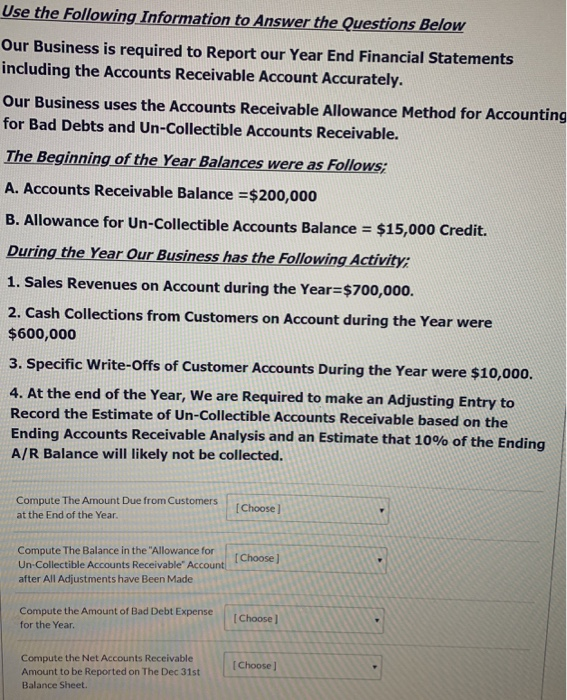

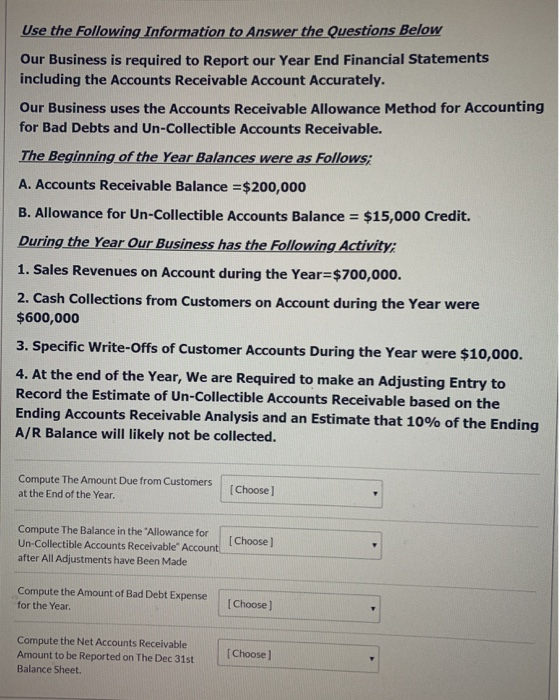

Use the following Information to Answer the questions Below Our Business is required to Report our Year End Financial Statements including the Accounts Receivable Account Accurately. Our Business uses the Accounts Receivable Allowance Method for Accounting for Bad Debts and Un-Collectible Accounts Receivable. The Beginning of the Year Balances were as follows: A. Accounts Receivable Balance = $200,000 B. Allowance for Un-Collectible Accounts Balance = $15,000 Credit. During the Year Our Business has the following Activity: 1. Sales Revenues on Account during the Year=$700,000. 2. Cash Collections from Customers on Account during the Year were $600,000 3. Specific Write-Offs of Customer Accounts During the Year were $10,000. 4. At the end of the Year, We are Required to make an Adjusting Entry to Record the Estimate of Un-Collectible Accounts Receivable based on the Ending Accounts Receivable Analysis and an Estimate that 10% of the Ending A/R Balance will likely not be collected. Compute The Amount Due from Customers at the End of the Year. Choose Compute The Balance in the "Allowance for Un Collectible Accounts Receivable Account nt [Choose] after All Adjustments have Been Made Compute the Amount of Bad Debt Expense sense for the Year C [Choose [Choose Compute the Net Accounts Receivable Amount to be Reported on The Dec 31st Balance Sheet. Use the following Information to Answer the questions Below Our Business is required to Report our Year End Financial Statements including the Accounts Receivable Account Accurately. Our Business uses the Accounts Receivable Allowance Method for Accounting for Bad Debts and Un-Collectible Accounts Receivable. The Beginning of the Year Balances were as follows; A. Accounts Receivable Balance =$200,000 B. Allowance for Un-Collectible Accounts Balance = $15,000 Credit. During the Year Our Business has the following Activity: 1. Sales Revenues on Account during the Year=$700,000. 2. Cash Collections from Customers on Account during the Year were $600,000 3. Specific Write-Offs of Customer Accounts During the Year were $10,000. 4. At the end of the Year, We are required to make an Adjusting Entry to Record the Estimate of Un-Collectible Accounts Receivable based on the Ending Accounts Receivable Analysis and an Estimate that 10% of the Ending A/R Balance will likely not be collected. Compute The Amount Due from Customers at the End of the Year. [Choose) Compute The Balance in the "Allowance for Un-Collectible Accounts Receivable" Account after All Adjustments have Been Made [Choose Compute the Amount of Bad Debt Expense for the Year [Choose] Compute the Net Accounts Receivable Amount to be Reported on The Dec 31st Balance Sheet. [Choose]