Answered step by step

Verified Expert Solution

Question

1 Approved Answer

USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (4) QUESTIONS: On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 non-interest-bearing

USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT (4) QUESTIONS:

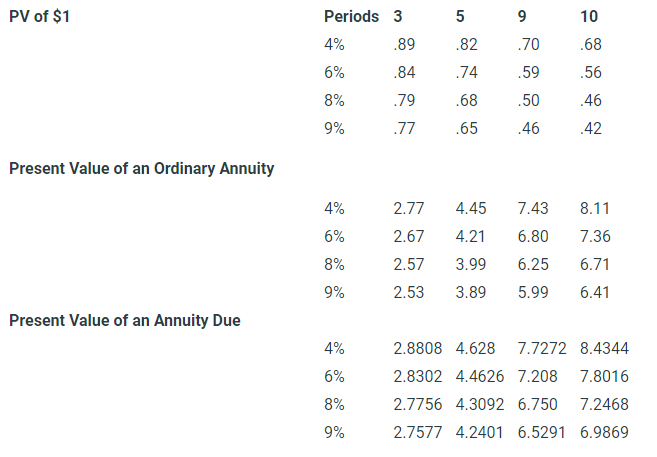

On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 non-interest-bearing note. In exchange, Smith agreed to make (5) annual payments of P&I with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed.

Required: Use the information above to answer the next (4) questions:

| 1. Determine the amount of (1) PMT of P&I | $ |

| 2. What amount of Service Revenue should ABC recognize on January 1, 2020? | $________________________________ |

| 3. What amount of Interest Revenue should ABC recognize on this note for the year ending December 31, 2021? | $________________________________ |

| 4. What is the Carrying Value of the Note Receivable at December 31, 2021? | $________________________________ |

PV of $1 5 5 9 10 .82 .68 Periods 3 4% .89 6% .84 8% .79 9% .77 .74 .70 .59 .50 .56 .46 .68 .65 .46 .42 Present Value of an Ordinary Annuity 4% 4.45 7.43 8.11 2.77 2.67 6% 4.21 6.80 7.36 8% 2.57 3.99 6.25 6.71 9% 2.53 3.89 5.99 6.41 Present Value of an Annuity Due 4% 6% 2.8808 4.628 7.7272 8.4344 2.8302 4.4626 7.208 7.8016 2.7756 4.3092 6.750 7.2468 2.7577 4.2401 6.5291 6.9869 8% 9%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started