Question

Use the information below to answer the questions that follow. U.S. $ EQUIVALENT .00916 .00899 Japanese yen Japanese yen 6 month Australian dollar Australian

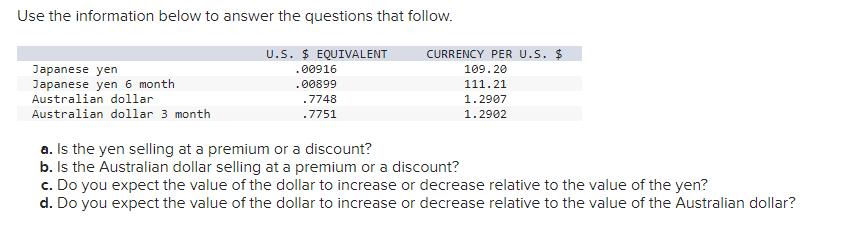

Use the information below to answer the questions that follow. U.S. $ EQUIVALENT .00916 .00899 Japanese yen Japanese yen 6 month Australian dollar Australian dollar 3 month 7748 .7751 CURRENCY PER U.S. $ 109.20 111.21 1.2907 1.2902 a. Is the yen selling at a premium or a discount? b. Is the Australian dollar selling at a premium or a discount? c. Do you expect the value of the dollar to increase or decrease relative to the value of the yen? d. Do you expect the value of the dollar to increase or decrease relative to the value of the Australian dollar?

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

a To determine if the yen is selling at a premium or a discount we can compare the current exchange ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting for Managers

Authors: Eric Noreen, Peter Brewer, Ray Garrison

2nd edition

978-0077403485, 77403487, 73527130, 978-0073527130

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App