Answered step by step

Verified Expert Solution

Question

1 Approved Answer

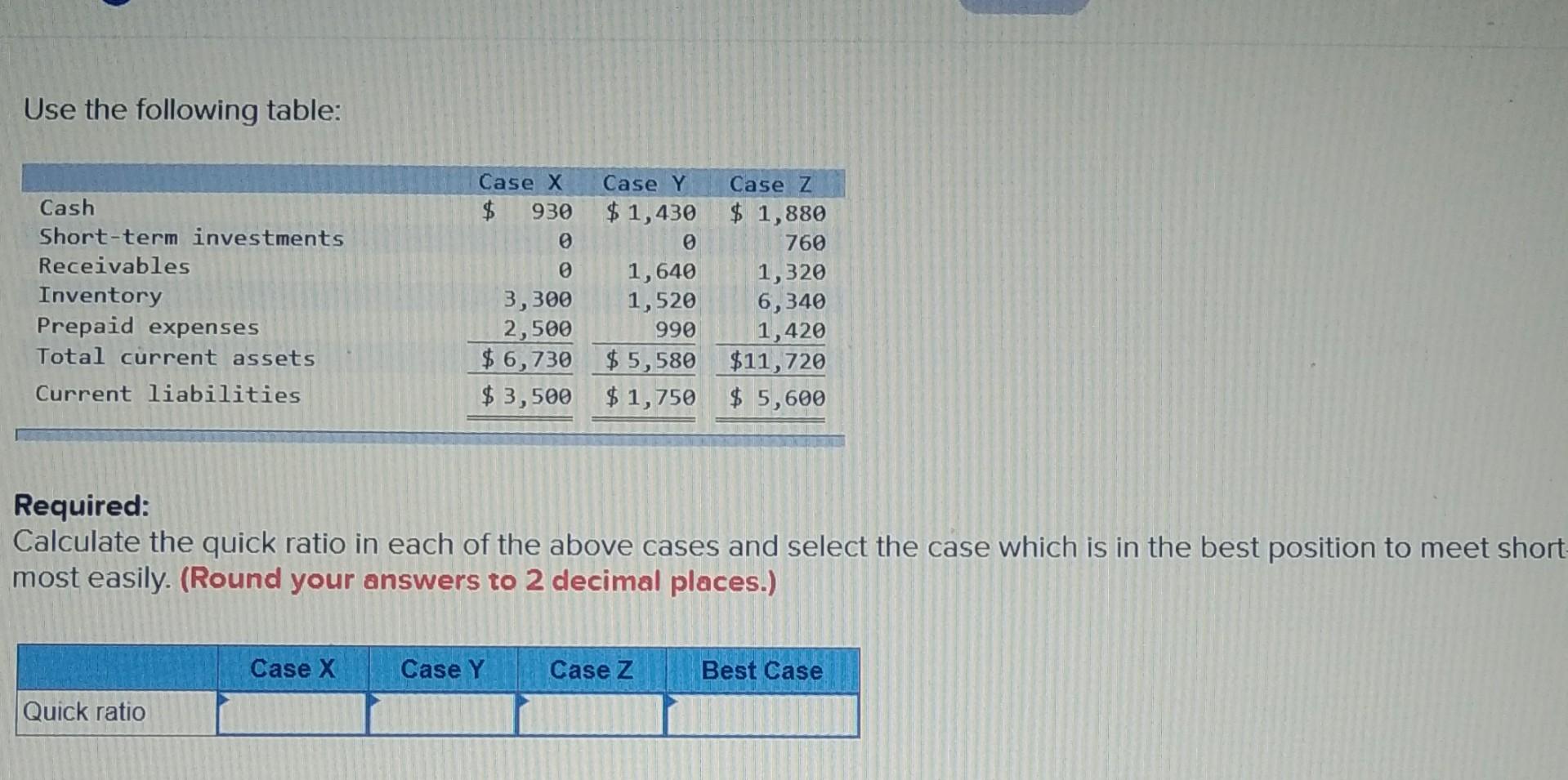

Use the following table: Required: Calculate the quick ratio in each of the above cases and select the case which is in the best position

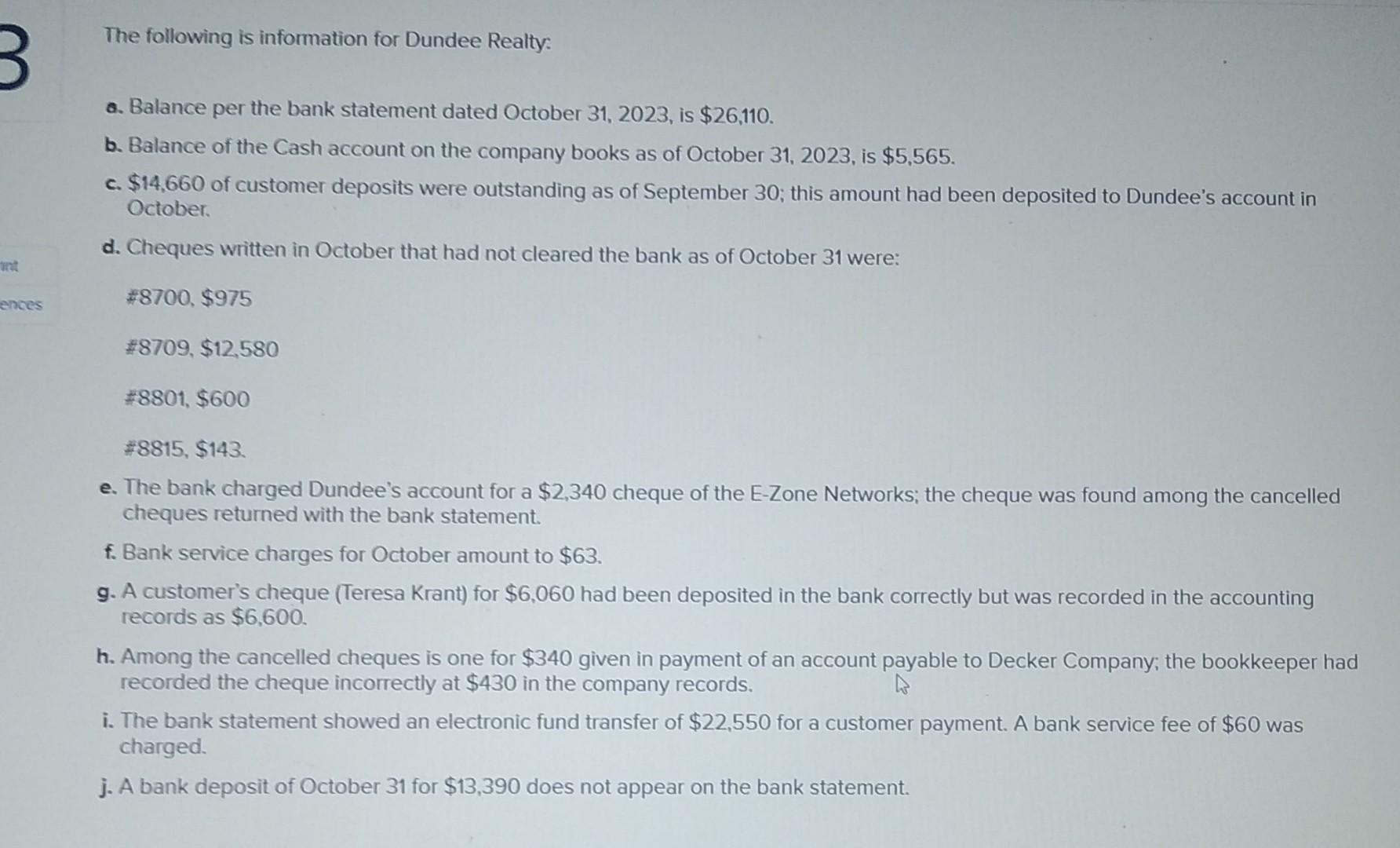

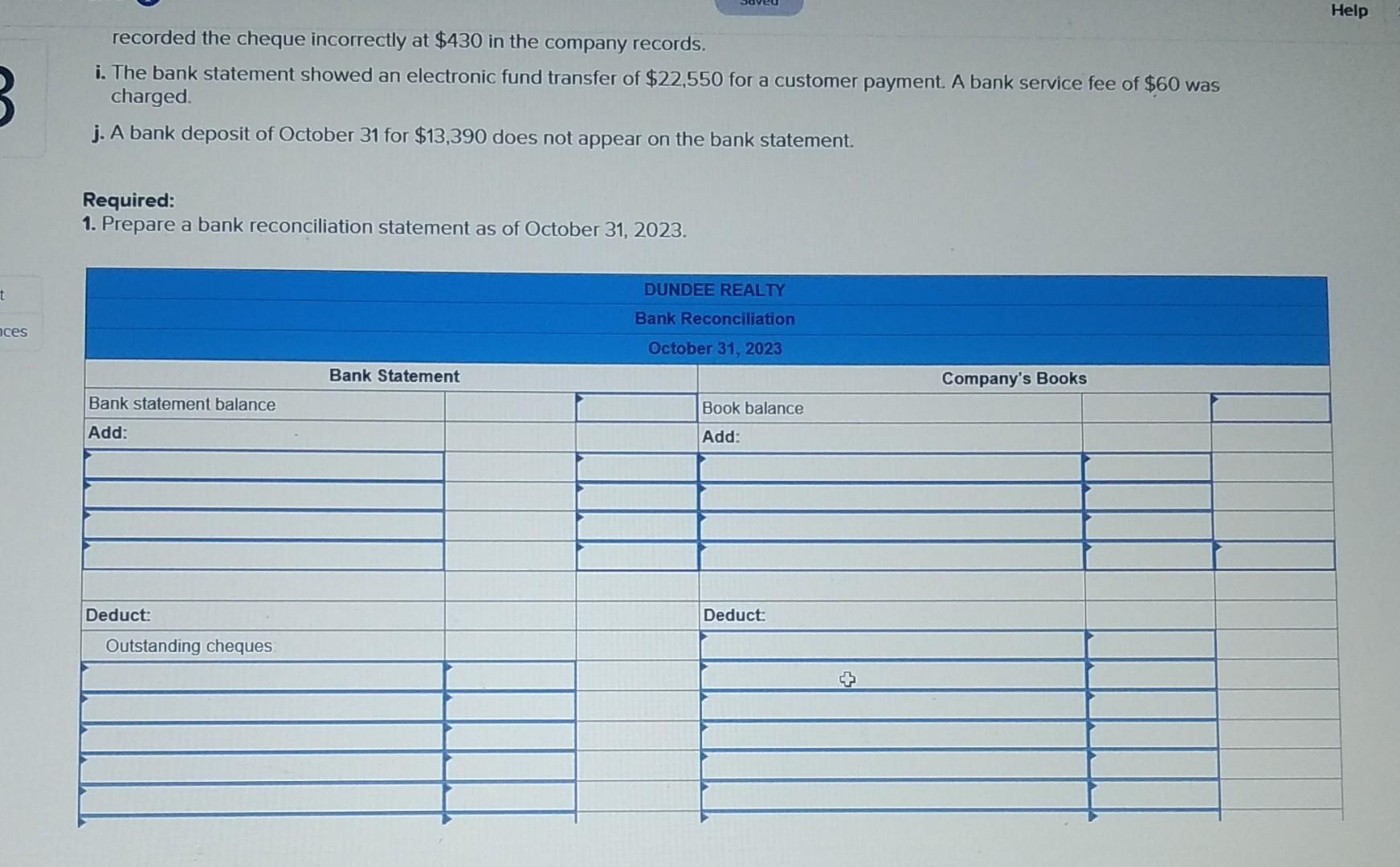

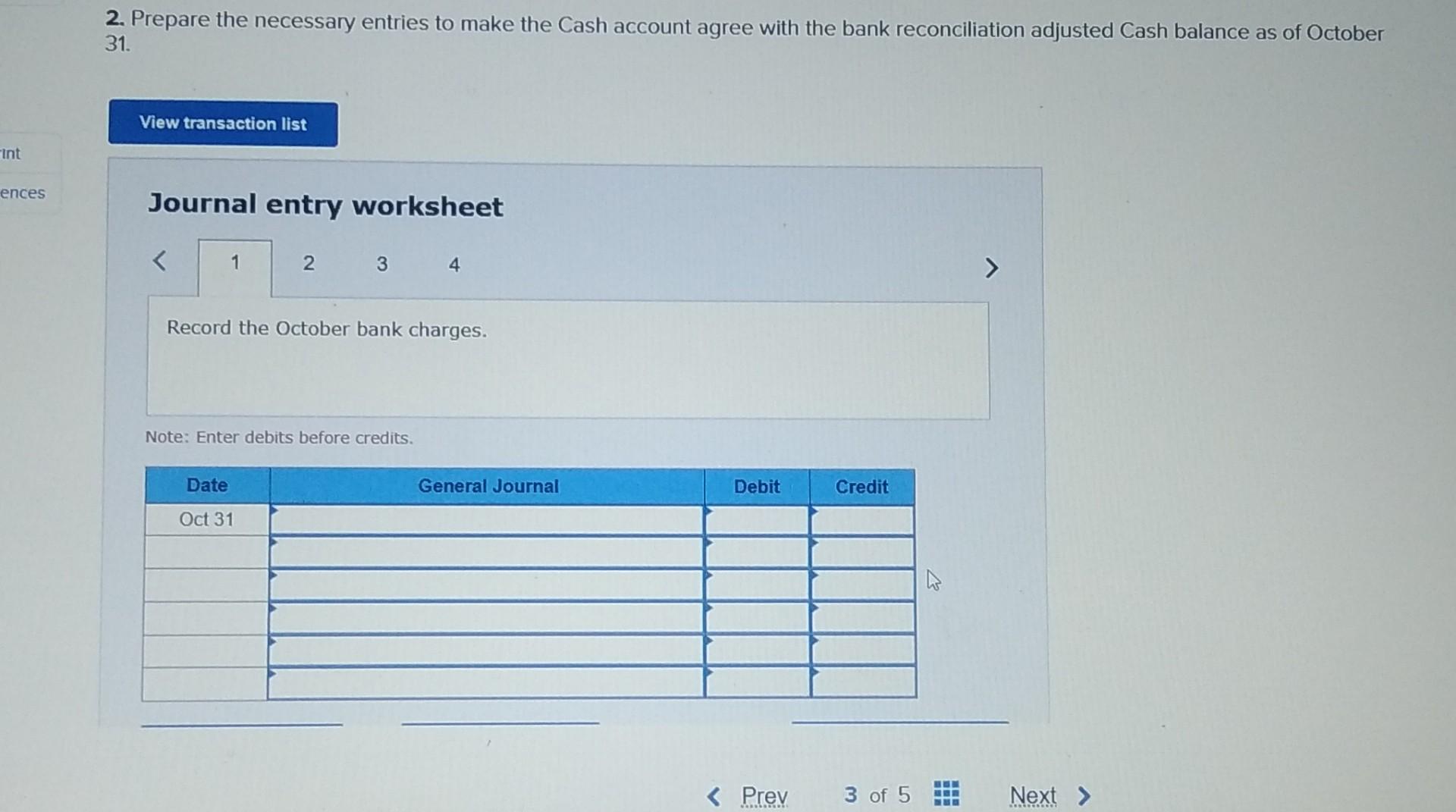

Use the following table: Required: Calculate the quick ratio in each of the above cases and select the case which is in the best position to meet short most easily. (Round your answers to 2 decimal places.) a. Balance per the bank statement dated October 31,2023 , is $26,110. b. Balance of the Cash account on the company books as of October 31,2023 , is $5,565. c. $14,660 of customer deposits were outstanding as of September 30; this amount had been deposited to Dundee's account in October. d. Cheques written in October that had not cleared the bank as of October 31 were: $8700,$975 $8709,$12,580 $8801,$600 $8815,$143. e. The bank charged Dundee's account for a $2,340 cheque of the E-Zone Networks; the cheque was found among the cancelled cheques returned with the bank statement. f. Bank service charges for October amount to $63. g. A customer's cheque (Teresa Krant) for $6,060 had been deposited in the bank correctly but was recorded in the accounting records as $6,600. h. Among the cancelled cheques is one for $340 given in payment of an account payable to Decker Company; the bookkeeper had recorded the cheque incorrectly at $430 in the company records. i. The bank statement showed an electronic fund transfer of $22,550 for a customer payment. A bank service fee of $60 was charged. j. A bank deposit of October 31 for $13,390 does not appear on the bank statement. recorded the cheque incorrectly at $430 in the company records. i. The bank statement showed an electronic fund transfer of $22,550 for a customer payment. A bank service fee of $60 was charged. j. A bank deposit of October 31 for $13,390 does not appear on the bank statement. Required: 1. Prepare a bank reconciliation statement as of October 31, 2023. 2. Prepare the necessary entries to make the Cash account agree with the bank reconciliation adjusted Cash balance as of October Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started