Answered step by step

Verified Expert Solution

Question

1 Approved Answer

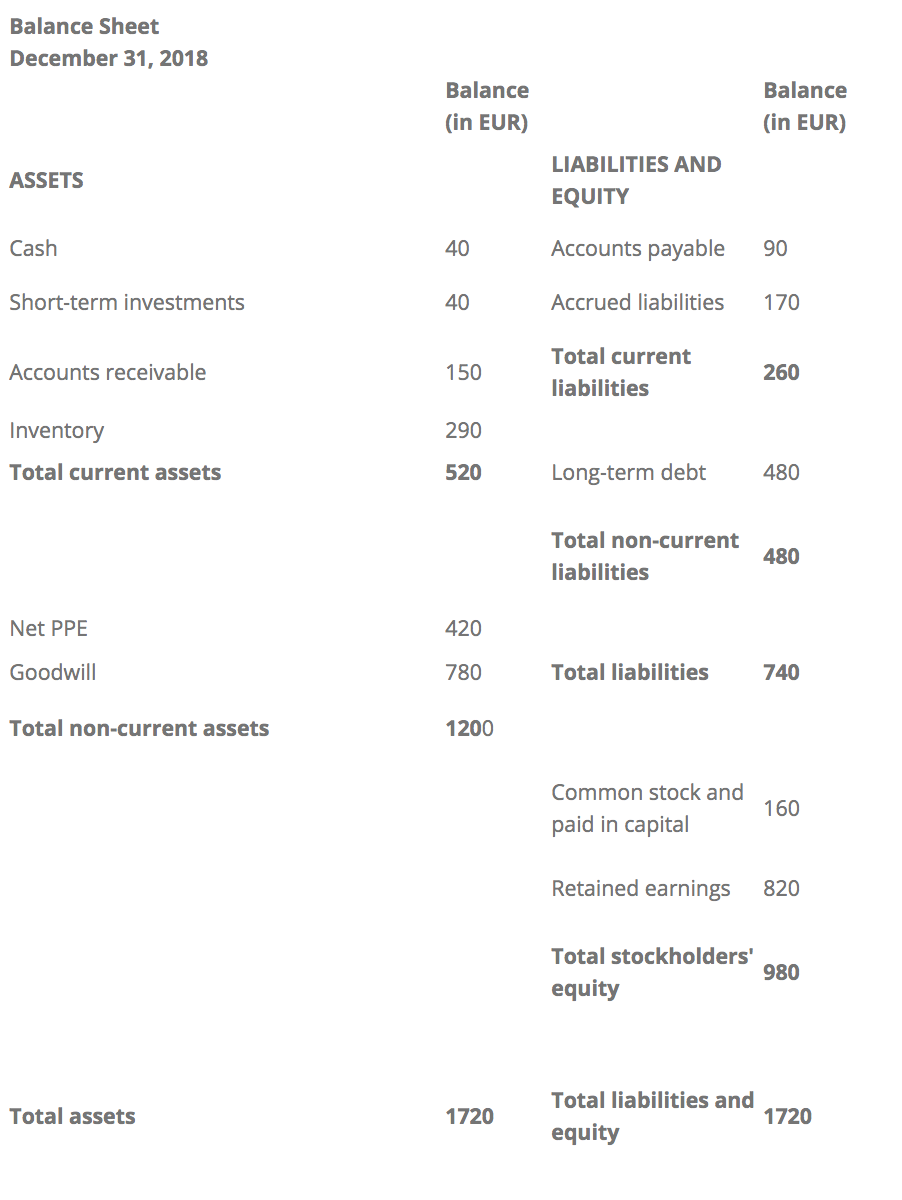

Use the following selected financial information to answer the following 10 ratios: 1. quick ratio 2. average collection period 3. days payable outstanding 4. total

| Use the following selected financial information to answer the following 10 ratios: |

| 1. quick ratio |

| 2. average collection period |

| 3. days payable outstanding |

| 4. total asset turnover ratio |

| 5. times interest earned ratio |

| 6. cash flow adequacy ratio |

| 7. cash flow margin |

| 8. effective tax rate |

| 9. debt ratio |

| 10. return on equity |

| Income Statement | |

| For the Year Ended December 31, 2018 | |

| EUR | 2018 |

| Net sales | 4770 |

| Cost of goods sold | 3000 |

| Gross profit | 1770 |

| Operating expenses | 1250 |

| Operating profit | 520 |

| Interest expense | 100 |

| Earnings before taxes | 420 |

| Income tax expense | 150 |

| Net profit | 270 |

| Statement of Cash Flow Information | |

| For the Year Ended December 31, 2018 | |

| EUR | 2018 |

| Cash from operating activities | 400 |

| Investing activities: | |

| Capital expenditures | 20 |

| Acquisitions | 20 |

| Financing activities: | |

| Proceeds from long-term borrowing | 50 |

| Payments on long-term borrowing | 100 |

| Payments of cash dividends | 40 |

| Cash paid for interest | 20 |

| Cash paid for income taxes | 150 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started