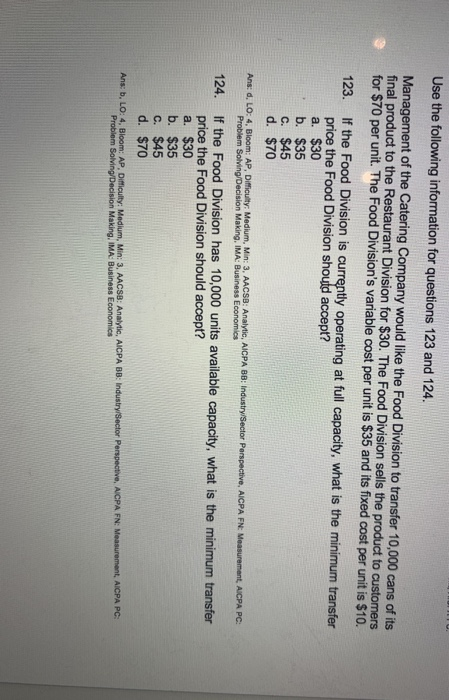

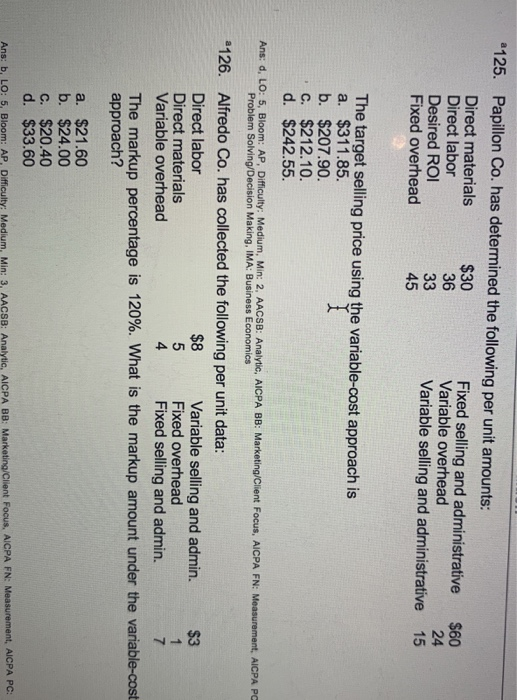

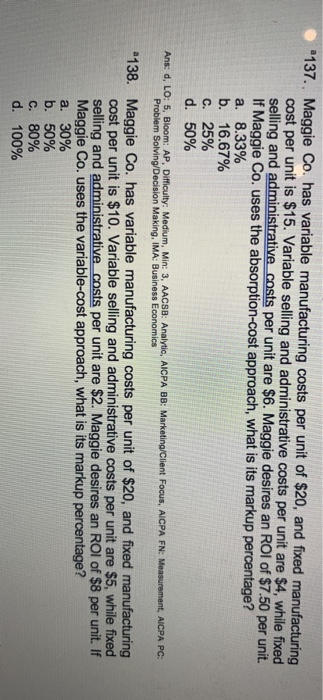

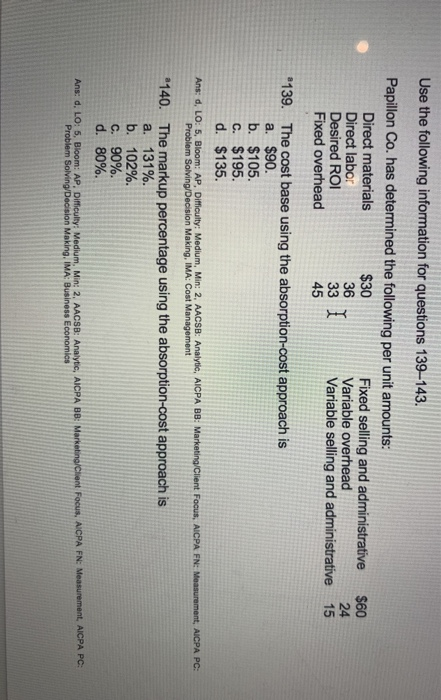

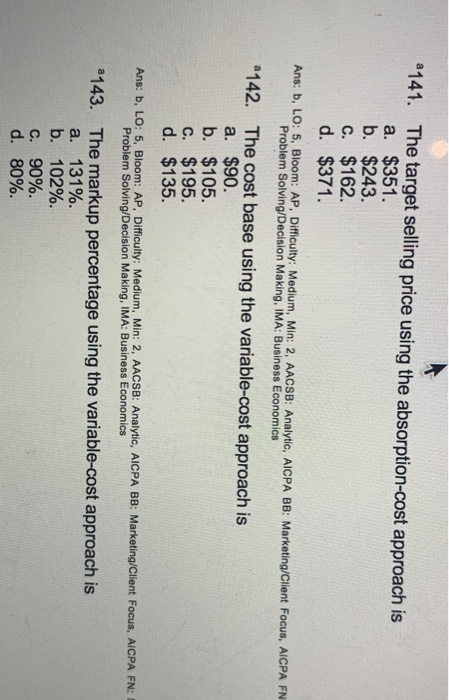

Use the following information for questions 123 and 124. Management of the Catering Company would like the Food Division to transfer 10,000 cans of its final product to the Restaurant Division for $30. The Food Division sells the product to customers for $70 per unit. The Food Division's variable cost per unit is $35 and its fixed cost per unit is $10. 123. If the Food Division is currently operating at full capacity, what is the minimum transfer price the Food Division should accept? a. $30 b. $35 c. $45 d. $70 Ans: d. LO: 4, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector Perspective, AICPA FN: Measurement, AICPA PC: Problem Solving/Decision Making, IMA: Business Economics 124. If the Food Division has 10,000 units available capacity, what is the minimum transfer price the Food Division should accept? a. $30 b. $35 c. $45 d. $70 Ans: b, L: 4, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Industry/Sector Perspective, AICPA FN: Measurement, AICPA PC Problem Solving/Decision Making, IMA: Business Economics "125. Papillon Co. has determined the following per unit amounts: Direct materials $30 Fixed selling and administrative Direct labor 36 Variable overhead Desired ROI Variable selling and administrative Fixed overhead $60 33 24 15 The target selling price using the variable-cost approach is a. $311.85. b. $207.90. c. $212.10. d. $242.55. Ans: d, LO: 5, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC Problem Solving/Decision Making, IMA: Business Economics $8 5 a126. Alfredo Co. has collected the following per unit data: Direct labor Variable selling and admin. Direct materials Fixed overhead Variable overhead 4 Fixed selling and admin. The markup percentage is 120%. What is the markup amount under the variable-cost approach? a. $21.60 b. $24.00 c. $20.40 d. $33.60 Ans: b, LO: 5, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC 137. Maggie Co. has variable manufacturing costs per unit of $20, and fixed manufacturing cost per unit is $15. Variable selling and administrative costs per unit are $4, while fixed selling and administrative costs per unit are $6. Maggie desires an ROI of $7.50 per unit. If Maggie Co. uses the absorption-cost approach, what is its markup percentage? a. 8.33% b. 16.67% C. 25% d. 50% Ans: d, LO: 5, Bloom: AP, Difficulty: Medium, Min: 3, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC: Problem Solving/Decision Making. IMA: Business Economics 138. Maggie Co. has variable manufacturing costs per unit of $20, and fixed manufacturing cost per unit is $10. Variable selling and administrative costs per unit are $5, while fixed selling and administrative costs per unit are $2. Maggie desires an ROI of $8 per unit. If Maggie Co. uses the variable-cost approach, what is its markup percentage? a. 30% b. 50% C. 80% d. 100% Use the following information for questions 139-143. Papillon Co. has determined the following per unit amounts: Direct materials Fixed selling and administrative Direct labor Variable overhead Desired ROI Variable selling and administrative Fixed overhead $60 24 15 "139. The cost base using the absorption-cost approach is a. $90. b. $105. C. $195. d. $135. Ans: d, LO: 5, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC Problem Solving/Decision Making, IMA: Cost Management 140. The markup percentage using the absorption-cost approach is a. 131%. b. 102%. C. 90%. d. 80%. Ans: d, LO: S, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Measurement, AICPA PC Problem Solving/Decision Making. IMA: Business Economics a 141. The target selling price using the absorption-cost approach is a. $351. b. $243. C. $162. d. $371. Ans: b, LO: 5, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN Problem Solving/Decision Making, IMA: Business Economics 142. The cost base using the variable-cost approach is a. $90. b. $105. c. $195. d. $135. Ans: b, LO: 5, Bloom: AP, Difficulty: Medium, Min: 2, AACSB: Analytic, AICPA BB: Marketing/Client Focus, AICPA FN: Problem Solving/Decision Making, IMA: Business Economics a143. The markup percentage using the variable-cost approach is a. 131%. b. 102%. c. 90%. d. 80%