the past year are given below. The company records the materials price variance when materials are purchased. Units produced. Direct material used Direct material purchased (2,000 pounds) Direct labor cost (1,100 600 units 2,000 pounds $7,400 $0.040 Direct material used.................. Direct material purchased (2,000 pound............. Direct labor cost (1,100 hours)...... Variable manufacturing overhead cost incurred...... O $400 F O $600 F O $600 U 2,000 pounds The company applies variable manufacturing overhead to products on the basis of standard direct labor-hours. The direct materials price variance is: O $400 U $7,400 $9,240 $5,720 The direct materials efficiency variance is: O$1,400 U O $760 U O $800 U direct labor-hours. O $760 F The direct labor price variance is: O $480 F O $440 F O $480 U ndard direct labor-hours. O $440 U

Step by Step Solution

★★★★★

3.53 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started