Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the following information on the various borrowing and leasing alternatives for an item that is commonly acquired for a business. Calculate the Net Present

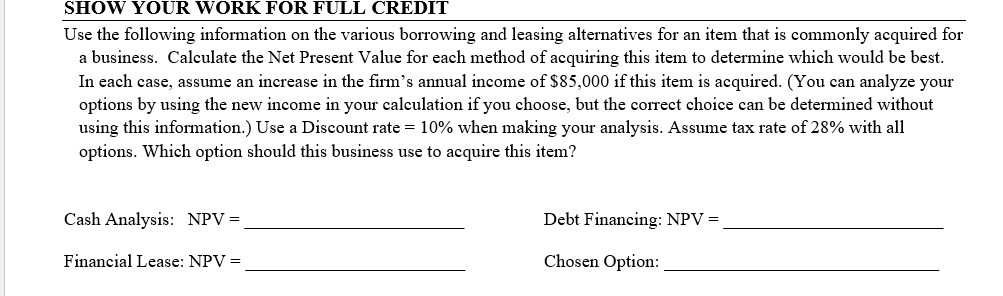

Use the following information on the various borrowing and leasing alternatives for an item that is commonly acquired for a business. Calculate the Net Present Value for each method of acquiring this item to determine which would be best. In each case, assume an increase in the firm's annual income of $85,000 if this item is acquired. (You can analyze your options by using the new income in your calculation if you choose, but the correct choice can be determined without using this information.) Use a Discount rate =10% when making your analysis. Assume tax rate of 28% with all options. Which option should this business use to acquire this item? Cash Analysis: NPV= Financial Lease: NPV = Debt Financing: NPV = Chosen Option

Use the following information on the various borrowing and leasing alternatives for an item that is commonly acquired for a business. Calculate the Net Present Value for each method of acquiring this item to determine which would be best. In each case, assume an increase in the firm's annual income of $85,000 if this item is acquired. (You can analyze your options by using the new income in your calculation if you choose, but the correct choice can be determined without using this information.) Use a Discount rate =10% when making your analysis. Assume tax rate of 28% with all options. Which option should this business use to acquire this item? Cash Analysis: NPV= Financial Lease: NPV = Debt Financing: NPV = Chosen Option Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started