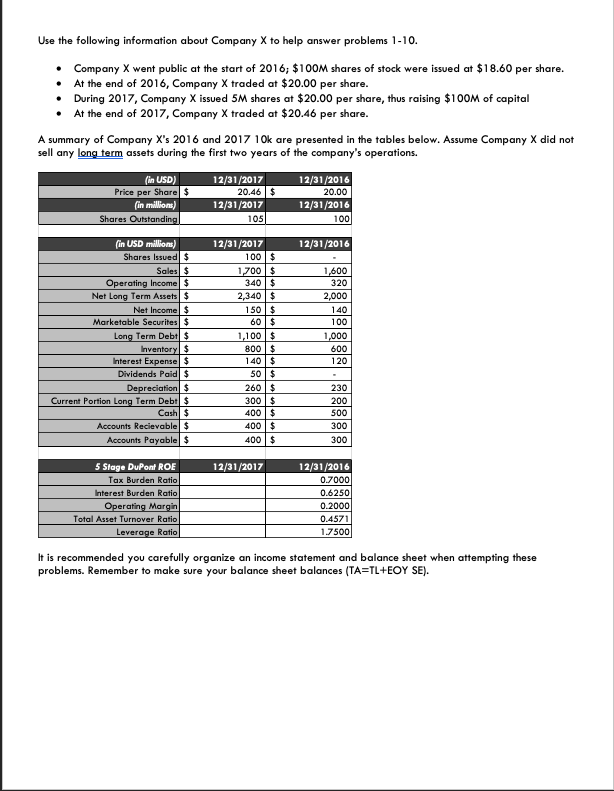

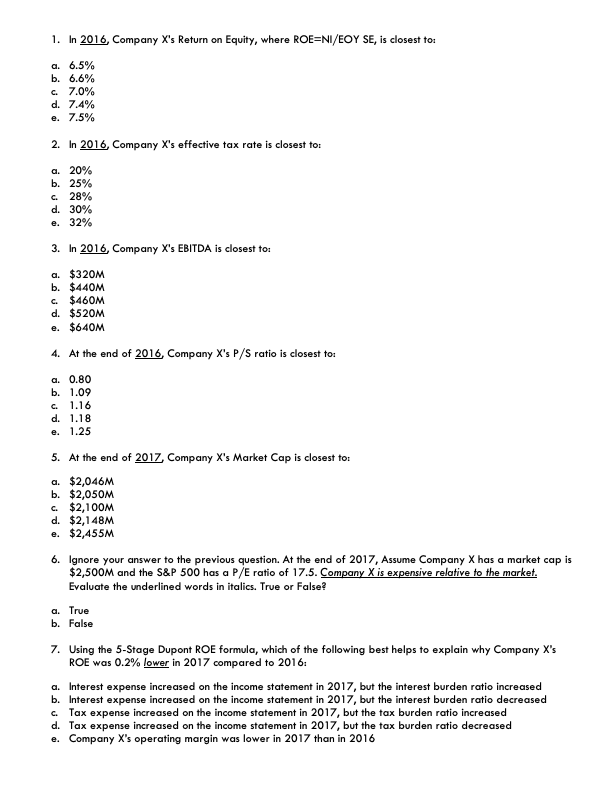

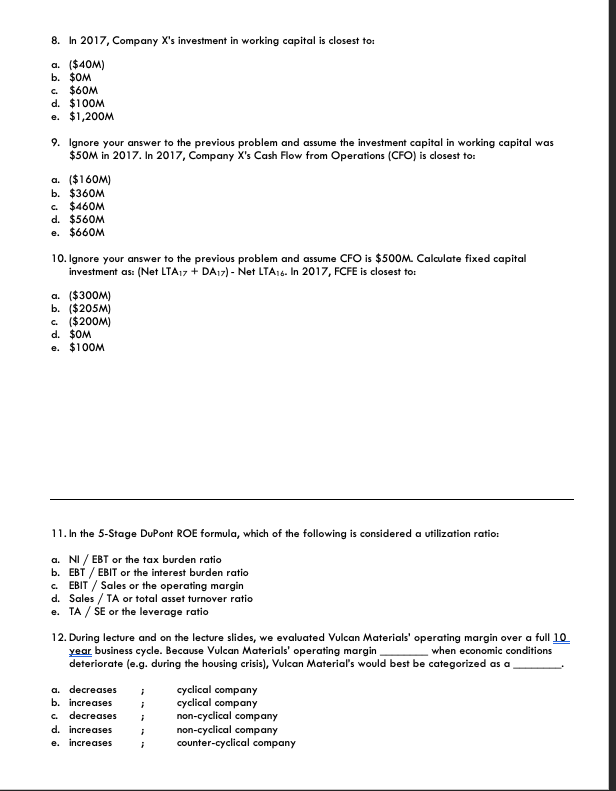

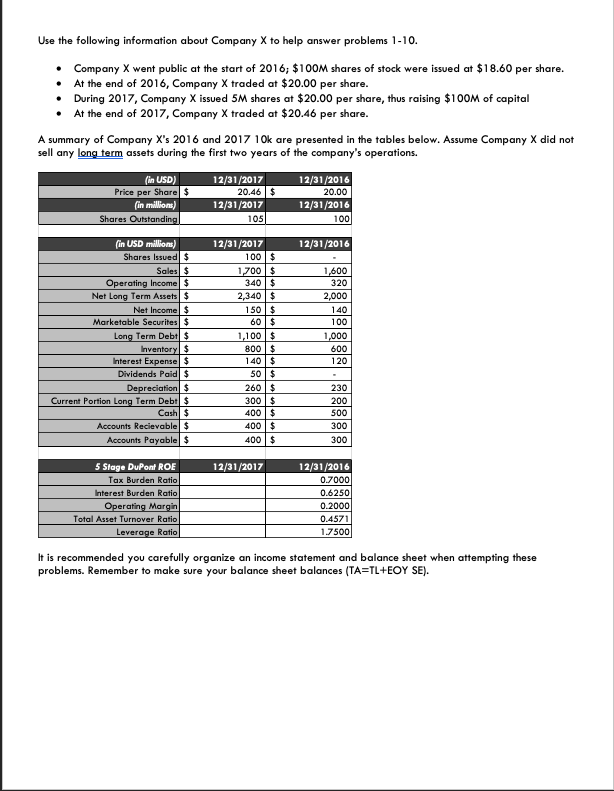

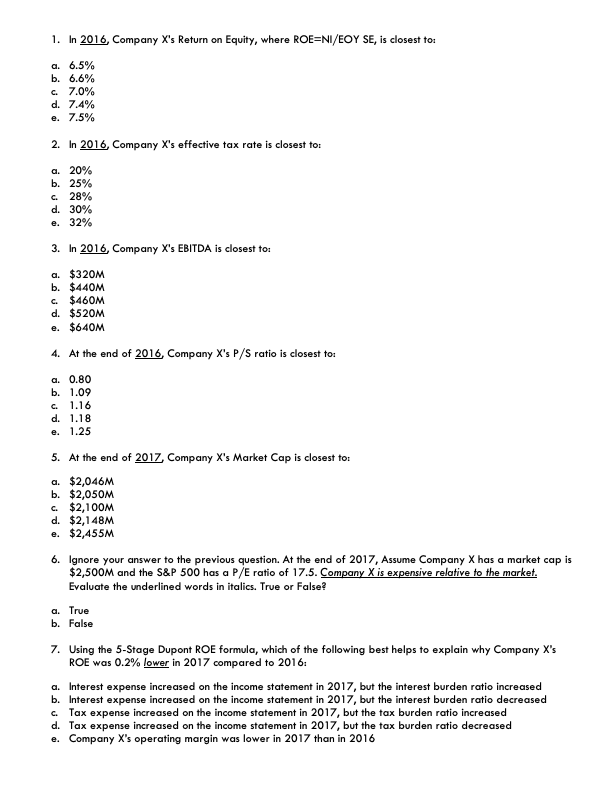

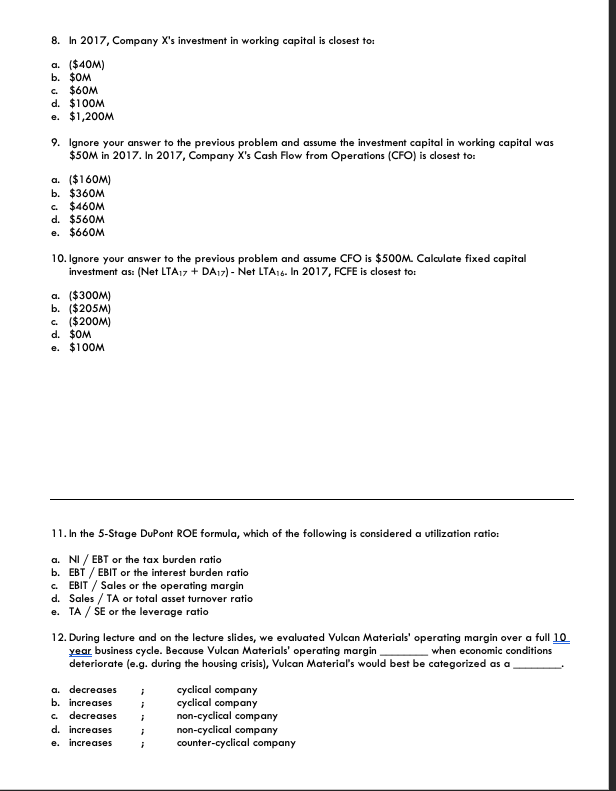

Use the following information about Company X to help answer problems 1-10. Company X went public at the start of 2016, $100M shares of stock were issued at $18.60 per share. At the end of 2016, Company X traded at $20.00 per share. During 2017, Company X issued 5 shares at $20.00 per share, thus raising $100M of capital At the end of 2017, Company X traded at $20.46 per share. A summary of Company X's 2016 and 2017 10k are presented in the tables below. Assume Company X did not sell any long term assets during the first two years of the company's operations. $ (in USD) Price per Share $ (in millions) Shares Outstanding 12/31/2017 20.46 12/31/2017 105 12/31/2016 20.00 12/31/2016 1001 12/31/2016 1,600 320 2,000 140 100 1,000 (in USD millions) Shares Issued $ Sales $ Operating Income $ Net Long Term Assets $ Net Income $ Marketable Securites $ Long Term Debt $ Inventoryl $ Interest Expense $ Dividends Paid $ Depreciation $ Current Portion Long Term Debtl $ Cashl $ Accounts Recievable $ Accounts Payable $ 12/31/2017 100 $ 1700$ 340 $ 2,340 $ 150 $ 60 $ 1,100 $ 800$ 140 $ 50 $ 260 $ 300 $ 400 $ 400 $ 400 $ 600 120 230 200 500 300 300 12/31/2017 5 Stage DuPont ROE Tax Burden Ratio Interest Burden Ratio Operating Margin Total Asset Turnover Ratio Leverage Ratio 12/31/2016 0.7000 0.6250 0.2000l 0.4571 1.75001 It is recommended you carefully organize an income statement and balance sheet when attempting these problems. Remember to make sure your balance sheet balances (TA=TL+EOY SE). 1. In 2016, Company X's Return on Equity, where ROE=NI/EOY SE, is closest to: a. 6.5% b. 6.6% c. 7.0% d. 7.4% e. 7.5% 2. In 2016, Company X's effective tax rate is closest to a. 20% b. 25% c 28% d. 30% e. 32% 3. In 2016, Company X's EBITDA is closest to: a. $320M b. $440M c. $460M d. $520M e. $640M 4. At the end of 2016, Company X's P/S ratio is closest to: a. 0.80 b. 1.09 c. 1.16 d. 1.18 e. 1.25 5. At the end of 2017, Company X's Market Cap is closest to a. $2,046M b. $2,050M c. $2,100M d. $2,148M e. $2,455M 6. Ignore your answer to the previous question. At the end of 2017, Assume Company X has a market cap is $2,500M and the S&P 500 has a P/E ratio of 17.5. Company X is expensive relative to the market. Evaluate the underlined words in italics. True or False? a. True b. False 7. Using the 5-Stage Dupont ROE formula, which of the following best helps to explain why Company X's ROE was 0.2% lower in 2017 compared to 2016: a. Interest expense increased on the income statement in 2017, but the interest burden ratio increased b. Interest expense increased on the income statement in 2017, but the interest burden ratio decreased c. Tax expense increased on the income statement in 2017, but the tax burden ratio increased d. Tax expense increased on the income statement in 2017, but the tax burden ratio decreased e. Company X's operating margin was lower in 2017 than in 2016 8. In 2017, Company X's investment in working capital is closest to: a. ($40M) b. $OM c. $60M d. $100M e. $1,200M 9. Ignore your answer to the previous problem and assume the investment capital in working capital was $50M in 2017. In 2017, Company X's Cash Flow from Operations (CFO) is closest to: a. ($ 160M) b. $360M c. $460M d. $560M e. $660M 10. Ignore your answer to the previous problem and assume CFO is $500M. Calculate fixed capital investment as: (Net LTA17 + DA17) - Net LTA16. In 2017, FCFE is closest to: a. ($300M) b. ($205M) c. ($200M) d. $OM e. $100M 11. In the 5-Stage DuPont ROE formula, which of the following is considered a utilization ratio: a. NI / EBT or the tax burden ratio b. EBT / EBIT or the interest burden ratio c. EBIT/ Sales or the operating margin d. Sales / TA or total asset turnover ratio e. TA / SE or the leverage ratio 12. During lecture and on the lecture slides, we evaluated Vulcan Materials' operating margin over a full 10 year business cycle. Because Vulcan Materials' operating margin_ when economic conditions deteriorate (e.g. during the housing crisis), Vulcan Material's would best be categorized as a a. decreases b. increases C. decreases d increases e increases cyclical company cyclical company non-cyclical company non-cyclical company counter-cyclical company