Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Use the formula (below). What does it measure? If an asset has a positive alpha, where would it plot with respect to the SML? What

Use the formula (below). What does it measure? If an asset has a positive alpha, where would it plot with respect to the SML? What is the financial interpretation of the residuals in the regression?

4. Compute the beta for each of the stocks using 12, 36, and 60 months. Are there any differences? If so, why? Compare the results you obtained for 36 months with those available online. Are there any differences? If so, why?

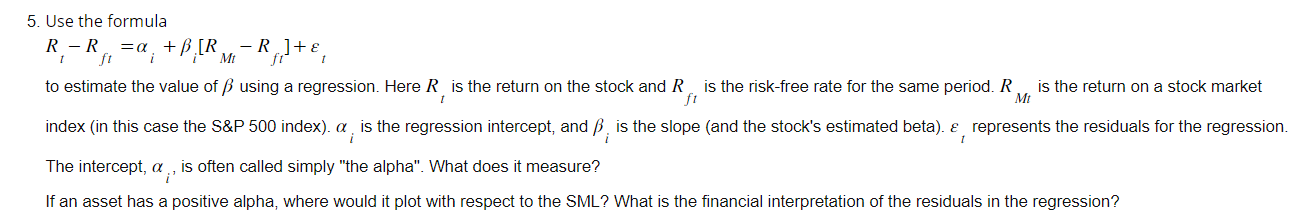

5. Use the formula RtRft=i+i[RMtRft]+t to estimate the value of using a regression. Here Rt is the return on the stock and Rft is the risk-free rate for the same period. RMt is the return on a stock market index (in this case the S\&P 500 index). i is the regression intercept, and i is the slope (and the stock's estimated beta). represents the residuals for the regression. The intercept, i, is often called simply "the alpha". What does it measure? If an asset has a positive alpha, where would it plot with respect to the SML? What is the financial interpretation of the residuals in the regression

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started