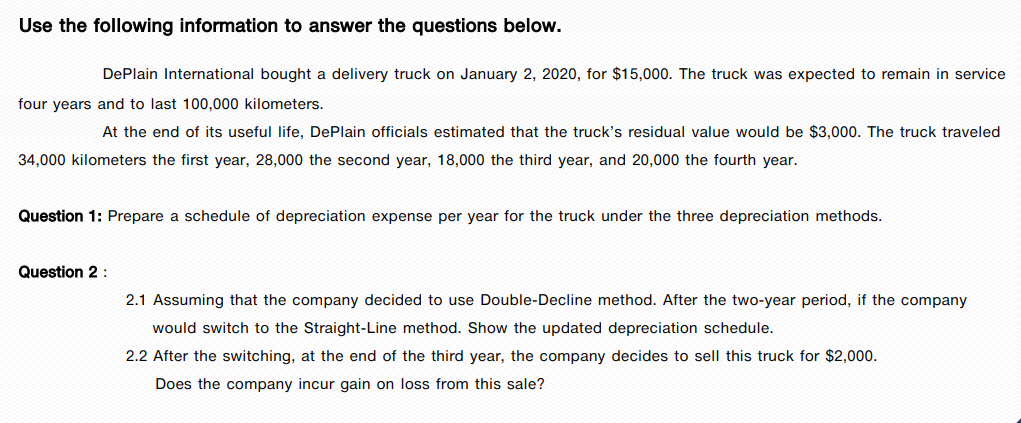

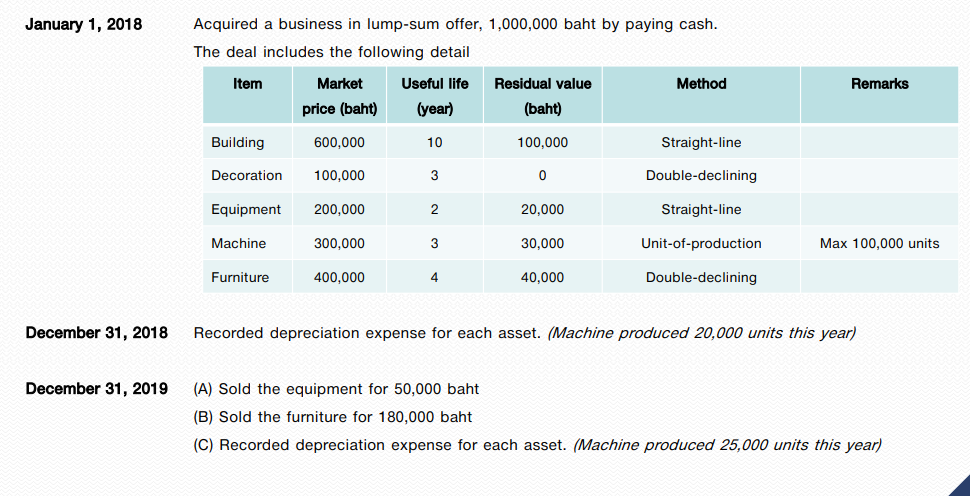

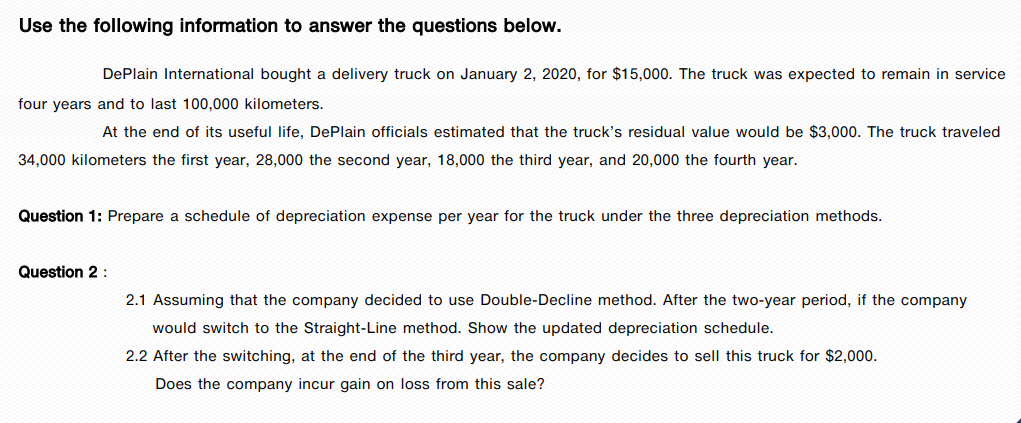

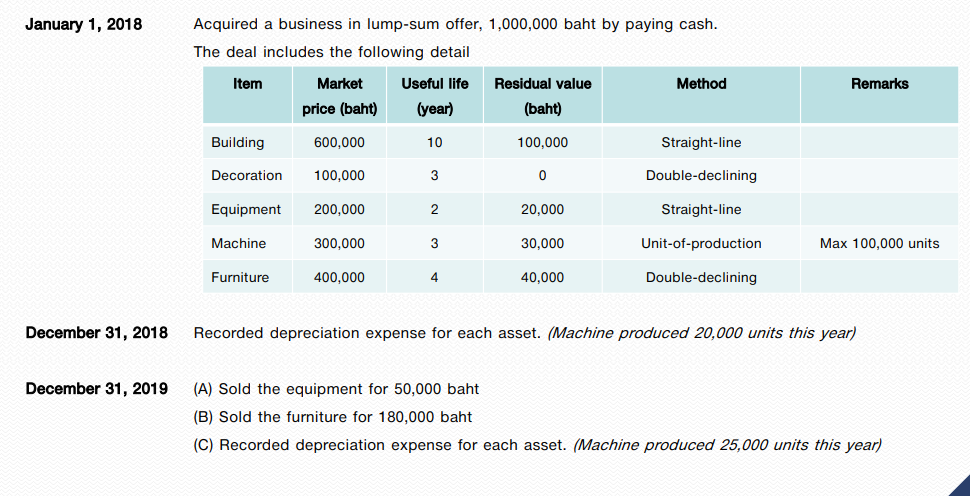

Use the following information to answer the questions below. De Plain International bought a delivery truck on January 2, 2020, for $15,000. The truck was expected to remain in service four years and to last 100,000 kilometers. At the end of its useful life, De Plain officials estimated that the truck's residual value would be $3,000. The truck traveled 34,000 kilometers the first year, 28,000 the second year, 18,000 the third year, and 20,000 the fourth year. Question 1: Prepare a schedule of depreciation expense per year for the truck under the three depreciation methods. Question 2 : 2.1 Assuming that the company decided to use Double-Decline method. After the two-year period, if the company would switch to the Straight-Line method. Show the updated depreciation schedule. 2.2 After the switching, at the end of the third year, the company decides to sell this truck for $2,000. Does the company incur gain on loss from this sale? January 1, 2018 Acquired a business in lump-sum offer, 1,000,000 baht by paying cash. The deal includes the following detail Item Method Remarks Market price (baht) Useful life (year) Residual value (baht) Building 600,000 10 100,000 Straight-line Decoration 100,000 3 0 Double-declining Equipment 200,000 2 20,000 Straight-line Machine 300,000 3 30,000 Unit-of-production Max 100,000 units Furniture 400,000 4 40,000 Double-declining December 31, 2018 Recorded depreciation expense for each asset. (Machine produced 20,000 units this year) December 31, 2019 (A) Sold the equipment for 50,000 baht (B) Sold the furniture for 180,000 baht (C) Recorded depreciation expense for each asset. (Machine produced 25,000 units this year) Use the following information to answer the questions below. De Plain International bought a delivery truck on January 2, 2020, for $15,000. The truck was expected to remain in service four years and to last 100,000 kilometers. At the end of its useful life, De Plain officials estimated that the truck's residual value would be $3,000. The truck traveled 34,000 kilometers the first year, 28,000 the second year, 18,000 the third year, and 20,000 the fourth year. Question 1: Prepare a schedule of depreciation expense per year for the truck under the three depreciation methods. Question 2 : 2.1 Assuming that the company decided to use Double-Decline method. After the two-year period, if the company would switch to the Straight-Line method. Show the updated depreciation schedule. 2.2 After the switching, at the end of the third year, the company decides to sell this truck for $2,000. Does the company incur gain on loss from this sale? January 1, 2018 Acquired a business in lump-sum offer, 1,000,000 baht by paying cash. The deal includes the following detail Item Method Remarks Market price (baht) Useful life (year) Residual value (baht) Building 600,000 10 100,000 Straight-line Decoration 100,000 3 0 Double-declining Equipment 200,000 2 20,000 Straight-line Machine 300,000 3 30,000 Unit-of-production Max 100,000 units Furniture 400,000 4 40,000 Double-declining December 31, 2018 Recorded depreciation expense for each asset. (Machine produced 20,000 units this year) December 31, 2019 (A) Sold the equipment for 50,000 baht (B) Sold the furniture for 180,000 baht (C) Recorded depreciation expense for each asset. (Machine produced 25,000 units this year)