Question

Use the following information for Parts A-D. On December 31st,2015, the company had 50M shares outstanding. In both 2015 & 2106, the company had an

Use the following information for Parts A-D.

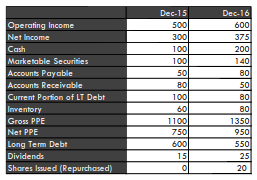

On December 31st,2015, the company had 50M shares outstanding. In both 2015 & 2106, the company had an effective tax rate of 25.0% and an interest expense of $100. In 2016, the company repurchased $20M shares at $50.00 per share and did not sell any assets. On December 31st,2016, the company traded at $50.00 per share. All data in the table below, including shares outstanding, is in USD millions.

HINT: In your calculations, be careful when choosing to include cash, marketable securities, and the current portion of long term debt.

Part A:

Which of the following statements is (are) TRUE:

I.By reducing total liabilities in 2016, the company increased total assets YOY

II.The company had a higher ROA in 2016 than in 2015

III.In 2016, the company made a working capital investment of $60M

A. I

B. II

C. III

D. I, III

E. None of the statements

Part B:

On December 31st,2016, the company had a Price-to-Book ratio of:

A. 2.11

B. 2.22

C. 3.49

D. 3.52

E. 3.62

Part C:

Ignore your answer to Part A. In 2016, assume the company made a working capital investment of $50. What was the companys FCFEin 2016?

A. $55M

B. $80M

C. $100M

D. $105M

E. $125M

Part D:

Ignore your answer to Part C. In 2016, assume the FCFF is $300 while the FCFE is $150. All cash flows (i.e. CFO, FCFF, & FCFE) will grow at 2.0% in perpetuity; the appropriate WACC is 8.0% and the cost of equity is 14.0%.How much would you pay for all of the companys stock?

A. $1250M

B. $1275M

C. $1875M

D.$2500M

E.$2550M

Dec-15 Operating Income Net Income 375 ash Marketable Securities Accounts Payable Accounts Receivable urrent Portion of LT Debt 80 Gross PPE Net PPE Long Term Debt Dividends Shares Issued (Repurchased) 750 950 550 25 20Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started