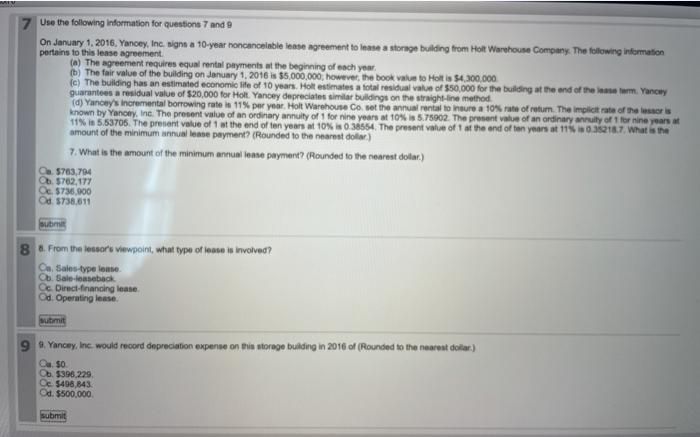

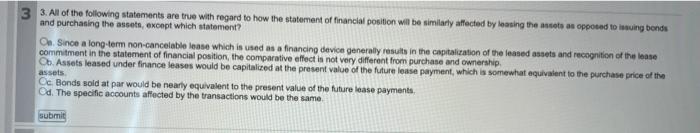

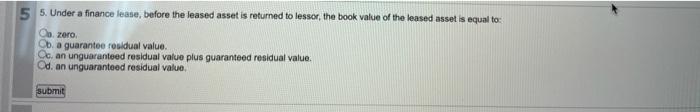

Use the following information for Questions 7 and 9 On January 1, 2016. Yancey, Inc. sign a 10-year roncancelable lease agreement to lease a storage building from Hot Warehouse Company. The following information pertains to this lease agreement. (a) The agreement requires equal rental payments at the beginning of each year, (b) The fair value of the building on January 1, 2016 is $5,000,000, however, the book value to Holt is $4,300,000 (c) The building has an estimated economic life of 10 years. Holt estimates a total residual value of $50,000 for the building at the end of the serm. Yanowy guarantees a residual value of $20,000 for Holl. Yancey depreciates similar buildings on the straight-line method (d) Yancey's incremental borrowing rate is 11% per year. Holt Warehouse Co set the annual rental to insure a 10% rate of return. The implicit rate of the lessoris known by Yancy, Inc. The present value of an ordinary annuity of 1 for nine years at 10% is 5.75902. The present value of an ordinary annuity of 1 for nine years at 11% in 5.53706. The present value of 1 at the end of ten years at 10% is 038554. The present value of at the end of ten years at 1156035218.7. What is the amount of the minimum annual lease payment? (Rounded to the nearest dollar) 7. What is the amount of the minimum annual tease payment? (Rounded to the nearest dollar) Ca. 5763,794 O $702,177 Oc5735.900 Od 5738.611 sub 8 . From the lessor viewpoint, what type of fease is involved? Co Sales-type lone b. Sale oseback Cc Direct-financing lease Od Operating lease butimit 9 Yancey, Inc. would record depreciation expense on this storage bulding in 2016 of (Rounded to the nearest dollar) a $0 O $396,229 Oc. 406,843 Od. $500.000 submit 3 3. All of the following statements are true with regard to how the statement of financial position will be similarly affected by leasing the meets as oppored to inuing bonds and purchasing the assets, except which statement? On. Since a long-term non-cancelable inase which is used as a financing device generally results in the capitalization of the leased assets and recognition of the lease On Assets leased under finance leases would be capitalized at the present value of the future lease payment, which is somewhat equivalent to the purchase price of the assets Cc Bonds sold at par would be nearly equivalent to the present value of the future lease payments Od. The specific accounts affected by the transactions would be the same submit 5 5. Under a finance leade, before the leased asset is returned to lessor, the book value of the based asset is equal to: zoro Ob a guarantee residual value. Co. an unguaranteed residual value plus guaranteed residual value Od. an unguaranteed residual value submit Use the following information for Questions 7 and 9 On January 1, 2016. Yancey, Inc. sign a 10-year roncancelable lease agreement to lease a storage building from Hot Warehouse Company. The following information pertains to this lease agreement. (a) The agreement requires equal rental payments at the beginning of each year, (b) The fair value of the building on January 1, 2016 is $5,000,000, however, the book value to Holt is $4,300,000 (c) The building has an estimated economic life of 10 years. Holt estimates a total residual value of $50,000 for the building at the end of the serm. Yanowy guarantees a residual value of $20,000 for Holl. Yancey depreciates similar buildings on the straight-line method (d) Yancey's incremental borrowing rate is 11% per year. Holt Warehouse Co set the annual rental to insure a 10% rate of return. The implicit rate of the lessoris known by Yancy, Inc. The present value of an ordinary annuity of 1 for nine years at 10% is 5.75902. The present value of an ordinary annuity of 1 for nine years at 11% in 5.53706. The present value of 1 at the end of ten years at 10% is 038554. The present value of at the end of ten years at 1156035218.7. What is the amount of the minimum annual lease payment? (Rounded to the nearest dollar) 7. What is the amount of the minimum annual tease payment? (Rounded to the nearest dollar) Ca. 5763,794 O $702,177 Oc5735.900 Od 5738.611 sub 8 . From the lessor viewpoint, what type of fease is involved? Co Sales-type lone b. Sale oseback Cc Direct-financing lease Od Operating lease butimit 9 Yancey, Inc. would record depreciation expense on this storage bulding in 2016 of (Rounded to the nearest dollar) a $0 O $396,229 Oc. 406,843 Od. $500.000 submit 3 3. All of the following statements are true with regard to how the statement of financial position will be similarly affected by leasing the meets as oppored to inuing bonds and purchasing the assets, except which statement? On. Since a long-term non-cancelable inase which is used as a financing device generally results in the capitalization of the leased assets and recognition of the lease On Assets leased under finance leases would be capitalized at the present value of the future lease payment, which is somewhat equivalent to the purchase price of the assets Cc Bonds sold at par would be nearly equivalent to the present value of the future lease payments Od. The specific accounts affected by the transactions would be the same submit 5 5. Under a finance leade, before the leased asset is returned to lessor, the book value of the based asset is equal to: zoro Ob a guarantee residual value. Co. an unguaranteed residual value plus guaranteed residual value Od. an unguaranteed residual value submit