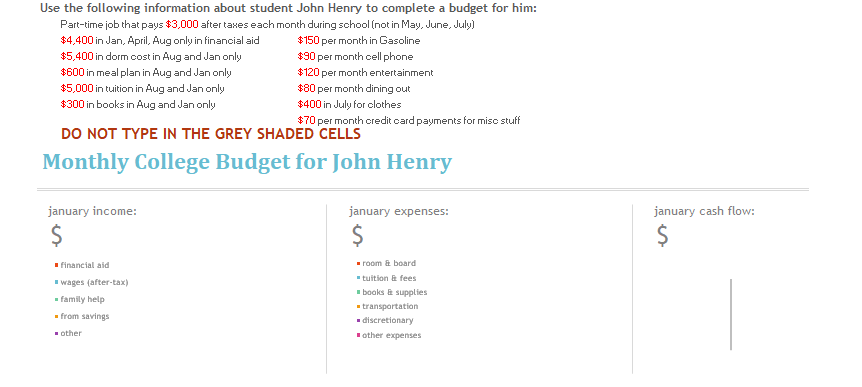

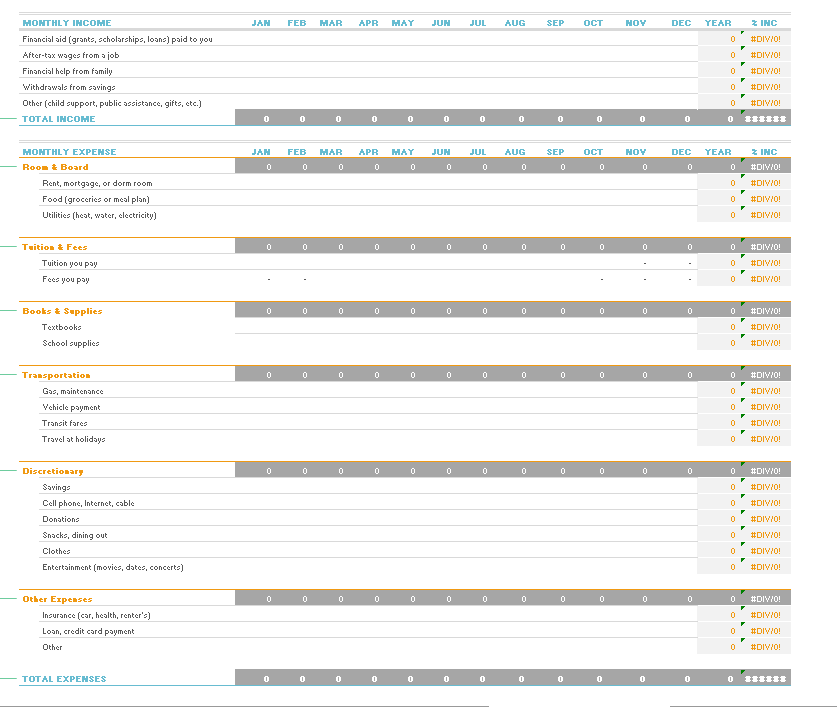

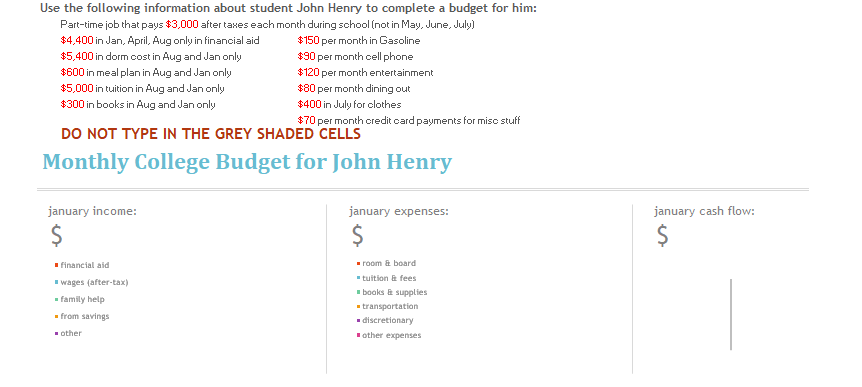

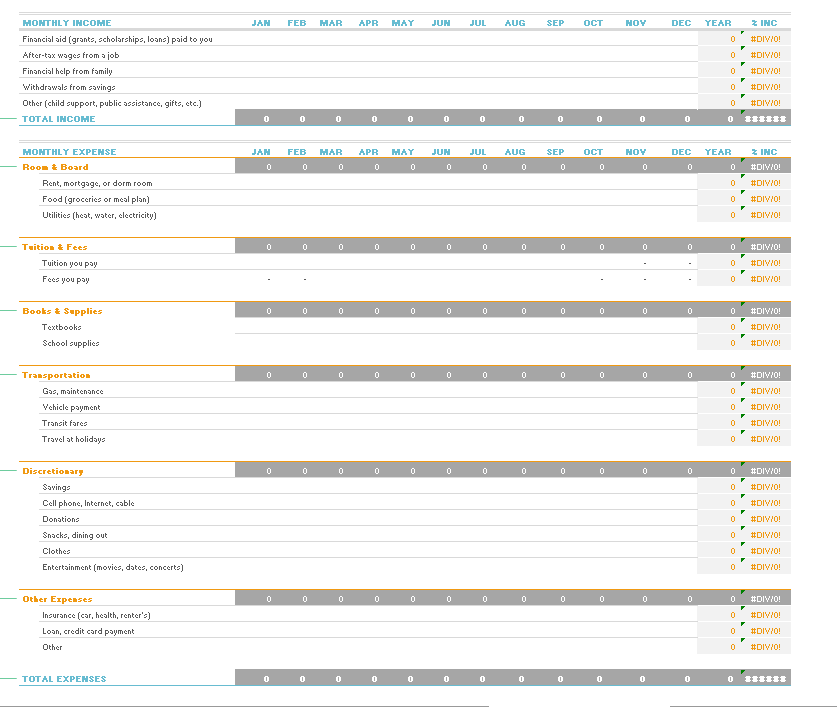

Use the following information about student John Henry to complete a budget for him: Part-time job that pays $3,000 after taxes each month during school (not in May, June July) $4,400 in Jan, April, Aug only in financial aid $150 per month in Gasoline $5,400 in dorm cost in Aug and Jan only $90 per month cell phone $600 in meal plan in Aug and Jan only $120 per month entertainment $5,000 in tuition in Aug and Jan only $80 per month dining out $300 in books in Aug and Jan only $400 in July for clothes $70 per month credit card payments for misc stuff DO NOT TYPE IN THE GREY SHADED CELLS Monthly College Budget for John Henry january income: $ january expenses: $ january cash flow: $ financial aid wages (after-tax) - family help from savings other room & board tuition fees books at supplies transportation discretionary other expenses JAN FEB HAR APR HAY JUN JUL AUG SEP OCT HOY DEC YEAR INC #DIV/0! 0 HONTHLY INCOME Financial aid (grants, scholarship, loond) paid to you After-tax wages from a job Financial help from family Withdrawals from Savings Other (child support, public assistance, gifts, etc.) TOTAL INCOME #DIV/0! #DIV/0! 0 0 #DIV/01 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 ###### JAN FEB HAR APR HAY JUN JUL AUG SEP OCT HOY DEC YEAR 0 0 0 0 0 0 0 0 0 0 0 0 0 HONTHLY EXPEHSE Room & Board Rent, mortgage, or dorm room Food (groceries or meal plan) Utilities (heat, water, electricity) ZINC #DIV/0! #DIV/0! #DIV/0! #DIV/0! Tuition & Fees 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! #DIV/0! 0 Tuition you pay Fees you pay 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! Books & Supplies Textbooks School Supplies 0 #DIV/0! 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Transportation Gas, maintenance Vehicle payment Transit fares Travel at holidays 0 #DIV/0! #DIV/0! #DIVYO! #DIV/0! #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! 0 #DIV/0! 0 Discretionary Savings Cell phone, Internet, cable Donations Snacks, dining out Clothes Entertainment (movies, dates, concerts) #DIV/0! #DIV/0! 0 0 #DIV/0! 0 #DIV/0! 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! 0 #DIV/0! Other Expenses Insurance (car, health, renter's) Loan, credit card payment Other 0 #DIV/0! 0 #DIV/0! TOTAL EXPENSES 0 0 0 0 0 0 0 0 0 0 0 0 0 ###### Use the following information about student John Henry to complete a budget for him: Part-time job that pays $3,000 after taxes each month during school (not in May, June July) $4,400 in Jan, April, Aug only in financial aid $150 per month in Gasoline $5,400 in dorm cost in Aug and Jan only $90 per month cell phone $600 in meal plan in Aug and Jan only $120 per month entertainment $5,000 in tuition in Aug and Jan only $80 per month dining out $300 in books in Aug and Jan only $400 in July for clothes $70 per month credit card payments for misc stuff DO NOT TYPE IN THE GREY SHADED CELLS Monthly College Budget for John Henry january income: $ january expenses: $ january cash flow: $ financial aid wages (after-tax) - family help from savings other room & board tuition fees books at supplies transportation discretionary other expenses JAN FEB HAR APR HAY JUN JUL AUG SEP OCT HOY DEC YEAR INC #DIV/0! 0 HONTHLY INCOME Financial aid (grants, scholarship, loond) paid to you After-tax wages from a job Financial help from family Withdrawals from Savings Other (child support, public assistance, gifts, etc.) TOTAL INCOME #DIV/0! #DIV/0! 0 0 #DIV/01 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 ###### JAN FEB HAR APR HAY JUN JUL AUG SEP OCT HOY DEC YEAR 0 0 0 0 0 0 0 0 0 0 0 0 0 HONTHLY EXPEHSE Room & Board Rent, mortgage, or dorm room Food (groceries or meal plan) Utilities (heat, water, electricity) ZINC #DIV/0! #DIV/0! #DIV/0! #DIV/0! Tuition & Fees 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! #DIV/0! 0 Tuition you pay Fees you pay 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! Books & Supplies Textbooks School Supplies 0 #DIV/0! 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 0 Transportation Gas, maintenance Vehicle payment Transit fares Travel at holidays 0 #DIV/0! #DIV/0! #DIVYO! #DIV/0! #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! 0 #DIV/0! 0 Discretionary Savings Cell phone, Internet, cable Donations Snacks, dining out Clothes Entertainment (movies, dates, concerts) #DIV/0! #DIV/0! 0 0 #DIV/0! 0 #DIV/0! 0 #DIV/0! 0 0 0 0 0 0 0 0 0 0 0 0 0 #DIV/0! 0 #DIV/0! Other Expenses Insurance (car, health, renter's) Loan, credit card payment Other 0 #DIV/0! 0 #DIV/0! TOTAL EXPENSES 0 0 0 0 0 0 0 0 0 0 0 0 0 ######