Answered step by step

Verified Expert Solution

Question

1 Approved Answer

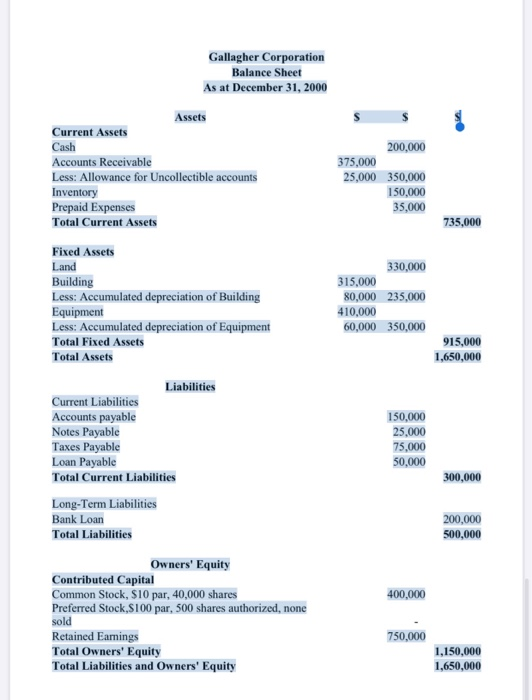

Use the Income Statement and/or Balance Sheet below to Compute each ratio. Ensure that ALL formulas and workings are clearly shown: 1. Current Ratio (5

Use the Income Statement and/or Balance Sheet below to Compute each ratio. Ensure that ALL formulas and workings are clearly shown:

1. Current Ratio (5 marks)

2. Quick Ratio (5 marks)

3. Debt Ratio (5 marks)

4. Average Inventory Turnover Ratio (5 marks) 5. Net Profit on Sales Ratio (5 marks)

Gallagher Corporation Income Statement

For the Period Ended December 31, 2000

Sales Revenue

Less: Sales Returns and allowances

Net Sales

Cost of Goods Sold

Inventory, January 1, 2000 Purchases

Goods available for Sale

less: Inventory, December, 2000 Cost of Goods Sold

Gross Margin

Operating Expenses

Selling Expenses Administrative Expenses Total Operating Expenses Operating Income

Financial Expense

Income before Income Taxes Estimated Income Taxes

Net Income

$$

1,750,000 50,000

150,000 1,050,000 1,200,000

200,000

150,000 100,000

450,000 20,000

1,700,000

1,000,000 700,000

250,000

430,000 172,000

258,000

Please go on to next page

Current Assets

Gallagher Corporation Balance Sheet

As at December 31, 2000

Assets

$ $

200,000 375,000

25,000 350,000 150,000 35,000

735,000

915,000 1,650,000

150,000 25,000 75,000 50,000

300,000

200,000

500,000

400,000

-

750,000

1,150,000 1,650,000

Cash

Accounts Receivable

Less: Allowance for Uncollectible accounts Inventory

Prepaid Expenses

Total Current Assets

Fixed Assets

Land

Building

Less: Accumulated depreciation of Building Equipment

Less: Accumulated depreciation of Equipment Total Fixed Assets

Total Assets

Liabilities

Current Liabilities Accounts payable

Notes Payable

Taxes Payable

Loan Payable

Total Current Liabilities

Long-Term Liabilities Bank Loan

Total Liabilities

Owners' Equity Contributed Capital

Common Stock, $10 par, 40,000 shares

Preferred Stock,$100 par, 500 shares authorized, none sold

Retained Earnings

Total Owners' Equity

Total Liabilities and Owners' Equity

330,000 315,000

80,000 235,000 410,000

60,000 350,000

Please go on to next page

$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started