Answered step by step

Verified Expert Solution

Question

1 Approved Answer

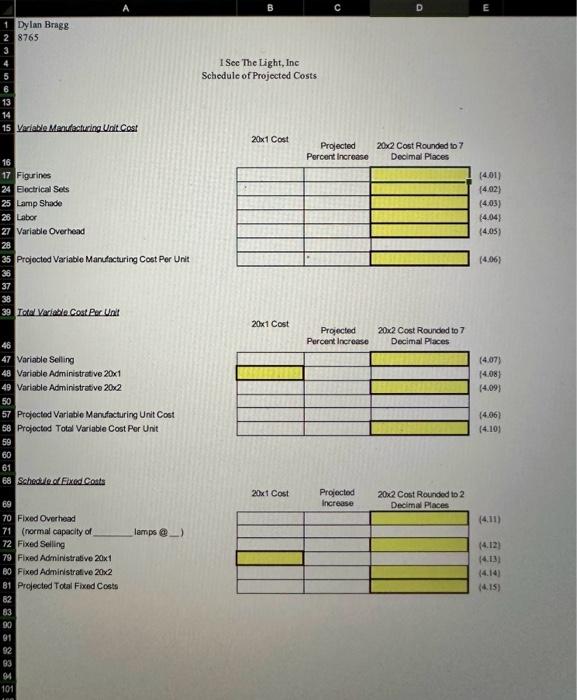

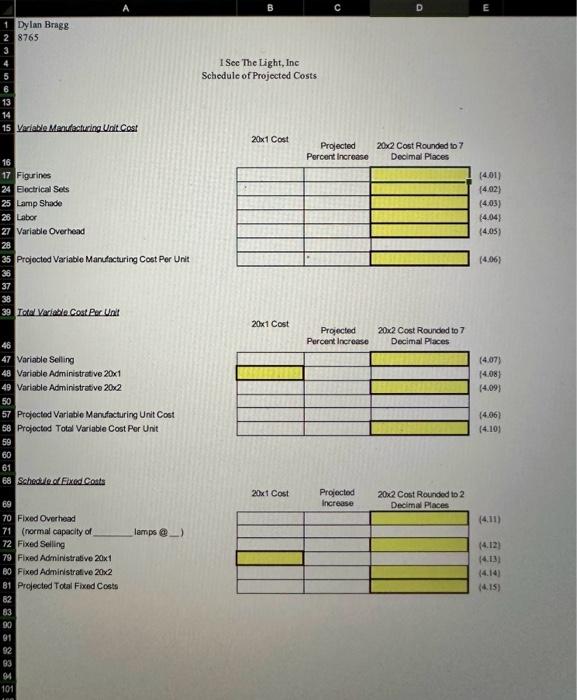

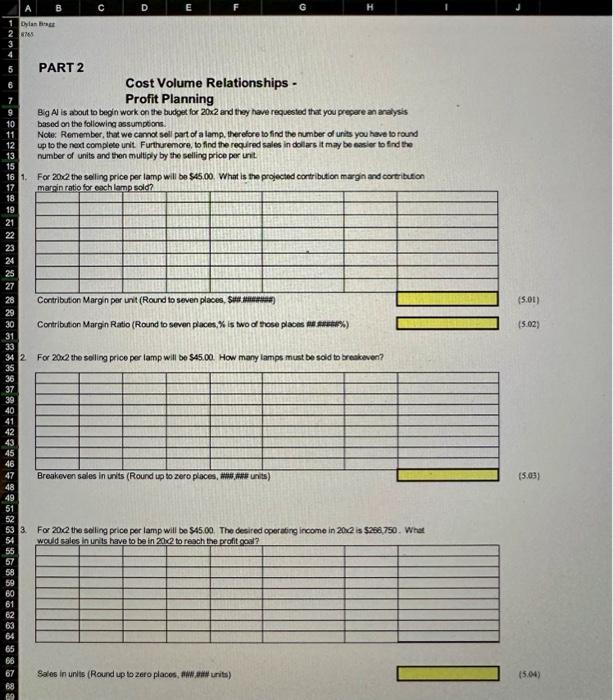

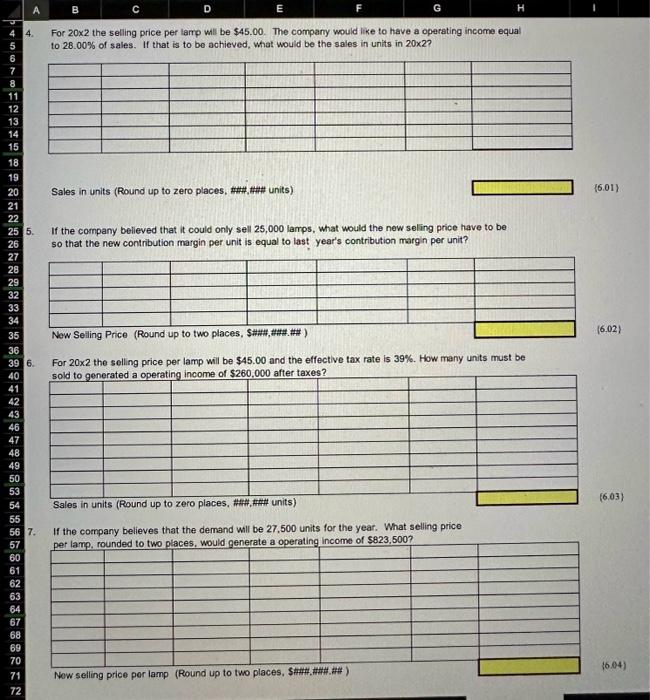

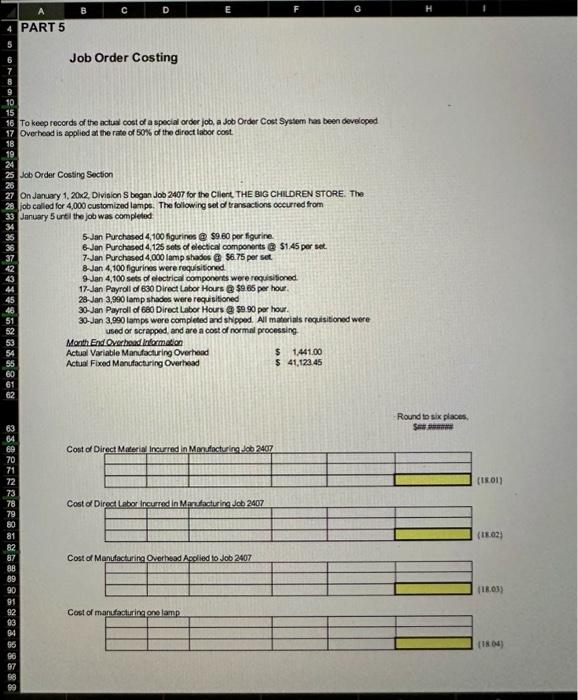

Use the information in the first two photos to solve for the yellow boxes. Any steps taken or cell references used in order to get

Use the information in the first two photos to solve for the yellow boxes. Any steps taken or cell references used in order to get the answers would be greatly appreciated. Thanks.

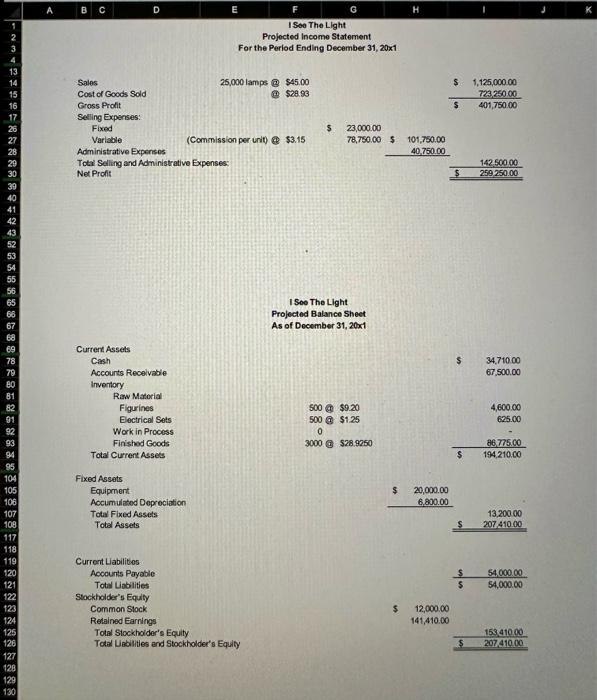

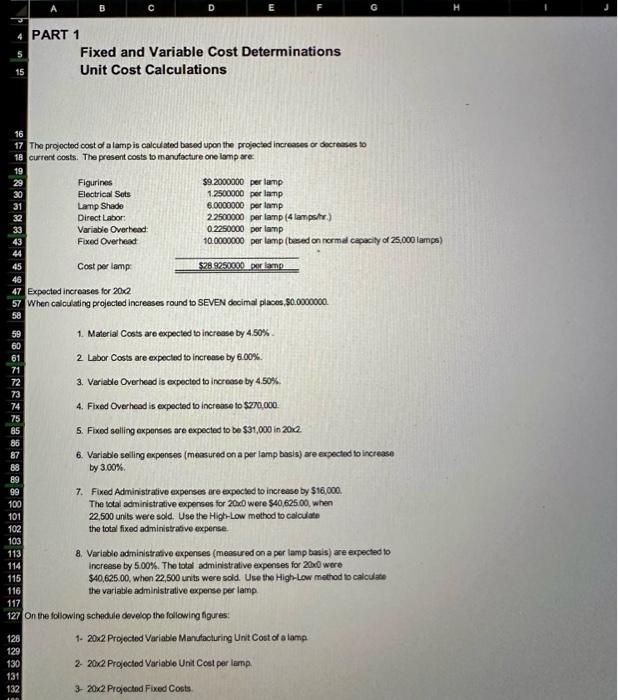

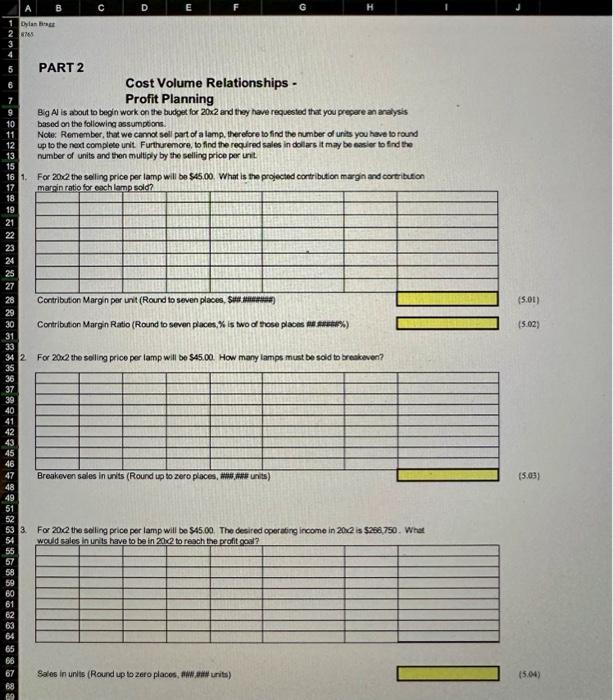

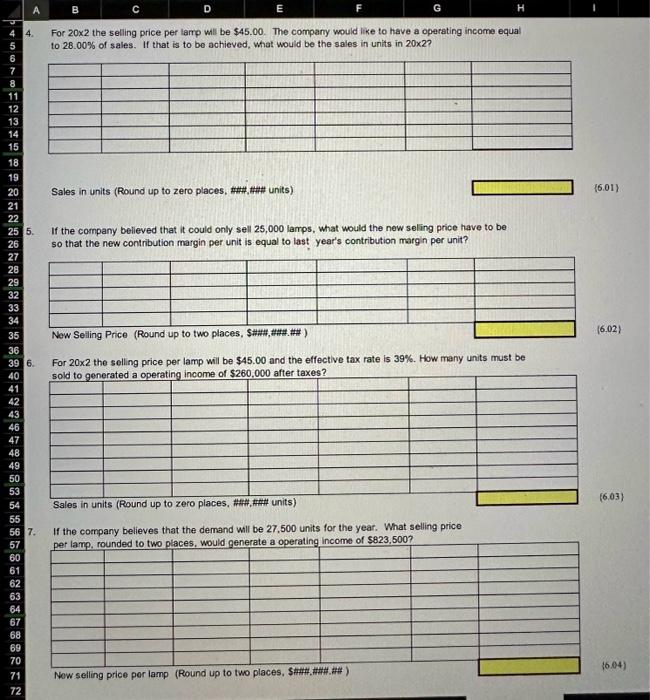

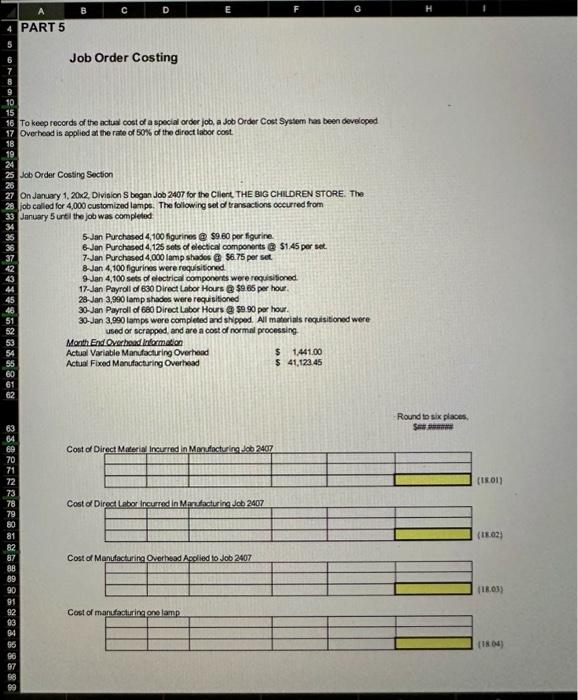

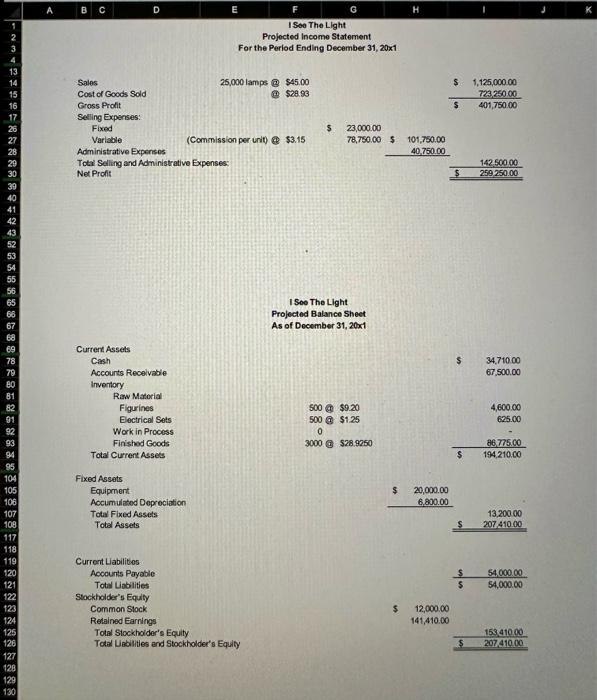

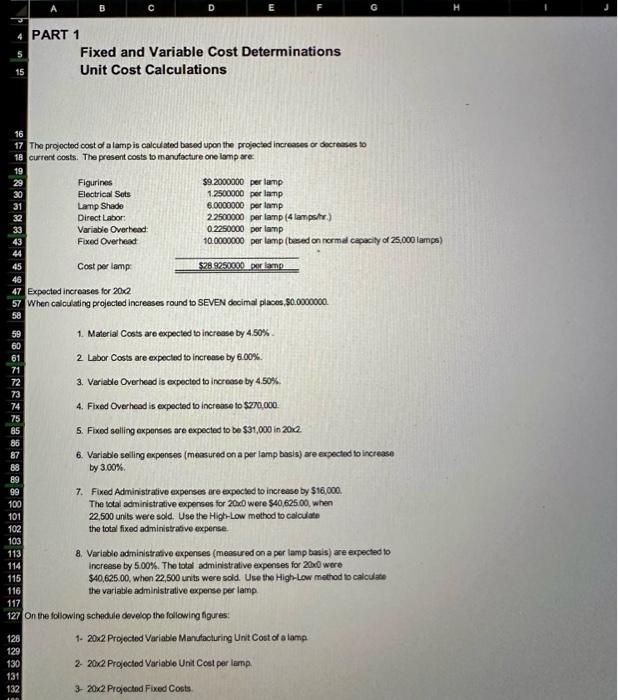

For 202 the selling price per lamp will be $45.00. The company would like to have a operating income equal to 28.00% of sales. If that is to be achieved, what would be the sales in units in 202 ? If the company believed that it could only sell 25,000 lamps, what would the new seling price have to be so that the new contribution margin per unit is equal to last year's contribution margin per unit? For 202 the selling price per lamp will be $45.00 and the effective tax rate is 39%. How many units must be If the company believes that the demand will be 27,500 units for the year. What selling price PART 2 Cost Volume Relationships - Profit Planning Big Al is about to begin work on the budoet for 202 and they have requested that you prepare an analysis based on the following assumptions. Notex Remember, that we camok sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to find the number of units and then multiply by the selling price per unt. 1. For 20 e. the seling price per lamp will be $45.00. What is the projectod cortribution margin and cortribution For 200 the selling price per lamp will be $45.00. How many lamps must be sold to treskeven? For 200 the seling price per lamp will be $45.00. The desired cperabing income in 2002 is $258,750. What Sales in units (Round up to zero places, Ant Antw units) ISee The Light, Ine IS Soe The Light Projected Income Statement For the Period Ending December 31, 20x1 Order Costing Section January 1,202, Diviaion 5 began Job 2407 for the Client, THE BIG CHELDREN STORE. The callod for 4,000 customirod lamps. The following set of transactions cecurred from uary 5 urti the job was completed: 5.Jan Purchased 4,100 fourines \& $9.60 per figurine. 6-Jan Purchased 4,125 sets of electical componerts iB $1.45 per set. 7.Jan Purchased 4,000 lamp shados a $6.75 por set. 8-Jan 4,100 figurines were requisitioned. 2.Jan 4,100 sets of electrical componerts were requisitioned 17. Jan Payroll of 630 Direct Labor Hours \& $9.65 per hour. 28.Jan 3,990 lamp shades were requisitioned 30-Jan Payrdil of 660 Direct Labor Hours 8990 per hour. 30-Jan 3,990 lamps wore completed and shipood. All materials requisitioned were used or scrapped, and are a cost of normal processing. Month End Overhood information Actual Variable Manufacturing Overthesd Actual Fixed Manufacturing Overhead $$1,441.0041,123,45 Cost of Cost Cost ot N Cont of For 202 the selling price per lamp will be $45.00. The company would like to have a operating income equal to 28.00% of sales. If that is to be achieved, what would be the sales in units in 202 ? If the company believed that it could only sell 25,000 lamps, what would the new seling price have to be so that the new contribution margin per unit is equal to last year's contribution margin per unit? For 202 the selling price per lamp will be $45.00 and the effective tax rate is 39%. How many units must be If the company believes that the demand will be 27,500 units for the year. What selling price PART 2 Cost Volume Relationships - Profit Planning Big Al is about to begin work on the budoet for 202 and they have requested that you prepare an analysis based on the following assumptions. Notex Remember, that we camok sell part of a lamp, therefore to find the number of units you have to round up to the next complete unit. Furthuremore, to find the required sales in dollars it may be easier to find the number of units and then multiply by the selling price per unt. 1. For 20 e. the seling price per lamp will be $45.00. What is the projectod cortribution margin and cortribution For 200 the selling price per lamp will be $45.00. How many lamps must be sold to treskeven? For 200 the seling price per lamp will be $45.00. The desired cperabing income in 2002 is $258,750. What Sales in units (Round up to zero places, Ant Antw units) ISee The Light, Ine IS Soe The Light Projected Income Statement For the Period Ending December 31, 20x1 Order Costing Section January 1,202, Diviaion 5 began Job 2407 for the Client, THE BIG CHELDREN STORE. The callod for 4,000 customirod lamps. The following set of transactions cecurred from uary 5 urti the job was completed: 5.Jan Purchased 4,100 fourines \& $9.60 per figurine. 6-Jan Purchased 4,125 sets of electical componerts iB $1.45 per set. 7.Jan Purchased 4,000 lamp shados a $6.75 por set. 8-Jan 4,100 figurines were requisitioned. 2.Jan 4,100 sets of electrical componerts were requisitioned 17. Jan Payroll of 630 Direct Labor Hours \& $9.65 per hour. 28.Jan 3,990 lamp shades were requisitioned 30-Jan Payrdil of 660 Direct Labor Hours 8990 per hour. 30-Jan 3,990 lamps wore completed and shipood. All materials requisitioned were used or scrapped, and are a cost of normal processing. Month End Overhood information Actual Variable Manufacturing Overthesd Actual Fixed Manufacturing Overhead $$1,441.0041,123,45 Cost of Cost Cost ot N Cont of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started