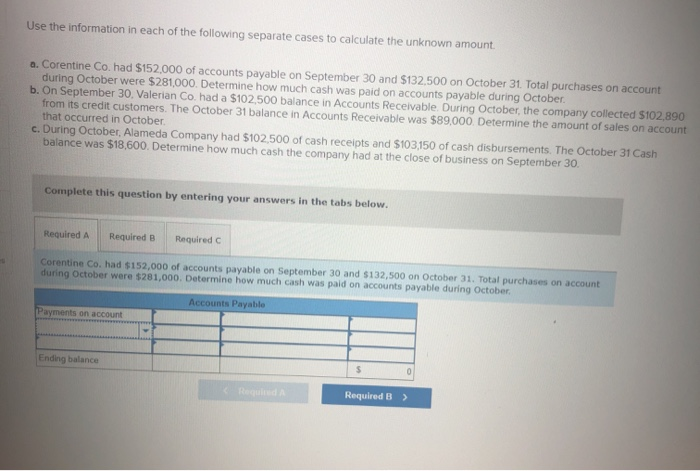

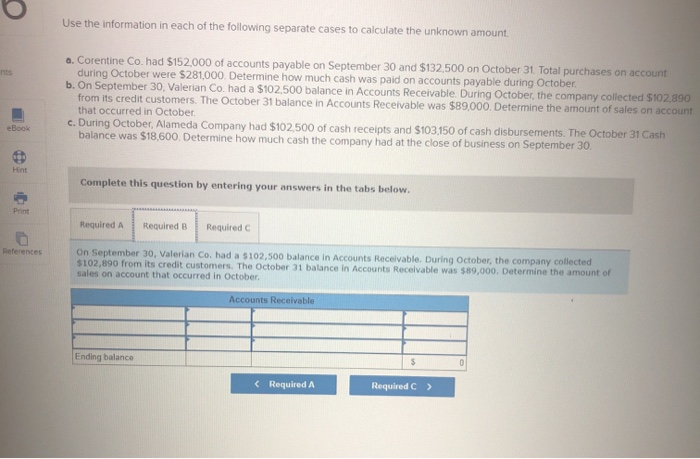

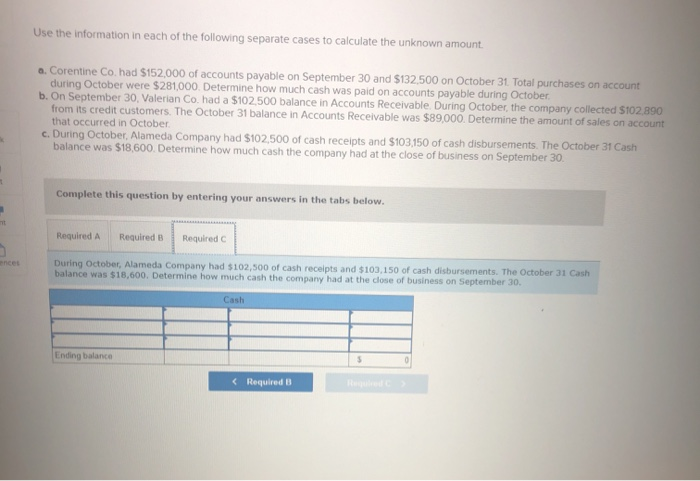

Use the information in each of the following separate cases to calculate the unknown amount a. Corentine Co. had $152,000 of accounts payable on September 30 and $132,500 on October 31. Total purchases on account during October were $281,000. Determine how much cash was paid on accounts payable during October b. On September 30. Valerian Co. had a $102,500 balance in Accounts Receivable. During October, the company collected $102,890 from its credit customers. The October 31 balance in Accounts Receivable was $89,000. Determine the amount of sales on account that occurred in October c. During October, Alameda Company had $102,500 of cash receipts and $103,150 of cash disbursements. The October 31 Cash balance was $18,600. Determine how much cash the company had at the close of business on September 30, Complete this question by entering your answers in the tabs below. Required A Required B Required c Corentine Co. had $152,000 of accounts payable on September 30 and $132,500 on October 31. Total purchases on account during October were $281,000. Determine how much cash was paid on accounts payable during October Accounts Payable Payments on account Ending balance 0 Required B > Use the information in each of the following separate cases to calculate the unknown amount. a. Corentine Co. had $152,000 of accounts payable on September 30 and $132.500 on October 31 Total purchases on account during October were $281.000. Determine how much cash was paid on accounts payable during October b. On September 30, Valerian Co. had a $102,500 balance in Accounts Receivable. During October, the company collected $102,890 from its credit customers. The October 31 balance in Accounts Receivable was $89,000. Determine the amount of sales on account that occurred in October. c. During October, Alameda Company had $102,500 of cash receipts and $103,150 of cash disbursements. The October 31 Cash balance was $18,600. Determine how much cash the company had at the close of business on September 30. eBook Hint Complete this question by entering your answers in the tabs below. Print Required A Required B Required References On September 30, Valerian Co. had a $102,500 balance in Accounts Receivable. During October, the company collected $102,890 from its credit customers. The October 31 balance in Accounts Receivable was $89,000. Determine the amount of sales on account that occurred in October Accounts Receivable Ending balance $ 0 Use the information in each of the following separate cases to calculate the unknown amount. a. Corentine Co. had $152,000 of accounts payable on September 30 and $132.500 on October 31 Total purchases on account during October were $281,000. Determine how much cash was paid on accounts payable during October b. On September 30, Valerian Co. had a $102,500 balance in Accounts Receivable. During October, the company collected $102.890 from its credit customers. The October 31 balance in Accounts Receivable was $89,000. Determine the amount of sales on account that occurred in October c. During October, Alameda Company had $102,500 of cash receipts and $103,150 of cash disbursements. The October 31 Cash balance was $18,600. Determine how much cash the company had at the close of business on September 30. Complete this question by entering your answers in the tabs below. Required A Required B Required rences During October, Alameda Company had $102,500 of cash receipts and $103,150 of cash disbursements. The October 31 Cash balance was $18,600. Determine how much cash the company had at the close of business on September 30. Cash Ending balance 5