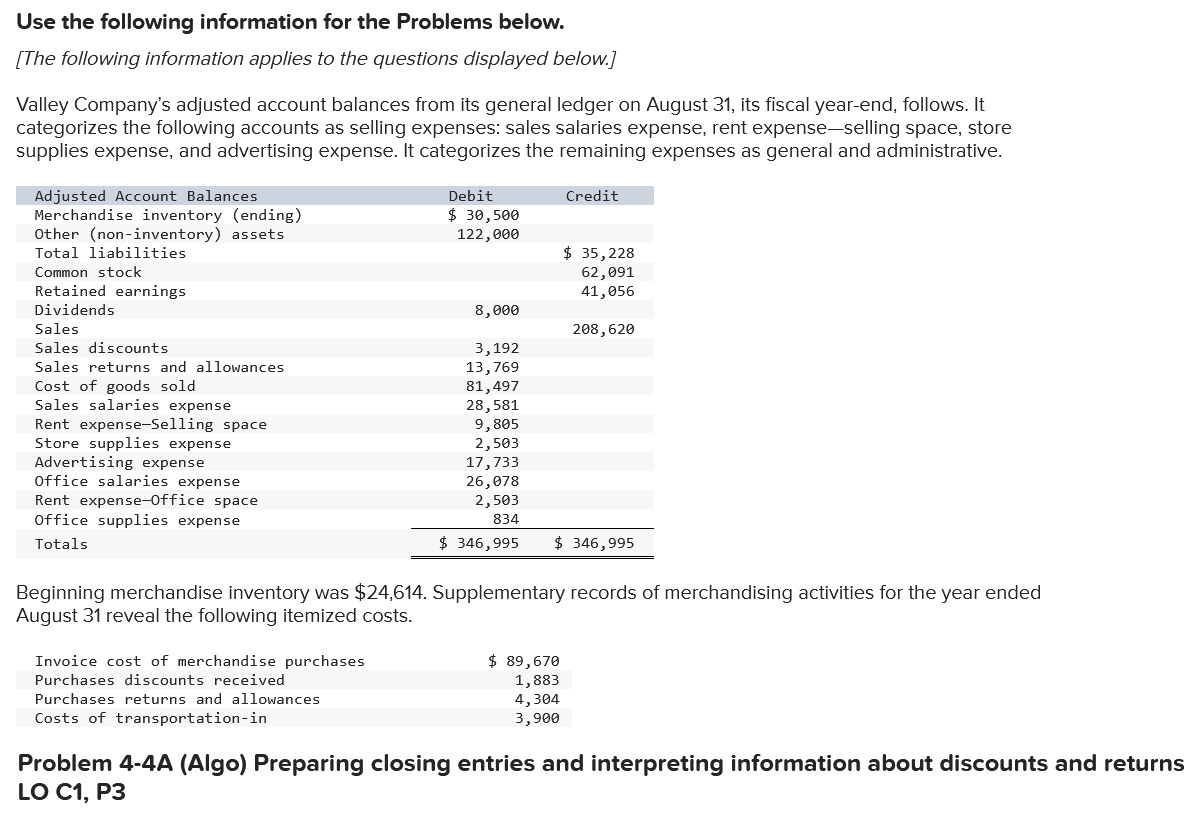

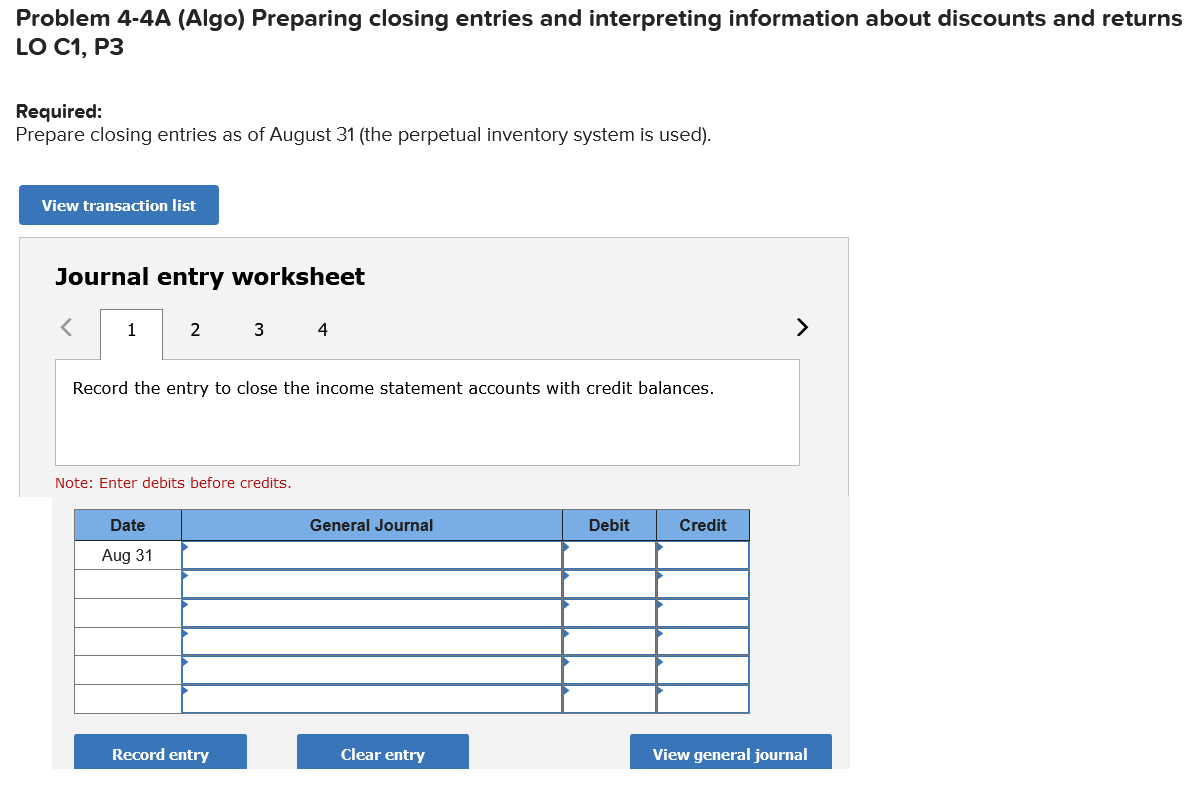

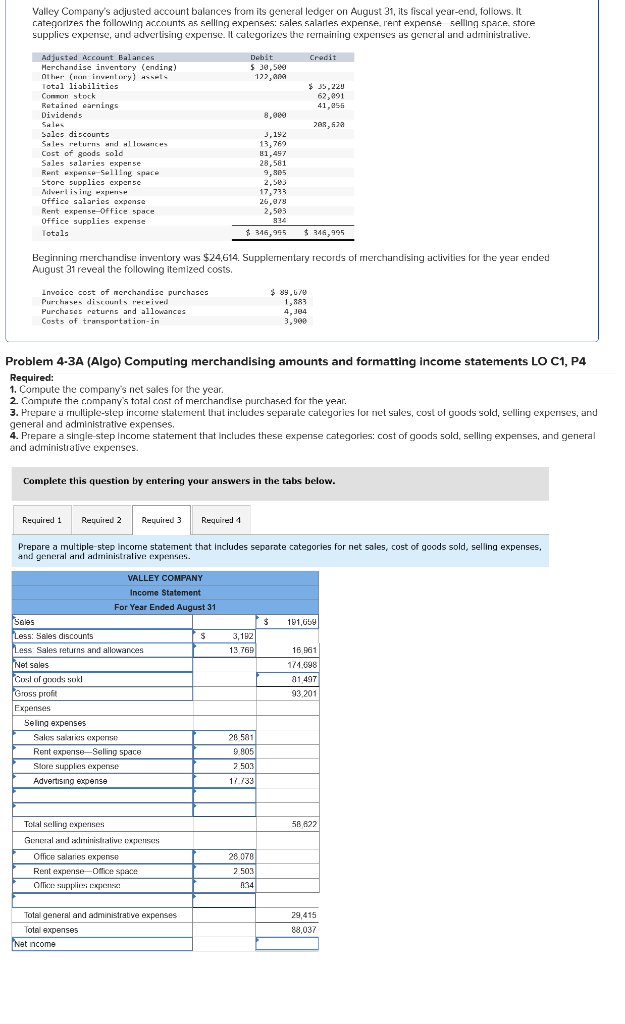

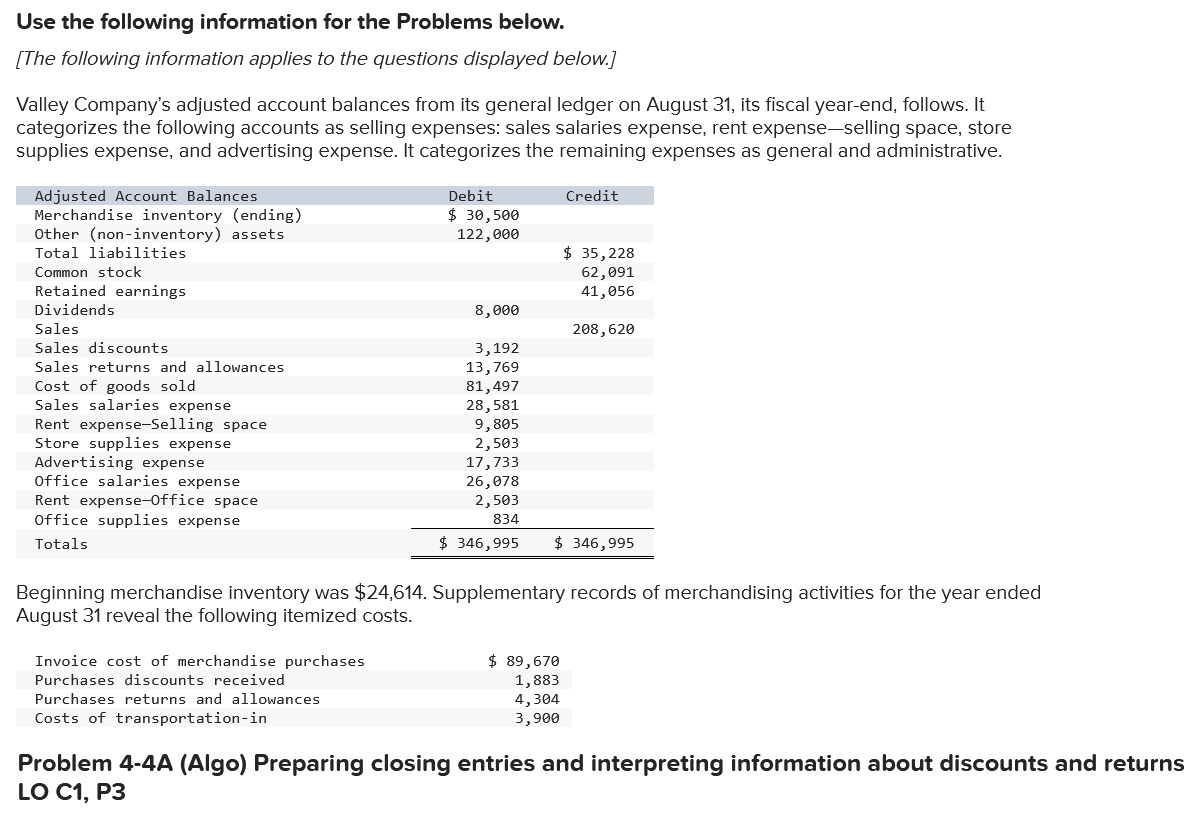

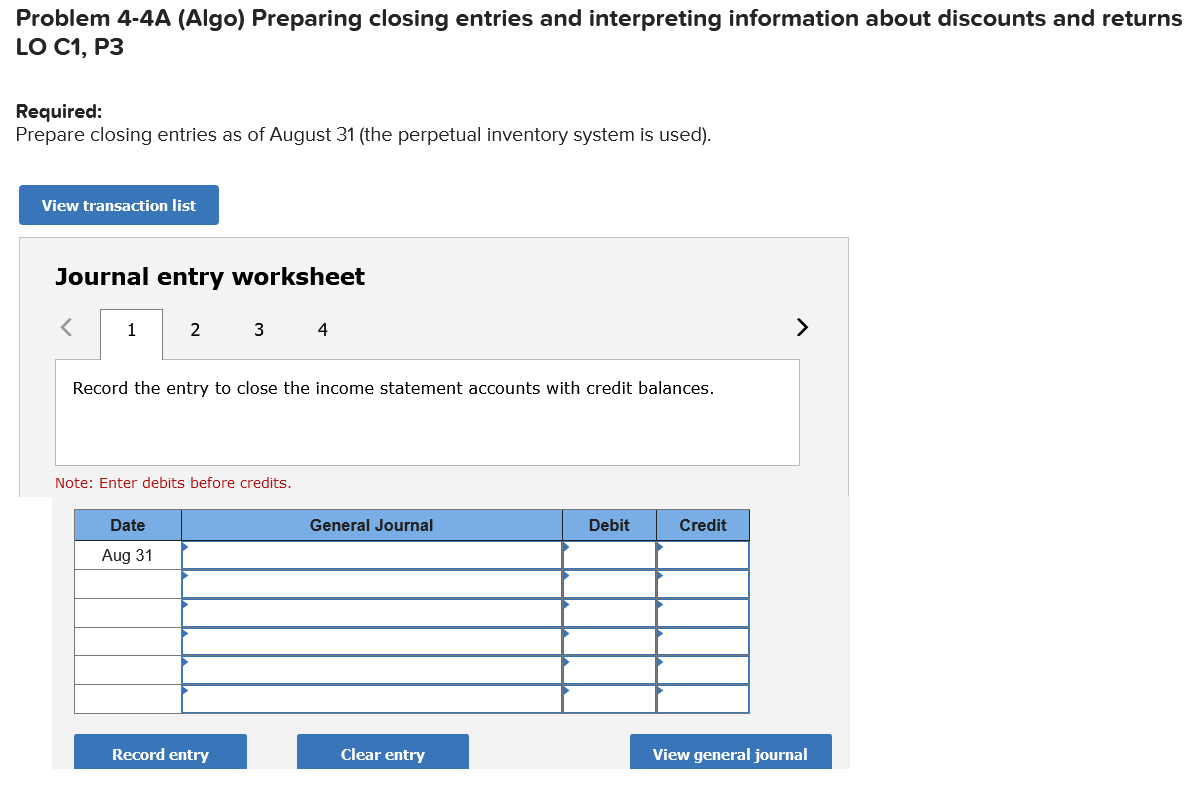

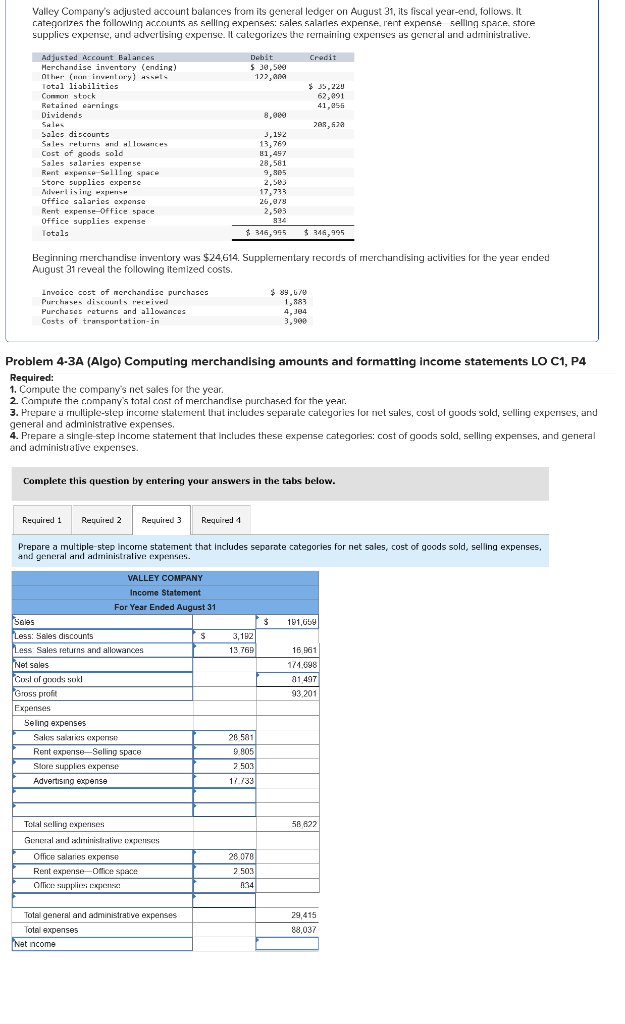

Use the following information for the Problems below. [The following information applies to the questions displayed below.] Valley Company's adjusted account balances from its general ledger on August 31 , its fiscal year-end, follows. It categorizes the following accounts as selling expenses: sales salaries expense, rent expense-selling space, store supplies expense, and advertising expense. It categorizes the remaining expenses as general and administrative. Beginning merchandise inventory was $24,614. Supplementary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Problem 4-4A (Algo) Preparing closing entries and interpreting information about discounts and returns LO C1, P3 Problem 4-4A (Algo) Preparing closing entries and interpreting information about discounts and returns LO C1, P3 Required: Prepare closing entries as of August 31 (the perpetual inventory system is used). Journal entry worksheet Record the entry to close the income statement accounts with credit balances. Note: Enter debits before credits. Valley Company's adjusted account balances from its general ledger on August 31, its fiscal year-end, follows. It r.ategorizes the following accounts as seilling expenses: s,ales, salarles, expense, rent expense. seelling s,par.e, store supplies expense, and adver tising expense. It calegorizes the remaining expense's as general and administrative. Beginning rmerchandise inventory was $24,614. Supplermentary records of merchandising activities for the year ended August 31 reveal the following itemized costs. Problem 4-3A (Algo) Computing merchandising amounts and formatting income statements LO C1, P4 Required: 1. Compute the company's net sales for the year. 2. Compute the r.ompany's total cost of merchandise purchased for the year. 3. Prepare a multiple-step income stalement that includes separate cateyories for net sales, cost ol goods sold, selling expenses, and general and administrative expenses. 4. Prepare a single-step income statement that includes these expense categories: cost of goods sold, selling expenses, and general and administrative expenses. Complete this question by entering your answers in the tabs below. Prepare a multiple-step income statement that includes separate categories for net soles, cost of goods sold, selling expenses