Answered step by step

Verified Expert Solution

Question

1 Approved Answer

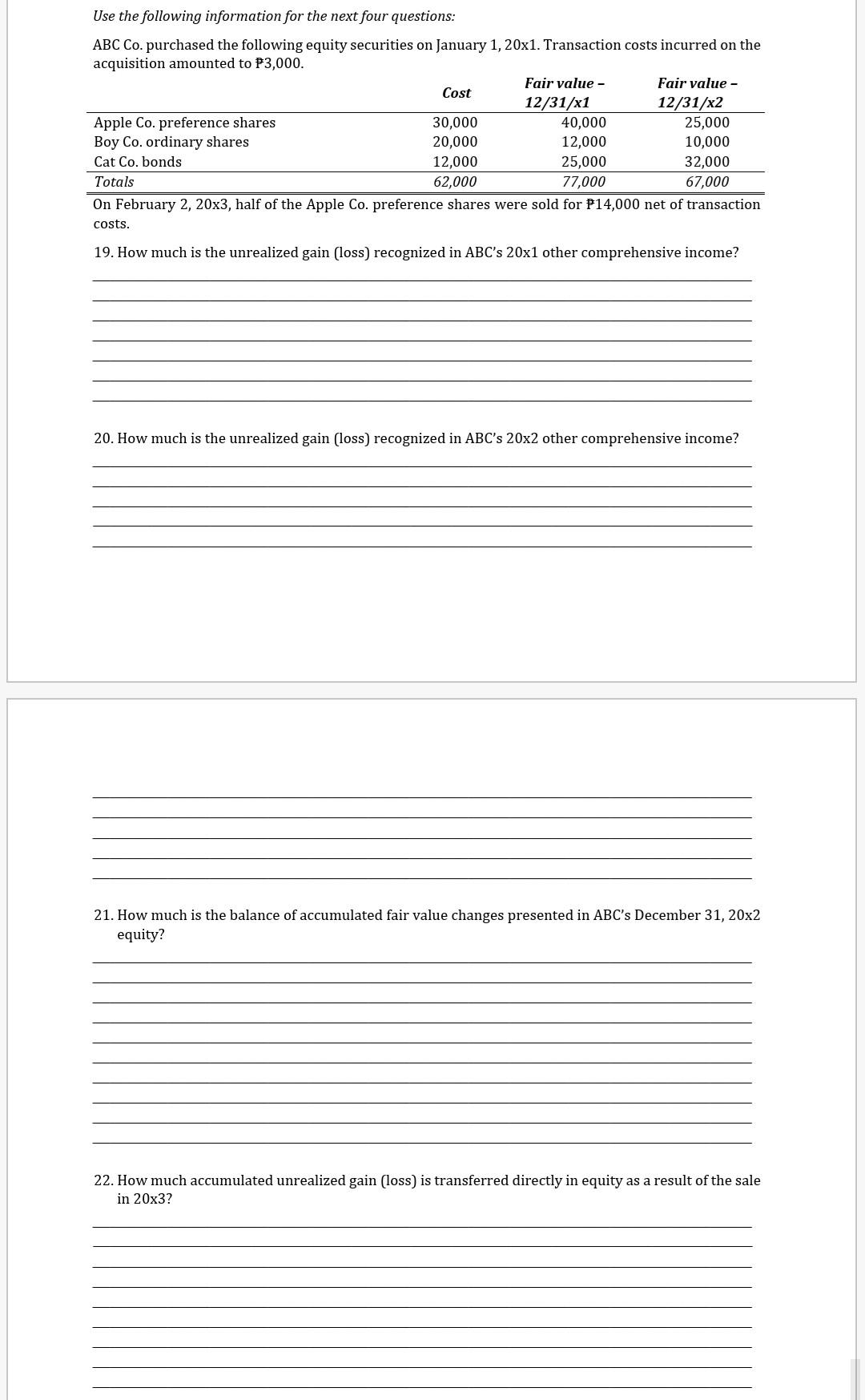

Use the following information for the next four questions: ABC Co. purchased the following equity securities on January 1, 20x1. Transaction costs incurred on the

Use the following information for the next four questions: ABC Co. purchased the following equity securities on January 1, 20x1. Transaction costs incurred on the acquisition amounted to P3,000. Fair value - Fair value - Cost 12/31/x1 12/31/x2 Apple Co. preference shares 30,000 40,000 25,000 Boy Co. ordinary shares 20,000 12,000 10,000 Cat Co. bonds 12,000 25,000 32,000 Totals 62,000 77,000 67,000 On February 2, 20x3, half of the Apple Co. preference shares were sold for P14,000 net of transaction costs. 19. How much is the unrealized gain (loss) recognized in ABC's 20x1 other comprehensive income? 20. How much is the unrealized gain (loss) recognized in ABC's 20x2 other comprehensive income? 21. How much is the balance of accumulated fair value changes presented in ABC's December 31, 20x2 equity? 22. How much accumulated unrealized gain (loss) is transferred directly in equity as a result of the sale in 20x3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started