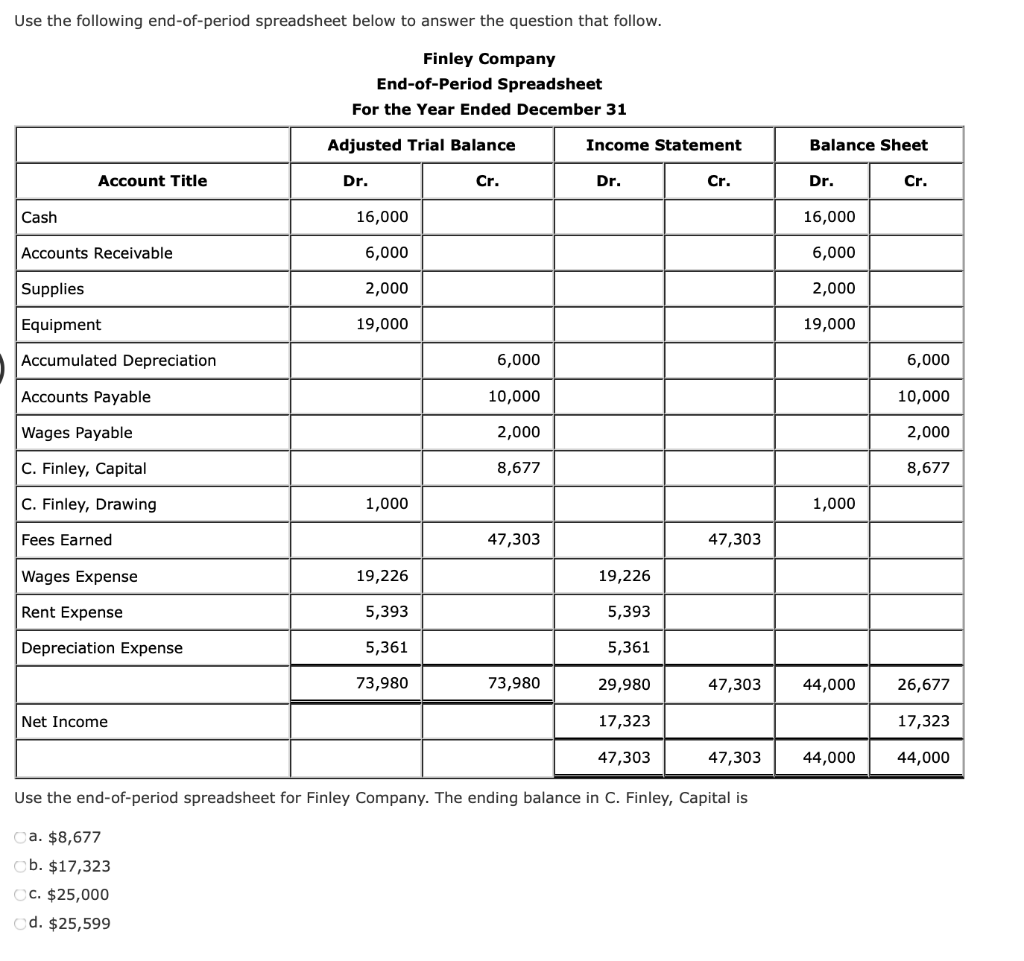

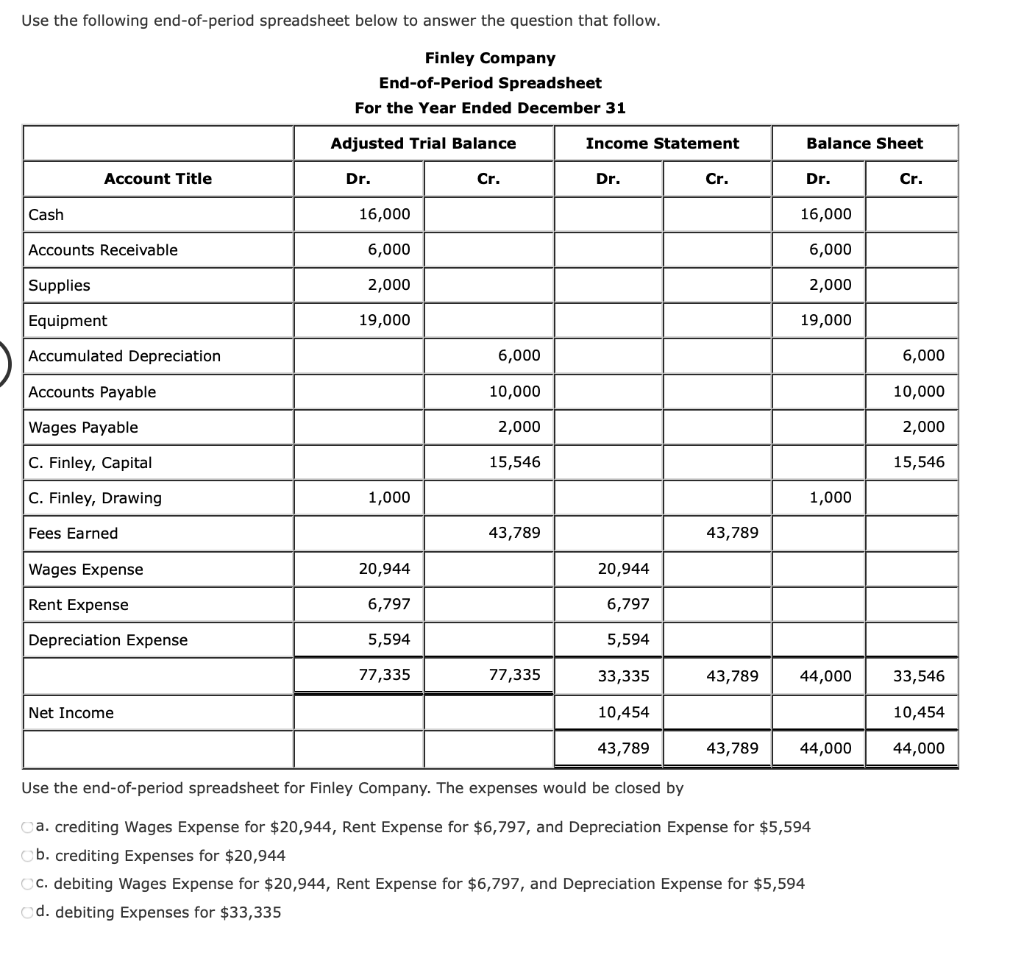

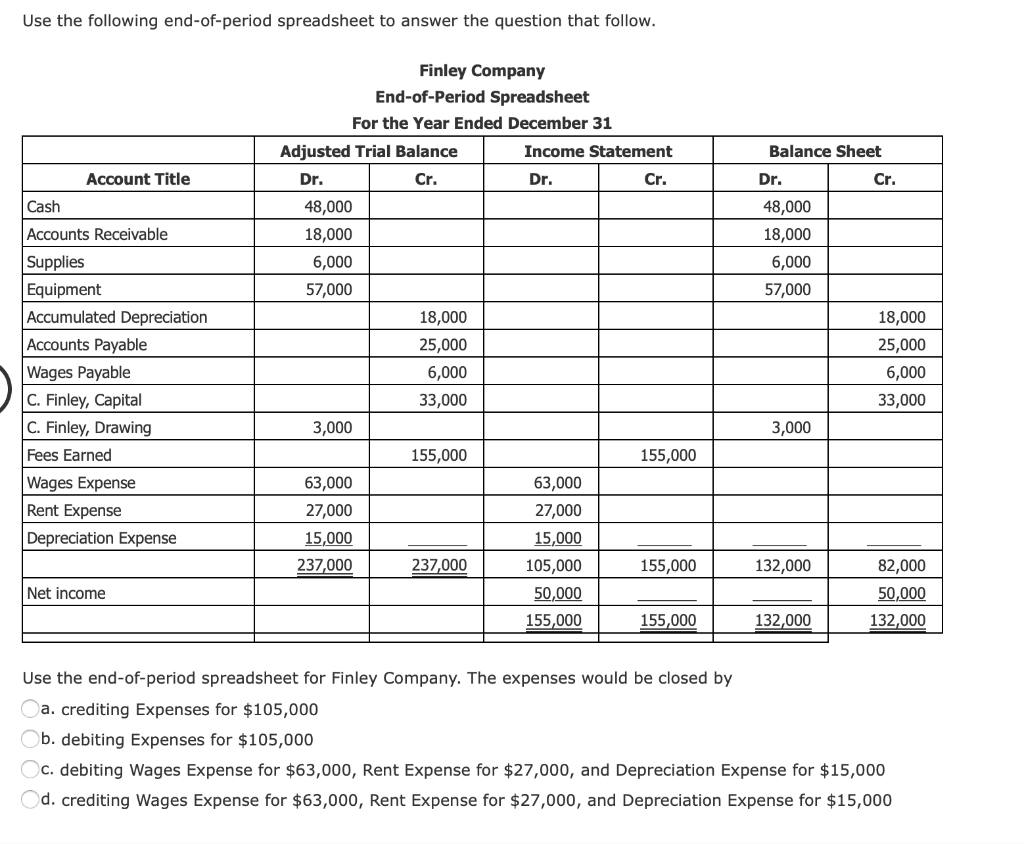

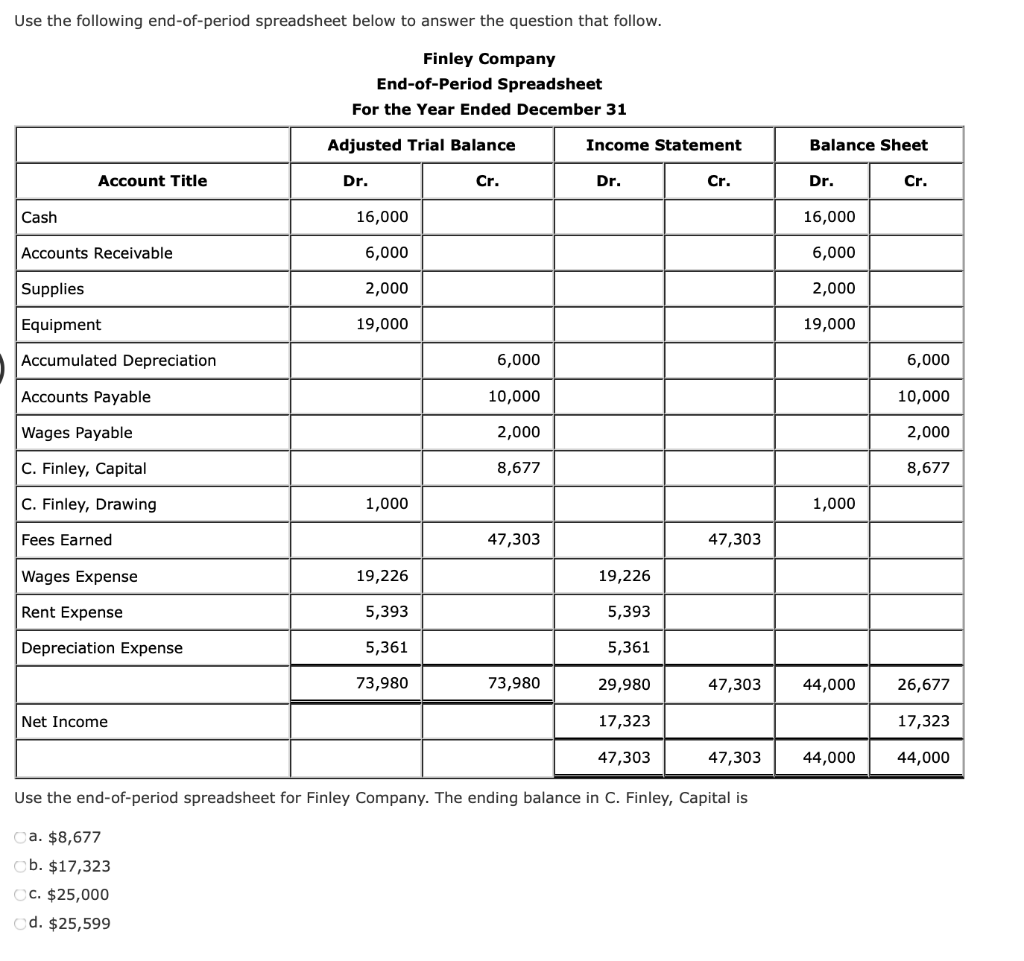

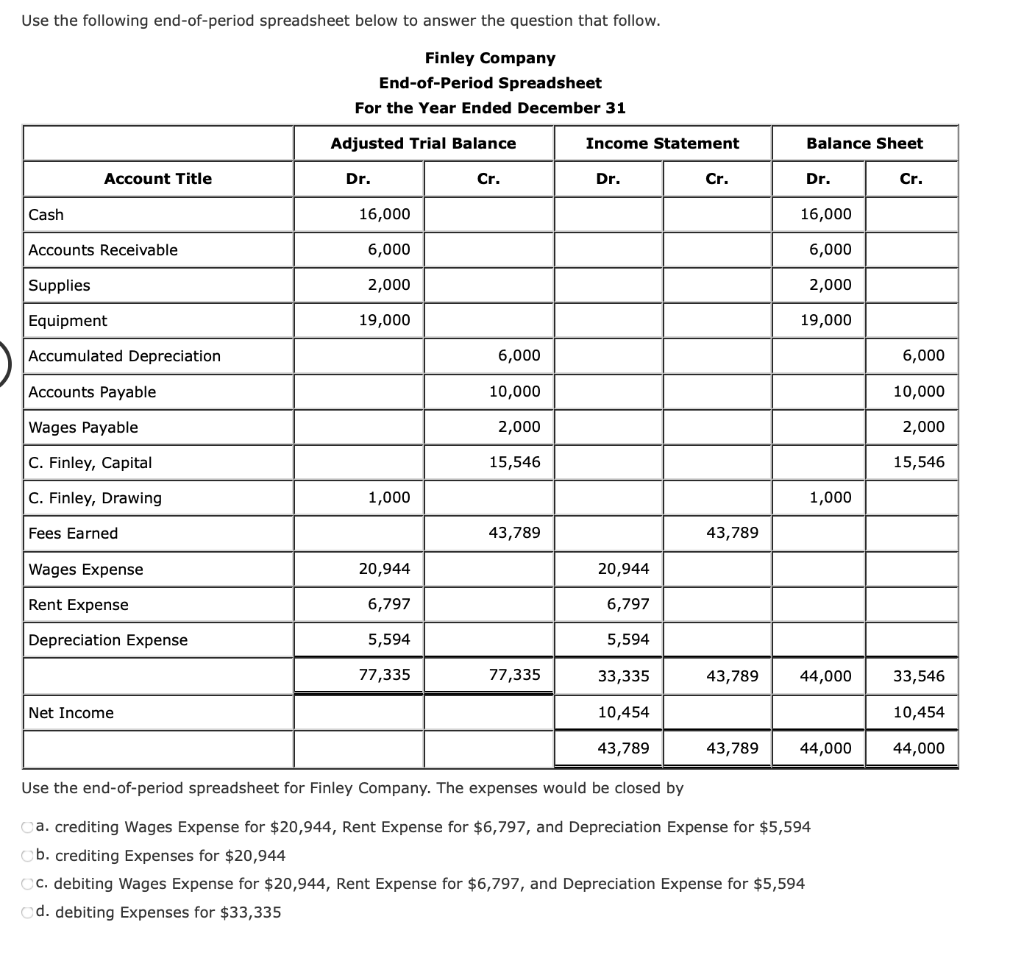

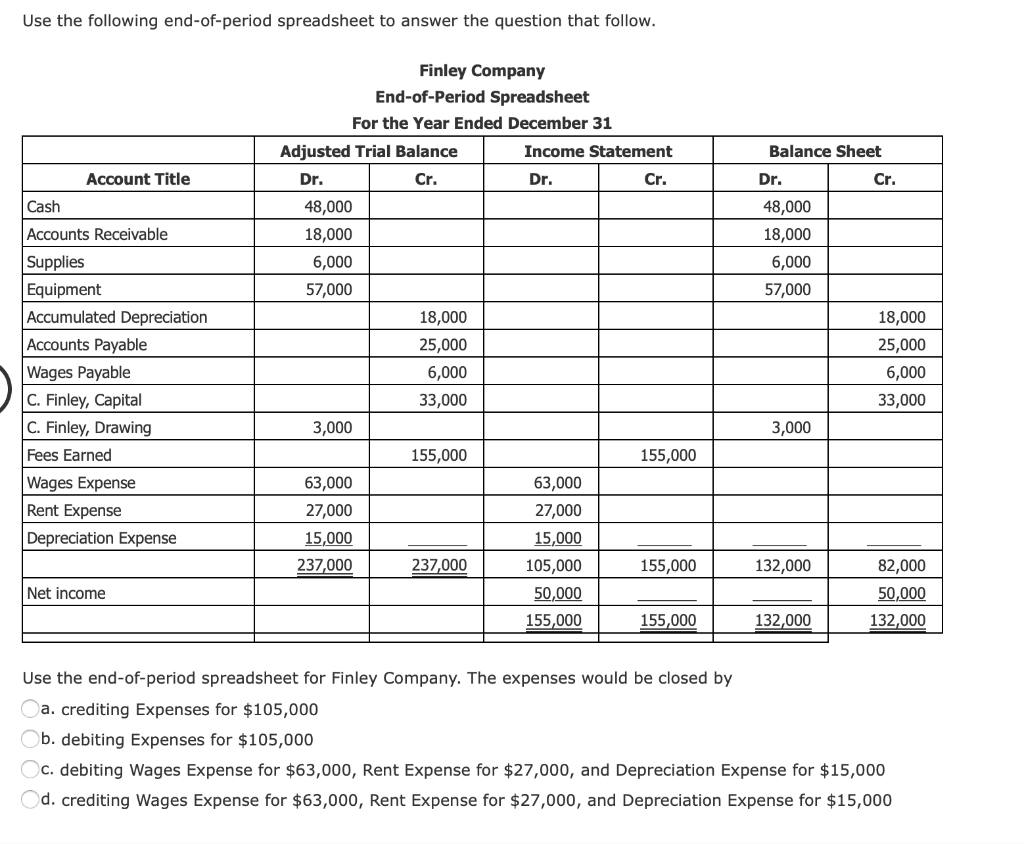

Use the following end-of-period spreadsheet below to answer the question that follow. Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Income Statement Balance Sheet Account Title Dr. Cr. Dr. Cr. Dr. Cr. 16,000 Cash 16,000 Accounts Receivable 6,000 6,000 2,000 2,000 Supplies 19,000 19,000 Equipment Accumulated Depreciation 6,000 6,000 Accounts Payable 10,000 10,000 Wages Payable 2,000 2,000 C. Finley, Capital 8,677 8,677 1,000 C. Finley, Drawing 1,000 47,303 47,303 Fees Earned 19,226 19,226 Wages Expense 5,393 Rent Expense 5,393 Depreciation Expense 5,361 5,361 73,980 73,980 47,303 44,000 26,677 29,980 17,323 17,323 Net Income 47,303 44,000 44,000 47,303 Use the end-of-period spreadsheet for Finley Company. The ending balance in C. Finley, Capital is a. $8,677 b. $17,323 c. $25,000 d. $25,599 Use the following end-of-period spreadsheet below to answer the question that follow. Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Adjusted Trial Balance Balance Sheet Income Statement Account Title Dr. Cr. Dr. Cr. Dr. Cr. 16,000 16,000 Cash 6,000 6,000 Accounts Receivable 2,000 Supplies 2,000 Equipment 19,000 19,000 Accumulated Depreciation 6,000 6,000 Accounts Payable 10,000 10,000 Wages Payable 2,000 2,000 C. Finley, Capital 15,546 15,546 C. Finley, Drawing 1,000 1,000 43,789 43,789 Fees Earned Wages Expense 20,944 20,944 Rent Expense 6,797 6,797 5,594 5,594 Depreciation Expense 77,335 77,335 33,335 43,789 44,000 33,546 10,454 10,454 Net Income 44,000 43,789 43,789 44,000 Use the end-of-period spreadsheet for Finley Company. The expenses would be closed by a. crediting Wages Expense for $20,944, Rent Expense for $6,797, and Depreciation Expense for $5,594 b.crediting Expenses for $20,944 c. debiting Wages Expense for $20,944, Rent Expense for $6,797, and Depreciation Expense for $5,594 d. debiting Expenses for $33,335 Use the following end-of-period spreadsheet to answer the question that follow. Finley Company End-of-Period Spreadsheet For the Year Ended December 31 Income Statement Adjusted Trial Balance Balance Sheet Account Title Dr. Cr. Dr. Cr. Dr. Cr. Cash 48,000 48,000 Accounts Receivable 18,000 18,000 Supplies 6,000 6,000 Equipment 57,000 57,000 Accumulated Depreciation 18,000 18,000 Accounts Payable Wages Payable 25,000 25,000 6,000 6,000 C. Finley, Capital 33,000 33,000 C. Finley, Drawing 3,000 3,000 Fees Earned 155,000 155,000 63,000 63,000 Wages Expense Rent Expense 27,000 27,000 Depreciation Expense 15,000 15,000 132,000 237,000 237,000 105,000 155,000 82,000 50,000 Net income 50,000 155,000 132,000 132,000 155,000 Use the end-of-period spreadsheet for Finley Company. The expenses would be closed by a. crediting Expenses for $105,000 b. debiting Expenses for $105,000 c. debiting Wages Expense for $63,000, Rent Expense for $27,000, and Depreciation Expense for $15,000 d. crediting Wages Expense for $63,000, Rent Expense for $27,000, and Depreciation Expense for $15,000