Answered step by step

Verified Expert Solution

Question

1 Approved Answer

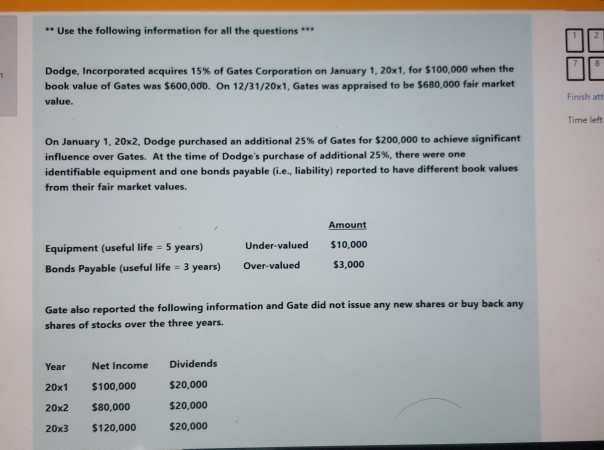

** Use the following information for all the questions *** Dodge, Incorporated acquires 15% of Gates Corporation on January 1, 20x1, for $100,000 when the

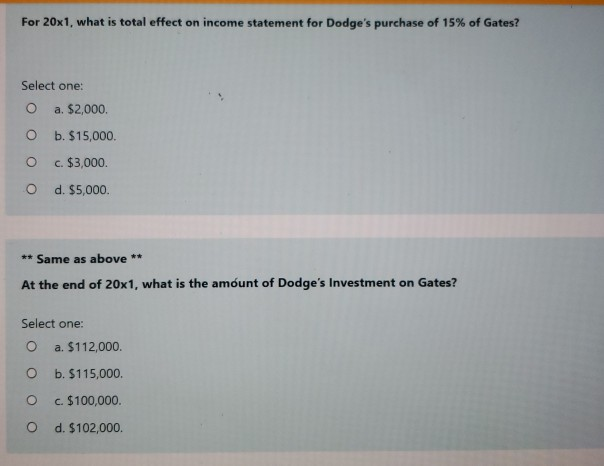

** Use the following information for all the questions *** Dodge, Incorporated acquires 15% of Gates Corporation on January 1, 20x1, for $100,000 when the book value of Gates was 5600,000. On 12/31/20x1. Gates was appraised to be 5680,000 fair market value. Finish at Time left On January 1, 20x2, Dodge purchased an additional 25% of Gates for $200,000 to achieve significant influence over Gates. At the time of Dodge's purchase of additional 25%, there were one identifiable equipment and one bonds payable (i.e., liability) reported to have different book values from their fair market values. Equipment (useful life = 5 years) Bonds Payable (useful life = 3 years) Under-valued Over-valued Amount $10,000 $3,000 Gate also reported the following information and Gate did not issue any new shares or buy back any shares of stocks over the three years. Year 20x1 20x2 20x3 Net Income $100,000 $80,000 $120,000 Dividends $20,000 $20,000 $20,000 For 20x1, what is total effect on income statement for Dodge's purchase of 15% of Gates? Select one: O a $2,000 O b. $15,000 o c. $3,000. O d. $5,000 ** Same as above ** At the end of 20x1, what is the amount of Dodge's Investment on Gates? Select one: o a. $112,000. o b. $115,000 o c. $100,000 o d. $102,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started