Answered step by step

Verified Expert Solution

Question

1 Approved Answer

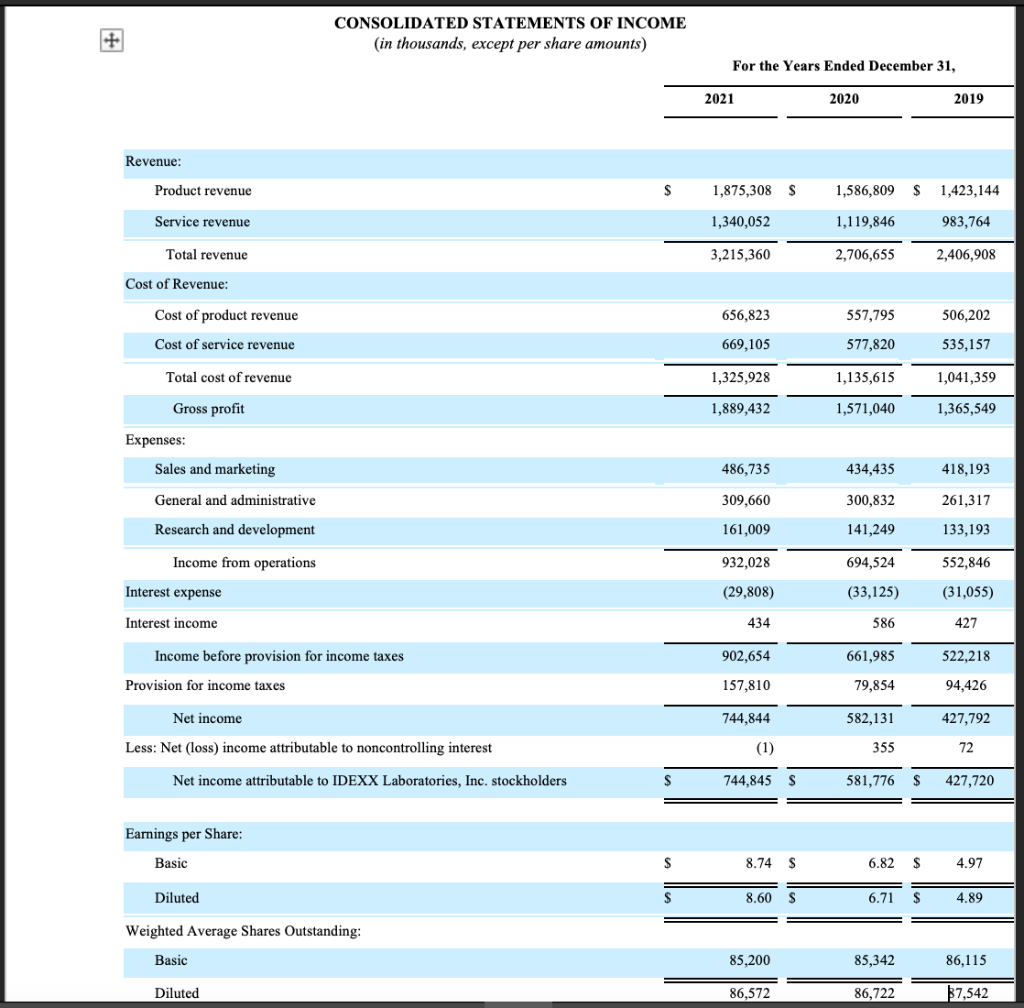

Use the high-low method described in chapter 2, Appendix 2A of our book to estimate what portion of your companys expenses are fixed vs. variable.

- Use the high-low method described in chapter 2, Appendix 2A of our book to estimate what portion of your companys expenses are fixed vs. variable. You should have 3 years of income statements, so pick the 2 years with the highest and lowest revenue to do the high-low analysis, and use total operating expenses from those same two years for the analysis.

- Based on your estimate of the portion of expenses that are variable, compute your companys contribution margin (described in Chapter 3) for the more recent year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started