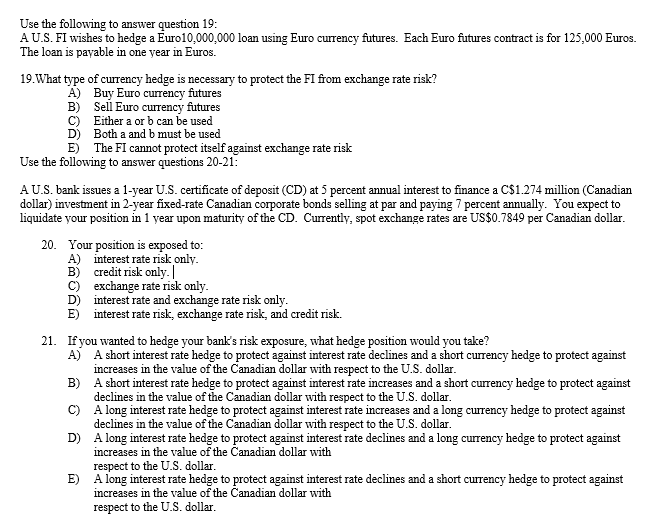

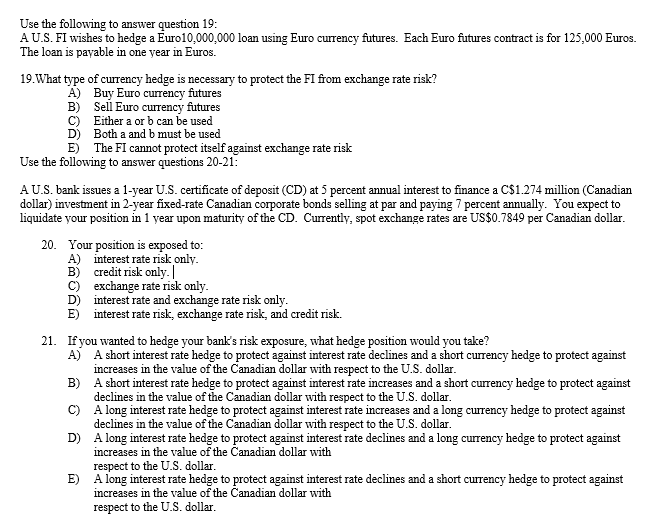

Use the following to answer question 19: AU.S. FI wishes to hedge a Euro10,000,000 loan using Euro currency futures. Each Euro futures contract is for 125,000 Euros. The loan is payable in one year in Euros. 19.What type of currency hedge is necessary to protect the FI from exchange rate risk? A) B) C) D) E) Buy Euro currency futures Sell Euro currency futures Either a or b can be used Both a and b must be used The FI cannot protect itself against exchange rate risk Use the following to answer questions 20-21 AU.S. bank issues a 1-year U.S. certificate of deposit (CD) at 5 percent annual interest to finance a C$1.274 million (Canadian dollar) investment in 2-year fixed-rate Canadian corporate bonds selling at par and paying 7 percent annually. You expect to liquidate your position in 1 year upon maturity of the CD. Currently, spot exchange rates are US$0.7849 per Canadian dollar 20. Your position is exposed to A) B) C) D) E) interest rate risk only credit risk only.| exchange rate risk only interest rate and exchange rate risk only interest rate risk, exchange rate risk, and credit risk. 21. If you wanted to hedge your bank's risk exposure, what hedge position would you take? A) A short interest rate hedge to protect against interest rate declines and a short currency hedge to protect against B) A short interest rate hedge to protect against interest rate increases and a short currency hedge to protect against C) A long interest rate hedge to protect against interest rate increases and a long curency hedge to protect against D) A long interest rate hedge to protect against interest rate declines and a long currency hedge to protect against E) A long interest rate hedge to protect against interest rate declines and a short currency hedge to protect against increases in the value of the Canadian dollar with respect to the U.S. dollar declines in the value of the Canadian dollar with respect to the U.S. dollar. declines in the value of the Canadian dollar with respect to the U.S. dollar increases in the value of the Canadian dollar with respect to the U.S. dollar increases in the value of the Canadian dollar with respect to the U.S. dollar