Answered step by step

Verified Expert Solution

Question

1 Approved Answer

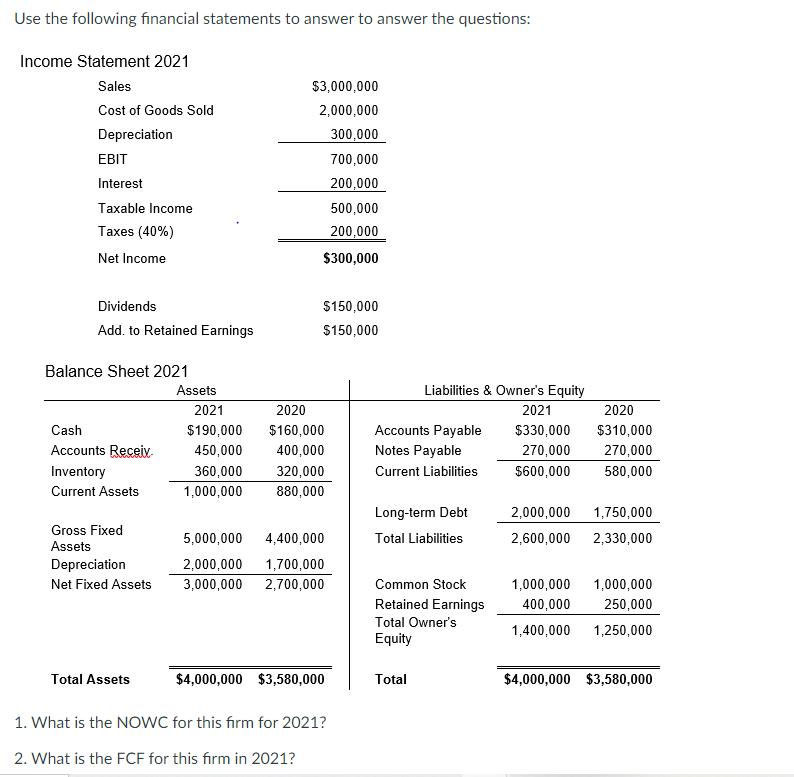

Use the following financial statements to answer to answer the questions: Income Statement 2021 Sales Cost of Goods Sold Depreciation EBIT Interest Taxable Income

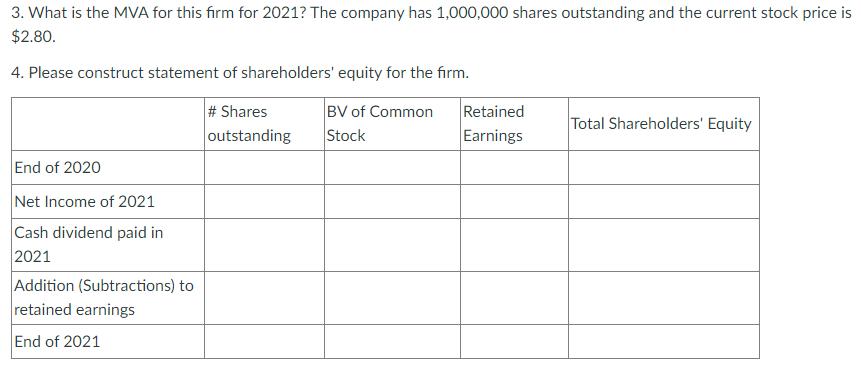

Use the following financial statements to answer to answer the questions: Income Statement 2021 Sales Cost of Goods Sold Depreciation EBIT Interest Taxable Income Taxes (40%) Net Income Dividends Add. to Retained Earnings Balance Sheet 2021 Cash Accounts Receix Inventory Current Assets Gross Fixed Assets Depreciation Net Fixed Assets Total Assets Assets $3,000,000 2,000,000 300,000 700,000 200,000 500,000 200,000 $300,000 $150,000 $150,000 2021 2020 $190,000 $160,000 450,000 400,000 360,000 1,000,000 320,000 880,000 5,000,000 4,400,000 2,000,000 1,700,000 3,000,000 2,700,000 $4,000,000 $3,580,000 1. What is the NOWC for this firm for 2021? 2. What is the FCF for this firm in 2021? Liabilities & Owner's Equity 2021 $330,000 270,000 $600,000 Accounts Payable Notes Payable Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Owner's Equity Total 2020 $310,000 270,000 580,000 2,000,000 1,750,000 2,600,000 2,330,000 1,000,000 1,000,000 400,000 250,000 1,400,000 1,250,000 $4,000,000 $3,580,000 3. What is the MVA for this firm for 2021? The company has 1,000,000 shares outstanding and the current stock price is $2.80. 4. Please construct statement of shareholders' equity for the firm. # Shares outstanding BV of Common Stock End of 2020 Net Income of 2021 Cash dividend paid in 2021 Addition (Subtractions) to retained earnings End of 2021 Retained Earnings Total Shareholders' Equity

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The questions relate to the analysis of financial statements of a company for the year 2021 Lets address each question one by one 1 What is the NOWC for this firm for 2021 NOWC stands for Net Operatin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started