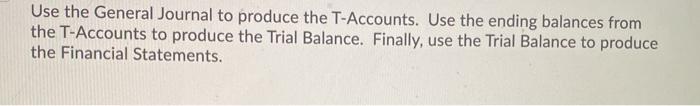

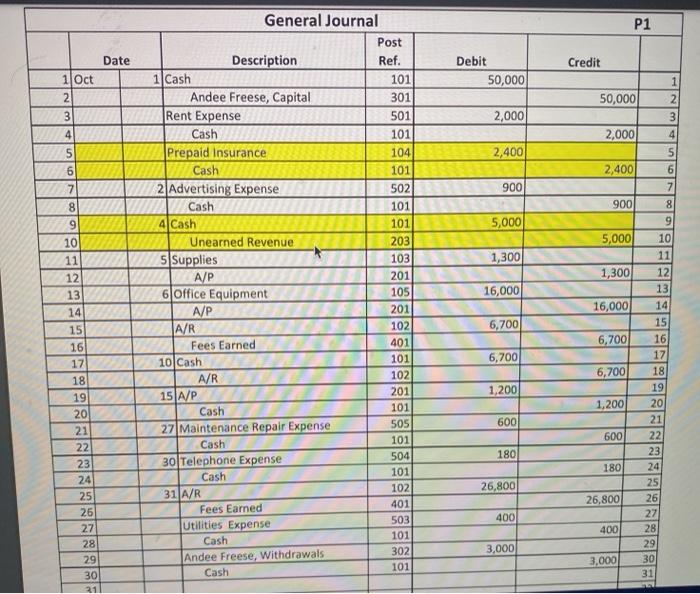

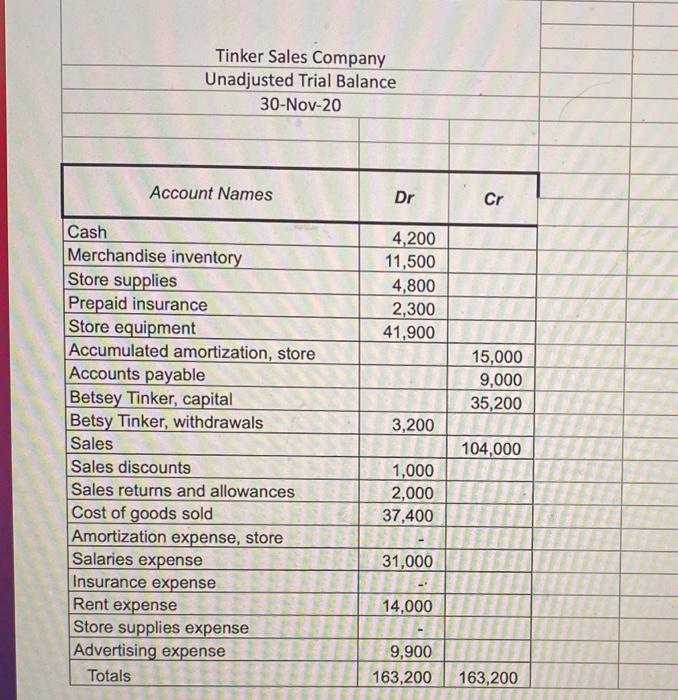

Use the General Journal to produce the T-Accounts. Use the ending balances from the T-Accounts to produce the Trial Balance. Finally, use the Trial Balance to produce the Financial Statements. P1 Date Credit Debit 50,000 1 Oct 2 3 2,000 4 5 2,400 6 900 5,000 10 1,300 General Journal Post Description Ref. 1 Cash 101 Andee Freese, Capital 301 Rent Expense 501 Cash 101 Prepaid Insurance 104 Cash 101 2 Advertising Expense 502 Cash 101 4 Cash 101 Unearned Revenue 203 5 Supplies 103 A/P 201 6 Office Equipment 105 A/P 201 |A/R Fees Earned 401 10 Cash 1011 102 15 A/P 201 Cash 101 27 Maintenance Repair Expense 505 Cash 101 30 Telephone Expense 504 101 102 31 A/R Fees Earned 401 Utilities Expense 503 Cash 101 302 Andee Freese, withdrawals Cash 101 16,000 102 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 6,700 1 50,000 2 3 2,000 4 5 2,400 6 7 900 8 9 5,000 11 1,300 12 13 16,000 14 15 6,700 16 17 6,700 18 19 1,200 20 21 600 22 23 180 24 25 26,800 261 27 400 28 29 3,000 30 31 6,700 A/R 1,200 600 180 Cash 26,800 26 400 3,000 27 28 29 30 311 Tinker Sales Company Unadjusted Trial Balance 30-Nov-20 Account Names Dr Cr 4,200 11,500 4,800 2,300 41,900 15,000 9,000 35,200 3,200 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated amortization, store Accounts payable Betsey Tinker, capital Betsy Tinker, withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Amortization expense, store Salaries expense Insurance expense Rent expense Store supplies expense Advertising expense Totals 104,000 1,000 2,000 37,400 31,000 14,000 9,900 163,200 163,200 Fees earned Operating expenses: 0 Rent expense Salary expense Utilities expense Telephone expense Janitorial Expense Postage Expense Software Expense Internet Expense Advertising expense Total operating expenses 0 Net income 0 Kenneth Jones Realty Statement of Owner's Equity For the Month Ending May 31, 2019 0 Kenneth Jones, capital, May 1 Investment Net income for May (Subtotal) Less: withdrawals Increase in owner's equity Kenneth Jones, capital, May 31 OOO 0 0 Kenneth Jones Realty Balance Sheet as of May 31, 2019 Assets Liabilities Accounts payable 0 Cash Supplies Equipment Total assets OOOO 0 Owner's Equity Kenneth Jones, capital Total liabilities and owner's equity 0 Use the General Journal to produce the T-Accounts. Use the ending balances from the T-Accounts to produce the Trial Balance. Finally, use the Trial Balance to produce the Financial Statements. P1 Date Credit Debit 50,000 1 Oct 2 3 2,000 4 5 2,400 6 900 5,000 10 1,300 General Journal Post Description Ref. 1 Cash 101 Andee Freese, Capital 301 Rent Expense 501 Cash 101 Prepaid Insurance 104 Cash 101 2 Advertising Expense 502 Cash 101 4 Cash 101 Unearned Revenue 203 5 Supplies 103 A/P 201 6 Office Equipment 105 A/P 201 |A/R Fees Earned 401 10 Cash 1011 102 15 A/P 201 Cash 101 27 Maintenance Repair Expense 505 Cash 101 30 Telephone Expense 504 101 102 31 A/R Fees Earned 401 Utilities Expense 503 Cash 101 302 Andee Freese, withdrawals Cash 101 16,000 102 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 6,700 1 50,000 2 3 2,000 4 5 2,400 6 7 900 8 9 5,000 11 1,300 12 13 16,000 14 15 6,700 16 17 6,700 18 19 1,200 20 21 600 22 23 180 24 25 26,800 261 27 400 28 29 3,000 30 31 6,700 A/R 1,200 600 180 Cash 26,800 26 400 3,000 27 28 29 30 311 Tinker Sales Company Unadjusted Trial Balance 30-Nov-20 Account Names Dr Cr 4,200 11,500 4,800 2,300 41,900 15,000 9,000 35,200 3,200 Cash Merchandise inventory Store supplies Prepaid insurance Store equipment Accumulated amortization, store Accounts payable Betsey Tinker, capital Betsy Tinker, withdrawals Sales Sales discounts Sales returns and allowances Cost of goods sold Amortization expense, store Salaries expense Insurance expense Rent expense Store supplies expense Advertising expense Totals 104,000 1,000 2,000 37,400 31,000 14,000 9,900 163,200 163,200 Fees earned Operating expenses: 0 Rent expense Salary expense Utilities expense Telephone expense Janitorial Expense Postage Expense Software Expense Internet Expense Advertising expense Total operating expenses 0 Net income 0 Kenneth Jones Realty Statement of Owner's Equity For the Month Ending May 31, 2019 0 Kenneth Jones, capital, May 1 Investment Net income for May (Subtotal) Less: withdrawals Increase in owner's equity Kenneth Jones, capital, May 31 OOO 0 0 Kenneth Jones Realty Balance Sheet as of May 31, 2019 Assets Liabilities Accounts payable 0 Cash Supplies Equipment Total assets OOOO 0 Owner's Equity Kenneth Jones, capital Total liabilities and owner's equity 0