Answered step by step

Verified Expert Solution

Question

1 Approved Answer

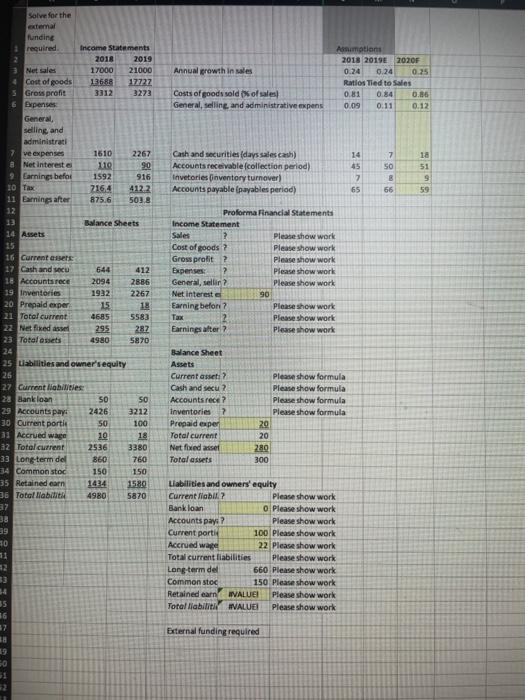

use the income statement and balance sheet along with assumptions to build a forecast to estimate external funding required Annual growth in sales 0.25 Animation

use the income statement and balance sheet along with assumptions to build a forecast to estimate external funding required

Annual growth in sales 0.25 Animation 2018 2019 2020F 0.24 0.24 Ratios Tied to Sales 0.81 0.84 0.86 0.09 0:11 0.12 Costs of goods sold of sales General, selling and administrative expens 14 7 18 SO Cash and securities (days salesca) Accounts receivable collection period) Invetories inventory turnover) Accounts payable (payables period) 7 65 B 56 51 9 59 Salve for the extemal Runding required Income Statements 2018 2019 Net sales 17000 21000 4 Cost of goods 13688 17727 5 Gross profit 3312 3273 Expenses General selling and administrati ve expenses 1510 2267 Net intereste 119 90 9 Carnings befor 1592 916 10 Tas 216.4 4122 11 Earnings after 875.6 503.8 12 13 Balance Sheets 14 Assets 15 16 Current se 17 Cash and secu 644 412 18 Accounts rece 2094 2886 19 Inventories 1932 2267 20 Prepaid exper 15 18 21 Total current 4685 5583 22 Netflixed as 295 282 23 Total assets 4980 5870 24 25 abilities and owner'sequity 26 27 Current liabilities 28 Bank loan 50 50 29 Accounts pay 2426 3212 30 Current porti 50 100 31 Accrued wage 10 18 32 Total current 2536 3380 33 Long-term del 860 760 34 Common stoc 150 150 35 Retained earn 1434 15.80 36 Total Habilita 4980 5870 37 38 39 30 Proforma Financial Statements Income Statement Sales 2 Please show work Cost of goods? Please show work Gross profit? Please show work Expenses 2 Please show work General, sellin2 Please show work Net interest 90 Earning befon? Please show work Tax Please show work Earnings after Please show work Balance Sheet Assets Current asset Cash and sexu Accounts rece? inventories? Prepaid exper Total current Net fixed asset Total assets Please show formula Please show formula Please show formula Please show formula 20 20 280 300 Liabilities and owners' equity Current liabil? Please show work Bank loan o Please show work Accounts pays? Please show work Current porti 100 Please show work Accrued wage 22 Please show work Total current liabilities Please show work Long-term del 660 Please show work Common stoc 150 Please show work Retained earn #VALUE! Please show work Total abiliti VALUES Please show work 2 33 4 5 16 37 18 External funding required 50 12 Annual growth in sales 0.25 Animation 2018 2019 2020F 0.24 0.24 Ratios Tied to Sales 0.81 0.84 0.86 0.09 0:11 0.12 Costs of goods sold of sales General, selling and administrative expens 14 7 18 SO Cash and securities (days salesca) Accounts receivable collection period) Invetories inventory turnover) Accounts payable (payables period) 7 65 B 56 51 9 59 Salve for the extemal Runding required Income Statements 2018 2019 Net sales 17000 21000 4 Cost of goods 13688 17727 5 Gross profit 3312 3273 Expenses General selling and administrati ve expenses 1510 2267 Net intereste 119 90 9 Carnings befor 1592 916 10 Tas 216.4 4122 11 Earnings after 875.6 503.8 12 13 Balance Sheets 14 Assets 15 16 Current se 17 Cash and secu 644 412 18 Accounts rece 2094 2886 19 Inventories 1932 2267 20 Prepaid exper 15 18 21 Total current 4685 5583 22 Netflixed as 295 282 23 Total assets 4980 5870 24 25 abilities and owner'sequity 26 27 Current liabilities 28 Bank loan 50 50 29 Accounts pay 2426 3212 30 Current porti 50 100 31 Accrued wage 10 18 32 Total current 2536 3380 33 Long-term del 860 760 34 Common stoc 150 150 35 Retained earn 1434 15.80 36 Total Habilita 4980 5870 37 38 39 30 Proforma Financial Statements Income Statement Sales 2 Please show work Cost of goods? Please show work Gross profit? Please show work Expenses 2 Please show work General, sellin2 Please show work Net interest 90 Earning befon? Please show work Tax Please show work Earnings after Please show work Balance Sheet Assets Current asset Cash and sexu Accounts rece? inventories? Prepaid exper Total current Net fixed asset Total assets Please show formula Please show formula Please show formula Please show formula 20 20 280 300 Liabilities and owners' equity Current liabil? Please show work Bank loan o Please show work Accounts pays? Please show work Current porti 100 Please show work Accrued wage 22 Please show work Total current liabilities Please show work Long-term del 660 Please show work Common stoc 150 Please show work Retained earn #VALUE! Please show work Total abiliti VALUES Please show work 2 33 4 5 16 37 18 External funding required 50 12 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started