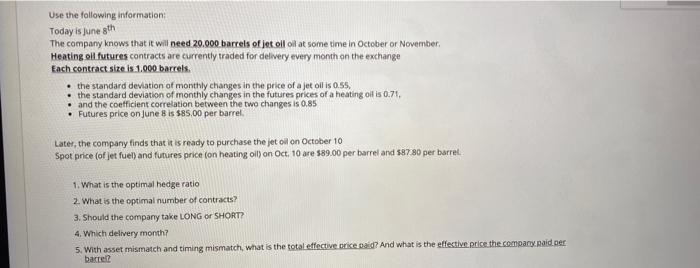

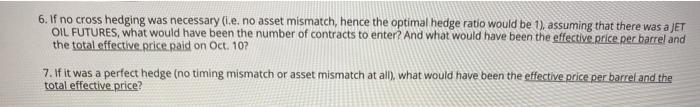

Use the following information Today is June 8th The company knows that it will need 20.000 barrels of jet oll oil at some time in October or November Heating all futures contracts are currently traded for delivery every month on the exchange Each contract size is 1,000 barrels. the standard deviation of monthly changes in the price of a jet oil is 0.55. the standard deviation of monthly changes in the future prices of a heating ok is 0.71 . and the coefficient correlation between the two changes is 0.85 Futures price on June 8 is $85.00 per barrel Later, the company finds that it is ready to purchase the jetoil on October 10 Spot price (of jet fuel) and futures price (on heating oily on Oct, 10 are $89.00 per barrel and 547 80 per barrel 1. What is the optimal hedge ratio 2. What is the optimal number of contracts? 3. Should the company take LONG OF SHORT? 4. Which delivery month? 5. With asset mismatch and timing mismatch, what is the total effective price ald? And what is the effective price the company. Raider barrel? 6. If no cross hedging was necessary (I.e. no asset mismatch, hence the optimal hedge ratio would be 1), assuming that there was a JET OIL FUTURES, what would have been the number of contracts to enter? And what would have been the effective price per barrel and the total effective price raid on Oct. 10? 7. If it was a perfect hedge (no timing mismatch or asset mismatch at all), what would have been the effective price per barrel and the total effective price? Use the following information Today is June 8th The company knows that it will need 20.000 barrels of jet oll oil at some time in October or November Heating all futures contracts are currently traded for delivery every month on the exchange Each contract size is 1,000 barrels. the standard deviation of monthly changes in the price of a jet oil is 0.55. the standard deviation of monthly changes in the future prices of a heating ok is 0.71 . and the coefficient correlation between the two changes is 0.85 Futures price on June 8 is $85.00 per barrel Later, the company finds that it is ready to purchase the jetoil on October 10 Spot price (of jet fuel) and futures price (on heating oily on Oct, 10 are $89.00 per barrel and 547 80 per barrel 1. What is the optimal hedge ratio 2. What is the optimal number of contracts? 3. Should the company take LONG OF SHORT? 4. Which delivery month? 5. With asset mismatch and timing mismatch, what is the total effective price ald? And what is the effective price the company. Raider barrel? 6. If no cross hedging was necessary (I.e. no asset mismatch, hence the optimal hedge ratio would be 1), assuming that there was a JET OIL FUTURES, what would have been the number of contracts to enter? And what would have been the effective price per barrel and the total effective price raid on Oct. 10? 7. If it was a perfect hedge (no timing mismatch or asset mismatch at all), what would have been the effective price per barrel and the total effective price