Answered step by step

Verified Expert Solution

Question

1 Approved Answer

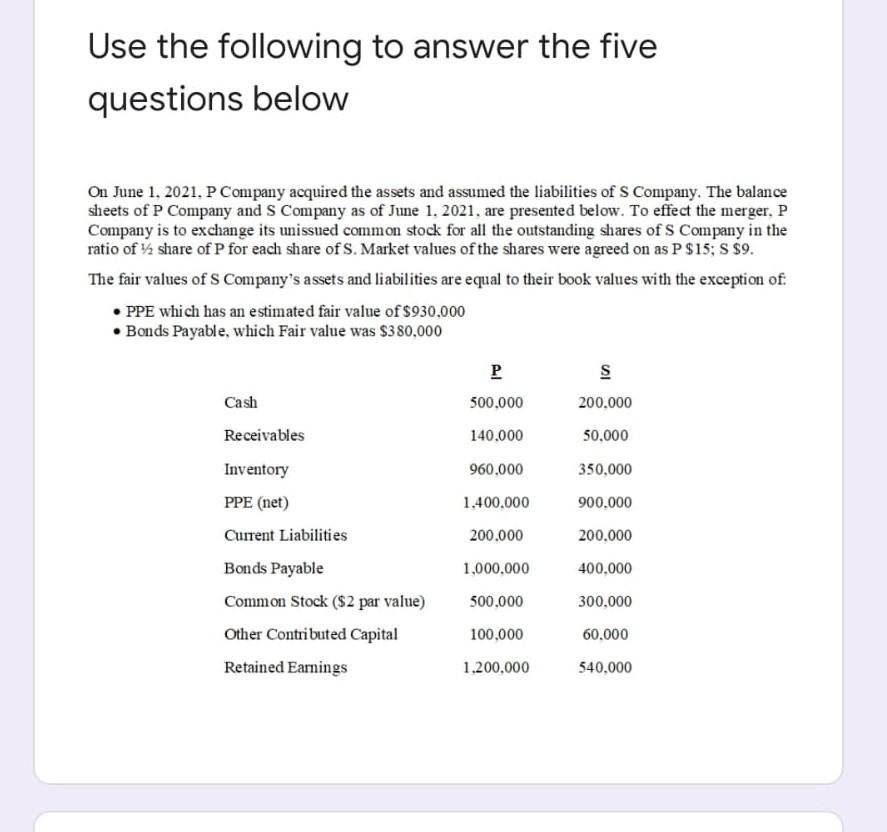

Use the following to answer the five questions below On June 1, 2021. P Company acquired the assets and assumed the liabilities of S Company.

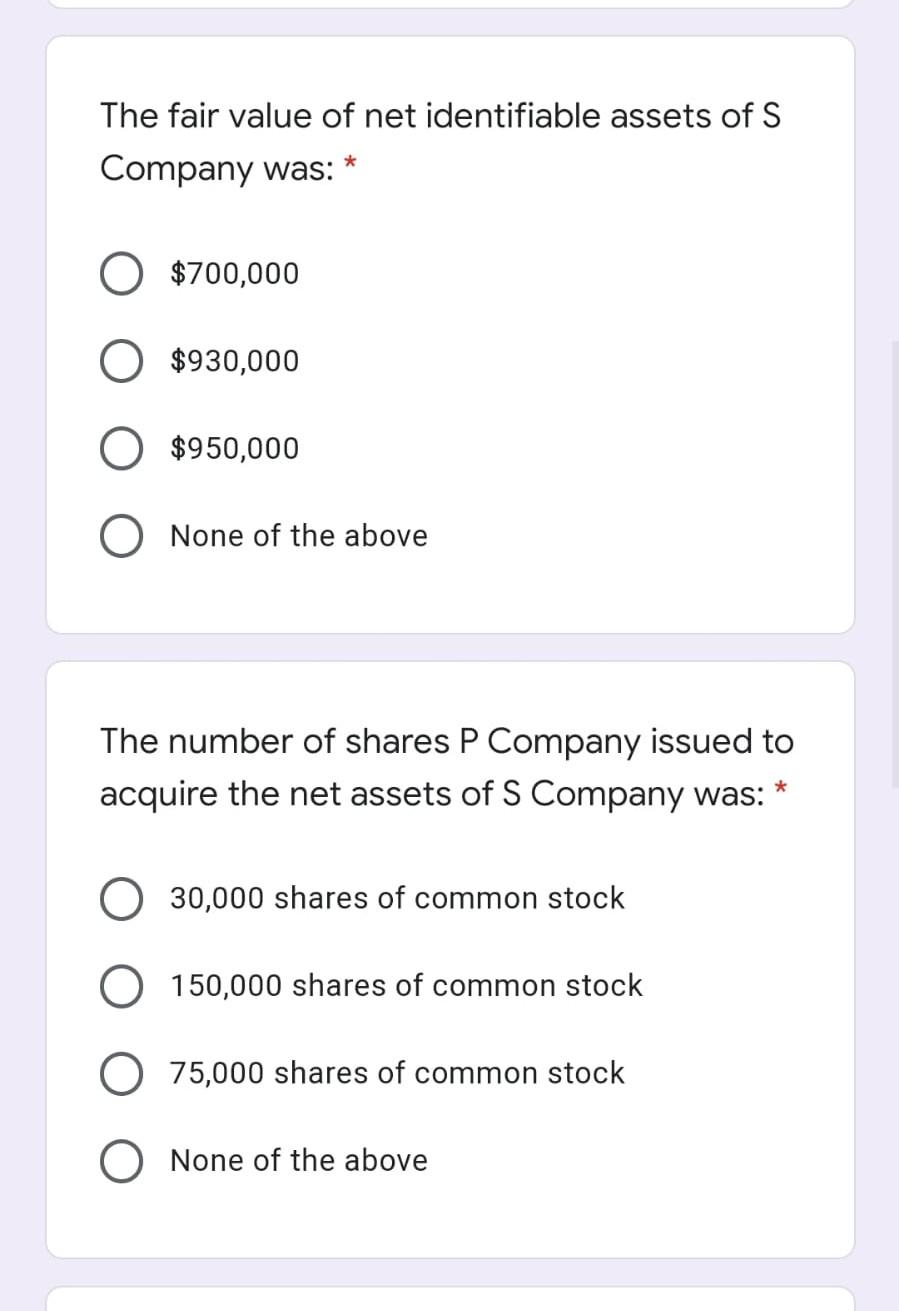

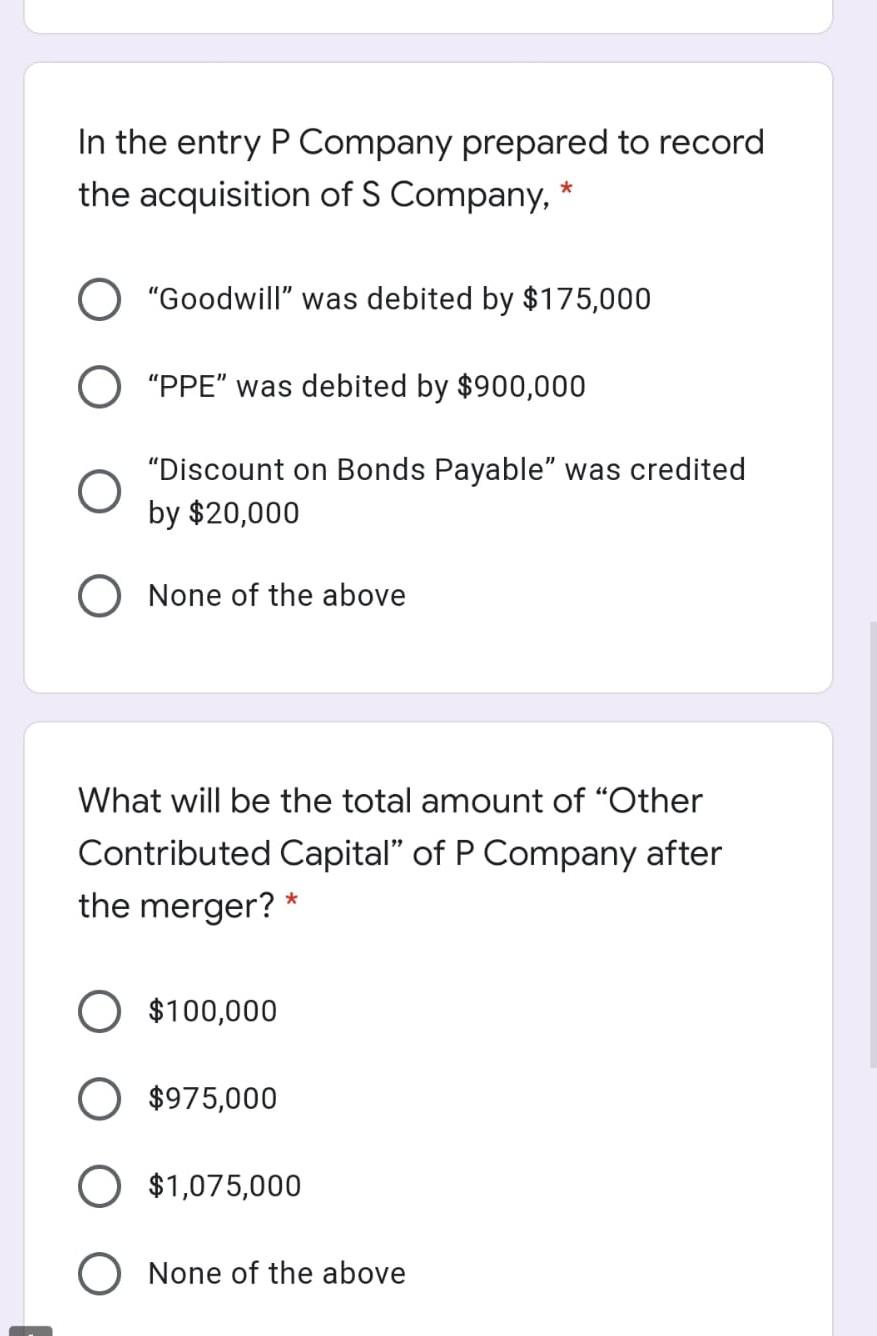

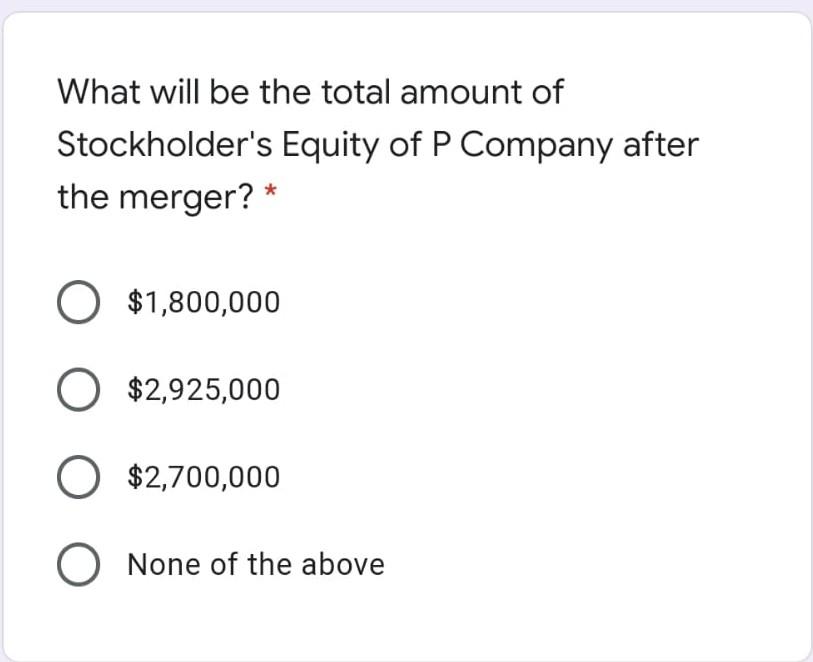

Use the following to answer the five questions below On June 1, 2021. P Company acquired the assets and assumed the liabilities of S Company. The balance sheets of P Company and S Company as of June 1, 2021. are presented below. To effect the merger, P Company is to exchange its unissued common stock for all the outstanding shares of S Company in the ratio of share of P for each share of S. Market values of the shares were agreed on as P $15; S $9. The fair values of S Company's assets and liabilities are equal to their book values with the exception of PPE which has an estimated fair value of $930.000 Bonds Payable, which Fair value was $380,000 500.000 140.000 s 200.000 50.000 350.000 960,000 900.000 Cash Receivables Inventory PPE (net) Current Liabilities Bonds Payable Common Stock ($2 par value) Other Contributed Capital Retained Earnings 1.400.000 200.000 1,000,000 500.000 200.000 400.000 300,000 100.000 60.000 1,200,000 540,000 The fair value of net identifiable assets of S Company was: $700,000 $930,000 $950,000 O None of the above The number of shares P Company issued to acquire the net assets of S Company was: * O 30,000 shares of common stock 150,000 shares of common stock 75,000 shares of common stock None of the above In the entry P Company prepared to record the acquisition of S Company, * O "Goodwill was debited by $175,000 PPE" was debited by $900,000 O Discount on Bonds Payable" was credited by $20,000 O None of the above What will be the total amount of Other Contributed Capital of P Company after the merger? * O $100,000 $975,000 O $1,075,000 None of the above What will be the total amount of Stockholder's Equity of P Company after the merger? * O $1,800,000 O $2,925,000 O $2,700,000 O None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started