Answered step by step

Verified Expert Solution

Question

1 Approved Answer

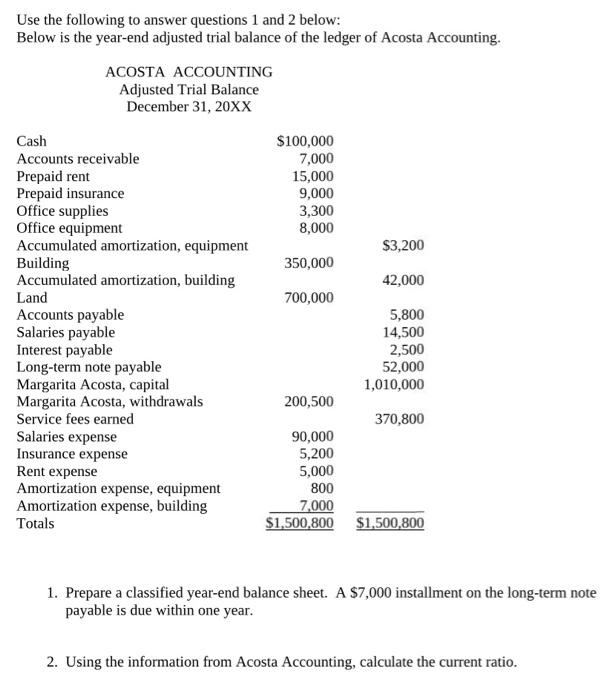

Use the following to answer questions 1 and 2 below: Below is the year-end adjusted trial balance of the ledger of Acosta Accounting. ACOSTA

Use the following to answer questions 1 and 2 below: Below is the year-end adjusted trial balance of the ledger of Acosta Accounting. ACOSTA ACCOUNTING Adjusted Trial Balance December 31, 20xX Cash Accounts receivable Prepaid rent Prepaid insurance Office supplies Office equipment Accumulated amortization, equipment Building Accumulated amortization, building Land $100,000 7,000 15,000 9,000 3,300 8,000 $3,200 350,000 42,000 700,000 Accounts payable Salaries payable Interest payable Long-term note payable Margarita Acosta, capital Margarita Acosta, withdrawals Service fees earned Salaries expense Insurance expense Rent expense Amortization expense, equipment Amortization expense, building Totals 5,800 14,500 2,500 52,000 1,010,000 200,500 370,800 90,000 5,200 5,000 800 7,000 $1,500,800 $1,500,800 1. Prepare a classified year-end balance sheet. A $7,000 installment on the long-term note payable is due within one year. 2. Using the information from Acosta Accounting, calculate the current ratio.

Step by Step Solution

★★★★★

3.58 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Classified balance sheet Assets Current assets Cash 100000 Account receivable 7000 Prepaid rent 1500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started