Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following financial statements of Heifer Sports Inc. in $ Table 14.14 to find Heifer's: ( 14-1) a. Inventory turnover ratio. b. Debt/equity ratio.

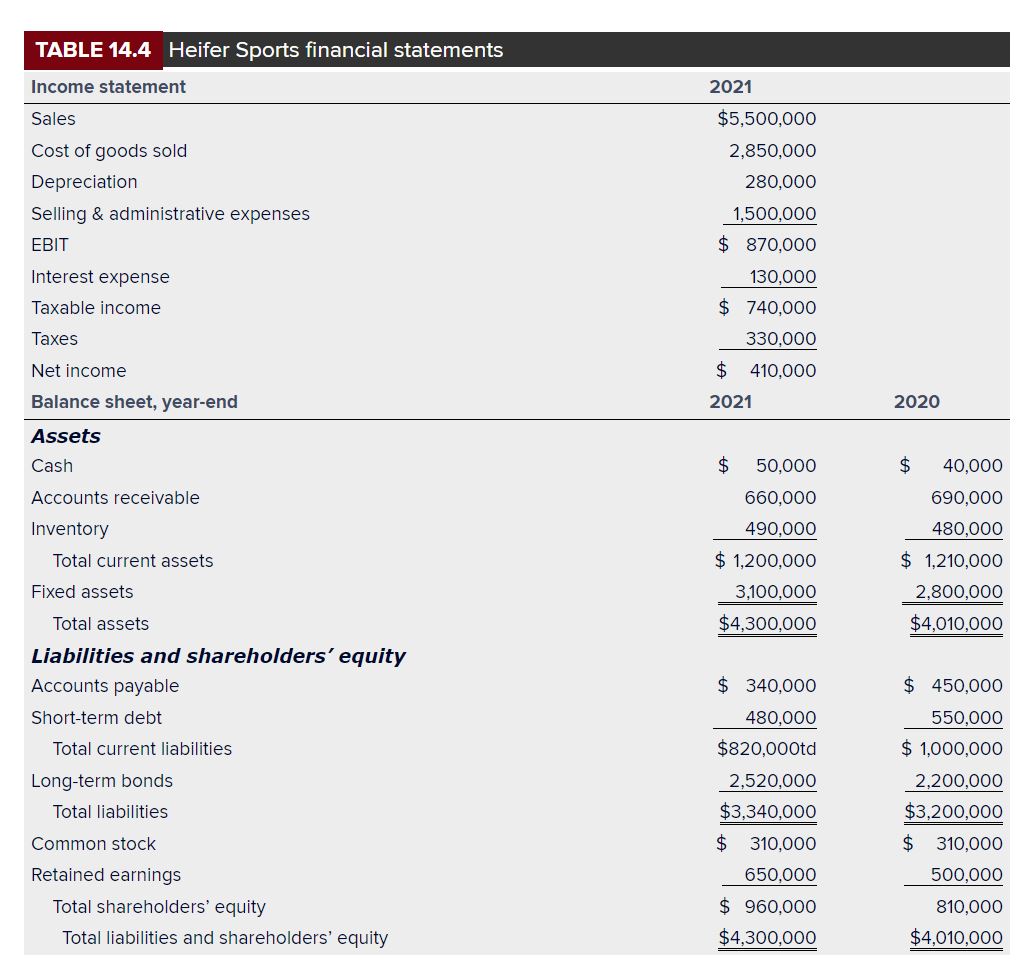

Use the following financial statements of Heifer Sports Inc. in $ Table 14.14 to find Heifer's: ( 14-1) a. Inventory turnover ratio. b. Debt/equity ratio. c. Cash flow from operating activities. d. Average collection period. e. Asset turnover ratio. f. Interest coverage ratio. g. Operating profit margin. h. Return on equity. i. P/E ratio. j. Compound leverage ratio. k. Net cash provided by operating activities. \begin{tabular}{|c|c|c|} \hline Income statement & 2021 & \\ \hline Sales & $5,500,000 & \\ \hline Cost of goods sold & 2,850,000 & \\ \hline Depreciation & 280,000 & \\ \hline Selling \& administrative expenses & 1,500,000 & \\ \hline EBIT & $870,000 & \\ \hline Interest expense & 130,000 & \\ \hline Taxable income & $740,000 & \\ \hline Taxes & 330,000 & \\ \hline Net income & $410,000 & \\ \hline Balance sheet, year-end & 2021 & 2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash & $50,000 & 40,000 \\ \hline Accounts receivable & 660,000 & 690,000 \\ \hline Inventory & 490,000 & 480,000 \\ \hline Total current assets & $1,200,000 & $1,210,000 \\ \hline Fixed assets & 3,100,000 & 2,800,000 \\ \hline Total assets & $4,300,000 & $4,010,000 \\ \hline \multicolumn{3}{|l|}{ Liabilities and shareholders' equity } \\ \hline Accounts payable & $340,000 & $450,000 \\ \hline Short-term debt & 480,000 & 550,000 \\ \hline Total current liabilities & $820,000td & $1,000,000 \\ \hline Long-term bonds & 2,520,000 & 2,200,000 \\ \hline Total liabilities & $3,340,000 & $3,200,000 \\ \hline Common stock & $310,000 & $310,000 \\ \hline Retained earnings & 650,000 & 500,000 \\ \hline Total shareholders' equity & $960,000 & 810,000 \\ \hline Total liabilities and shareholders' equity & $4,300,000 & $4,010,000 \\ \hline \end{tabular} Use the following financial statements of Heifer Sports Inc. in $ Table 14.14 to find Heifer's: ( 14-1) a. Inventory turnover ratio. b. Debt/equity ratio. c. Cash flow from operating activities. d. Average collection period. e. Asset turnover ratio. f. Interest coverage ratio. g. Operating profit margin. h. Return on equity. i. P/E ratio. j. Compound leverage ratio. k. Net cash provided by operating activities. \begin{tabular}{|c|c|c|} \hline Income statement & 2021 & \\ \hline Sales & $5,500,000 & \\ \hline Cost of goods sold & 2,850,000 & \\ \hline Depreciation & 280,000 & \\ \hline Selling \& administrative expenses & 1,500,000 & \\ \hline EBIT & $870,000 & \\ \hline Interest expense & 130,000 & \\ \hline Taxable income & $740,000 & \\ \hline Taxes & 330,000 & \\ \hline Net income & $410,000 & \\ \hline Balance sheet, year-end & 2021 & 2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash & $50,000 & 40,000 \\ \hline Accounts receivable & 660,000 & 690,000 \\ \hline Inventory & 490,000 & 480,000 \\ \hline Total current assets & $1,200,000 & $1,210,000 \\ \hline Fixed assets & 3,100,000 & 2,800,000 \\ \hline Total assets & $4,300,000 & $4,010,000 \\ \hline \multicolumn{3}{|l|}{ Liabilities and shareholders' equity } \\ \hline Accounts payable & $340,000 & $450,000 \\ \hline Short-term debt & 480,000 & 550,000 \\ \hline Total current liabilities & $820,000td & $1,000,000 \\ \hline Long-term bonds & 2,520,000 & 2,200,000 \\ \hline Total liabilities & $3,340,000 & $3,200,000 \\ \hline Common stock & $310,000 & $310,000 \\ \hline Retained earnings & 650,000 & 500,000 \\ \hline Total shareholders' equity & $960,000 & 810,000 \\ \hline Total liabilities and shareholders' equity & $4,300,000 & $4,010,000 \\ \hline \end{tabular}

Use the following financial statements of Heifer Sports Inc. in $ Table 14.14 to find Heifer's: ( 14-1) a. Inventory turnover ratio. b. Debt/equity ratio. c. Cash flow from operating activities. d. Average collection period. e. Asset turnover ratio. f. Interest coverage ratio. g. Operating profit margin. h. Return on equity. i. P/E ratio. j. Compound leverage ratio. k. Net cash provided by operating activities. \begin{tabular}{|c|c|c|} \hline Income statement & 2021 & \\ \hline Sales & $5,500,000 & \\ \hline Cost of goods sold & 2,850,000 & \\ \hline Depreciation & 280,000 & \\ \hline Selling \& administrative expenses & 1,500,000 & \\ \hline EBIT & $870,000 & \\ \hline Interest expense & 130,000 & \\ \hline Taxable income & $740,000 & \\ \hline Taxes & 330,000 & \\ \hline Net income & $410,000 & \\ \hline Balance sheet, year-end & 2021 & 2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash & $50,000 & 40,000 \\ \hline Accounts receivable & 660,000 & 690,000 \\ \hline Inventory & 490,000 & 480,000 \\ \hline Total current assets & $1,200,000 & $1,210,000 \\ \hline Fixed assets & 3,100,000 & 2,800,000 \\ \hline Total assets & $4,300,000 & $4,010,000 \\ \hline \multicolumn{3}{|l|}{ Liabilities and shareholders' equity } \\ \hline Accounts payable & $340,000 & $450,000 \\ \hline Short-term debt & 480,000 & 550,000 \\ \hline Total current liabilities & $820,000td & $1,000,000 \\ \hline Long-term bonds & 2,520,000 & 2,200,000 \\ \hline Total liabilities & $3,340,000 & $3,200,000 \\ \hline Common stock & $310,000 & $310,000 \\ \hline Retained earnings & 650,000 & 500,000 \\ \hline Total shareholders' equity & $960,000 & 810,000 \\ \hline Total liabilities and shareholders' equity & $4,300,000 & $4,010,000 \\ \hline \end{tabular} Use the following financial statements of Heifer Sports Inc. in $ Table 14.14 to find Heifer's: ( 14-1) a. Inventory turnover ratio. b. Debt/equity ratio. c. Cash flow from operating activities. d. Average collection period. e. Asset turnover ratio. f. Interest coverage ratio. g. Operating profit margin. h. Return on equity. i. P/E ratio. j. Compound leverage ratio. k. Net cash provided by operating activities. \begin{tabular}{|c|c|c|} \hline Income statement & 2021 & \\ \hline Sales & $5,500,000 & \\ \hline Cost of goods sold & 2,850,000 & \\ \hline Depreciation & 280,000 & \\ \hline Selling \& administrative expenses & 1,500,000 & \\ \hline EBIT & $870,000 & \\ \hline Interest expense & 130,000 & \\ \hline Taxable income & $740,000 & \\ \hline Taxes & 330,000 & \\ \hline Net income & $410,000 & \\ \hline Balance sheet, year-end & 2021 & 2020 \\ \hline \multicolumn{3}{|l|}{ Assets } \\ \hline Cash & $50,000 & 40,000 \\ \hline Accounts receivable & 660,000 & 690,000 \\ \hline Inventory & 490,000 & 480,000 \\ \hline Total current assets & $1,200,000 & $1,210,000 \\ \hline Fixed assets & 3,100,000 & 2,800,000 \\ \hline Total assets & $4,300,000 & $4,010,000 \\ \hline \multicolumn{3}{|l|}{ Liabilities and shareholders' equity } \\ \hline Accounts payable & $340,000 & $450,000 \\ \hline Short-term debt & 480,000 & 550,000 \\ \hline Total current liabilities & $820,000td & $1,000,000 \\ \hline Long-term bonds & 2,520,000 & 2,200,000 \\ \hline Total liabilities & $3,340,000 & $3,200,000 \\ \hline Common stock & $310,000 & $310,000 \\ \hline Retained earnings & 650,000 & 500,000 \\ \hline Total shareholders' equity & $960,000 & 810,000 \\ \hline Total liabilities and shareholders' equity & $4,300,000 & $4,010,000 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started