Answered step by step

Verified Expert Solution

Question

1 Approved Answer

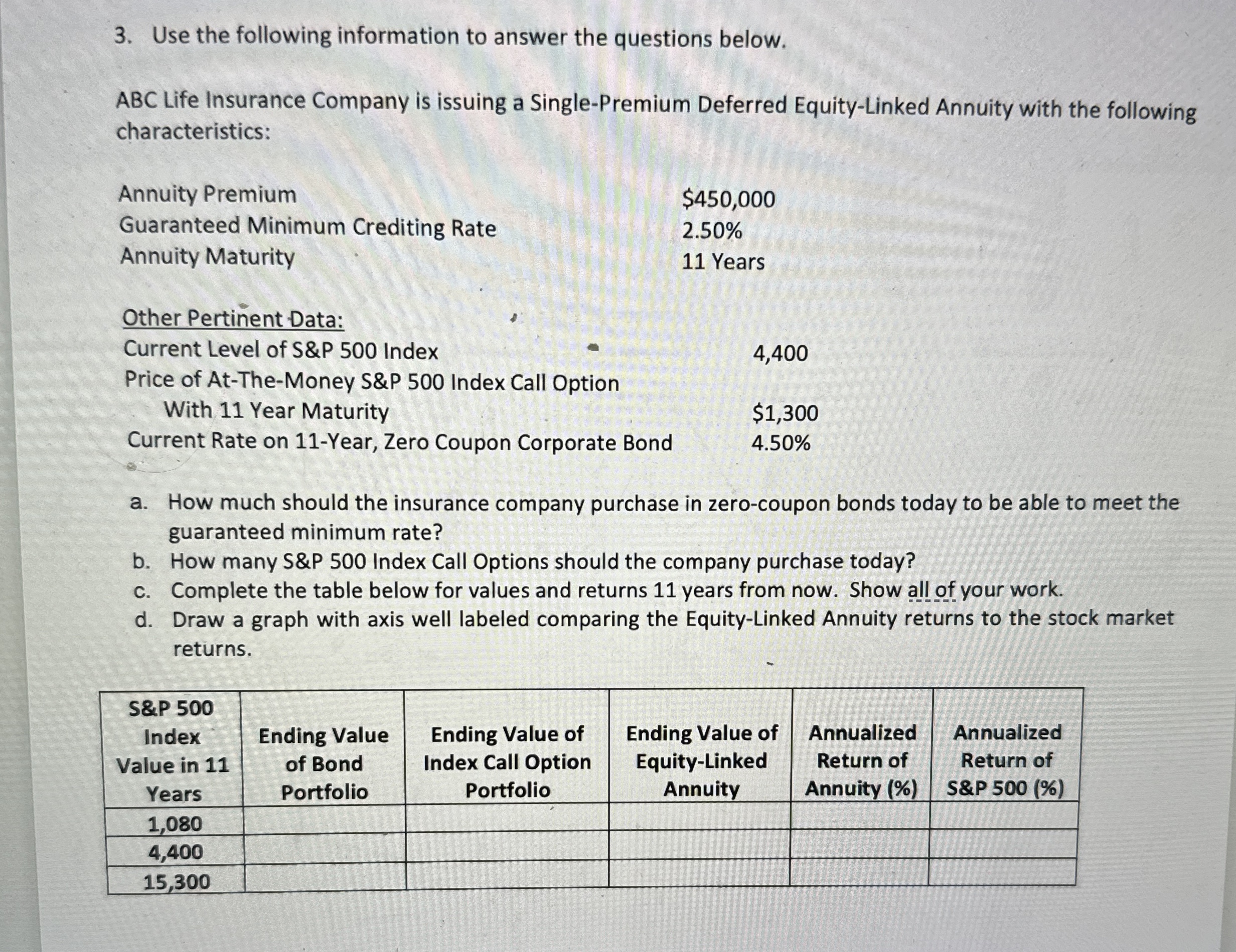

Use the following information to answer the questions below. ABC Life Insurance Company is issuing a Single - Premium Deferred Equity - Linked Annuity with

Use the following information to answer the questions below.

ABC Life Insurance Company is issuing a SinglePremium Deferred EquityLinked Annuity with the following

characteristics:

Annuity Premium

Guaranteed Minimum Crediting Rate

Annuity Maturity

$

Years

Other Pertinent Data:

Current Level of S&P Index

Price of AtTheMoney S&P Index Call Option

With Year Maturity

Current Rate on Year, Zero Coupon Corporate Bond

a How much should the insurance company purchase in zerocoupon bonds today to be able to meet the

guaranteed minimum rate?

b How many S&P Index Call Options should the company purchase today?

c Complete the table below for values and returns years from now. Show all of your work.

d Draw a graph with axis well labeled comparing the EquityLinked Annuity returns to the stock market

returns.Use the following information to answer the questions below.

ABC Life Insurance Company is issuing a SinglePremium Deferred EquityLinked Annuity with the following

characteristics:

Annuity Premium

Guaranteed Minimum Crediting Rate

Annuity Maturity

$

Years

Other Pertinent Data:

Current Level of S&P Index

Price of AtTheMoney S&P Index Call Option

With Year Maturity

Current Rate on Year, Zero Coupon Corporate Bond

a How much should the insurance company purchase in zerocoupon bonds today to be able to meet the

guaranteed minimum rate?

b How many S&P Index Call Options should the company purchase today?

c Complete the table below for values and returns years from now. Show all of your work.

d Draw a graph with axis well labeled comparing the EquityLinked Annuity returns to the stock market

returns.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started