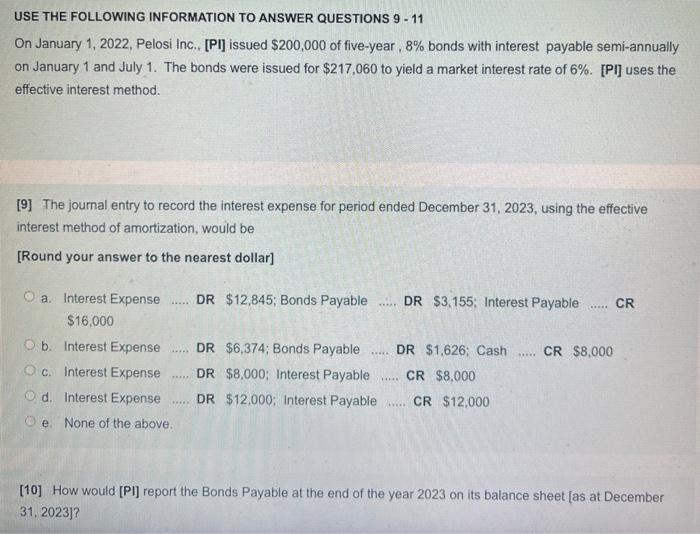

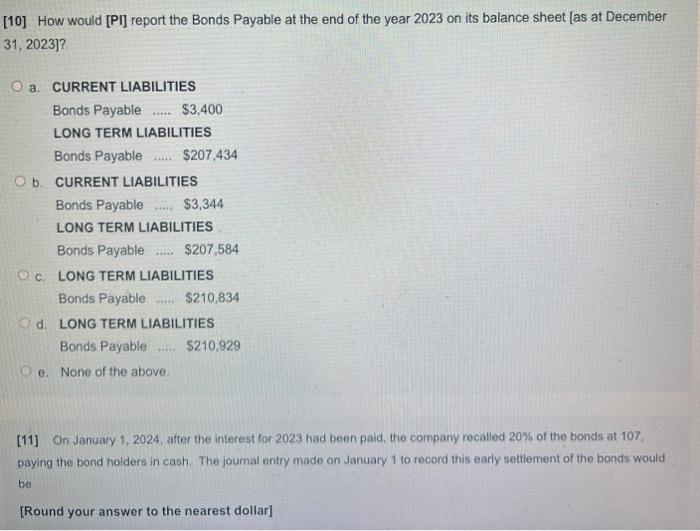

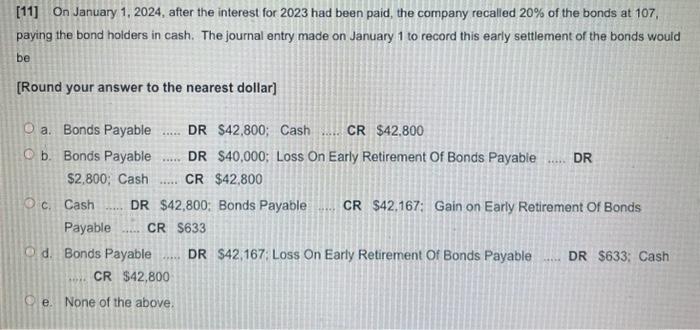

USE THE FOLLOWING INFORMATION TO ANSWER QUESTIONS 9 - 11 On January 1,2022 , Pelosi Inc., [PI] issued $200,000 of five-year , 8% bonds with interest payable semi-annually on January 1 and July 1 . The bonds were issued for $217,060 to yield a market interest rate of 6%. [PI] uses the effective interest method. [9] The journal entry to record the interest expense for period ended December 31, 2023, using the effective interest method of amortization, would be [Round your answer to the nearest dollar] a. Interest Expense DR $12,845; Bonds Payable DR \$3,155: Interest Payable CR $16,000 b. Interest Expense DR $6,374; Bonds Payable DR \$1,626; Cash CR $8,000 c. Interest Expense DR $8,000; Interest Payable CR $8,000 d. Interest Expense DR $12,000; Interest Payable CR $12,000 e. None of the above. [10] How would [PI] report the Bonds Payable at the end of the year 2023 on its balance sheet [as at December 31, 2023]? [10] How would [PI] report the Bonds Payable at the end of the year 2023 on its balance sheet [as at December 31, 2023]? a. CURRENT LIABILITIES Bonds Payable $3.400 LONG TERM LIABILITIES Bonds Payable $207,434 b. CURRENT LIABILITIES Bonds Payable $3,344 LONG TERM LIABILITIES Bonds Payable $207.584 c. LONG TERM LIABILITIES Bonds Payable ..... $210,834 d. LONG TERM LIABILITIES Bonds Payable ..... $210,929 e. None of the above. [11] On January 1, 2024, after the interest for 2023 had been paid, the company recalled 20% of the bonds at 107, paying the bond holders in cash. The joumal entry made on January 1 to record this early settlement of the bonds would be [Round your answer to the nearest dollar] [11] On January 1, 2024, after the interest for 2023 had been paid, the company recalled 20% of the bonds at 107 , paying the bond holders in cash. The journal entry made on January 1 to record this early settlement of the bonds would be [Round your answer to the nearest dollar] a. Bonds Payable DR $42,800; Cash CR $42,800 b. Bonds Payable DR $40,000; Loss On Early Retirement Of Bonds Payable DR \$2,800; Cash CR $42,800 c. Cash DR $42,800; Bonds Payable CR \$42,167: Gain on Early Retirement Of Bonds Payable CR $633 d. Bonds Payable DR \$42,167; Loss On Early Retirement Of Bonds Payable DR \$633; Cash CR $42,800 e. None of the above