Question

Use the information provided to answer the following questions. 1. Compute the effect on Companys net income of software capitalization for the years 2002 -

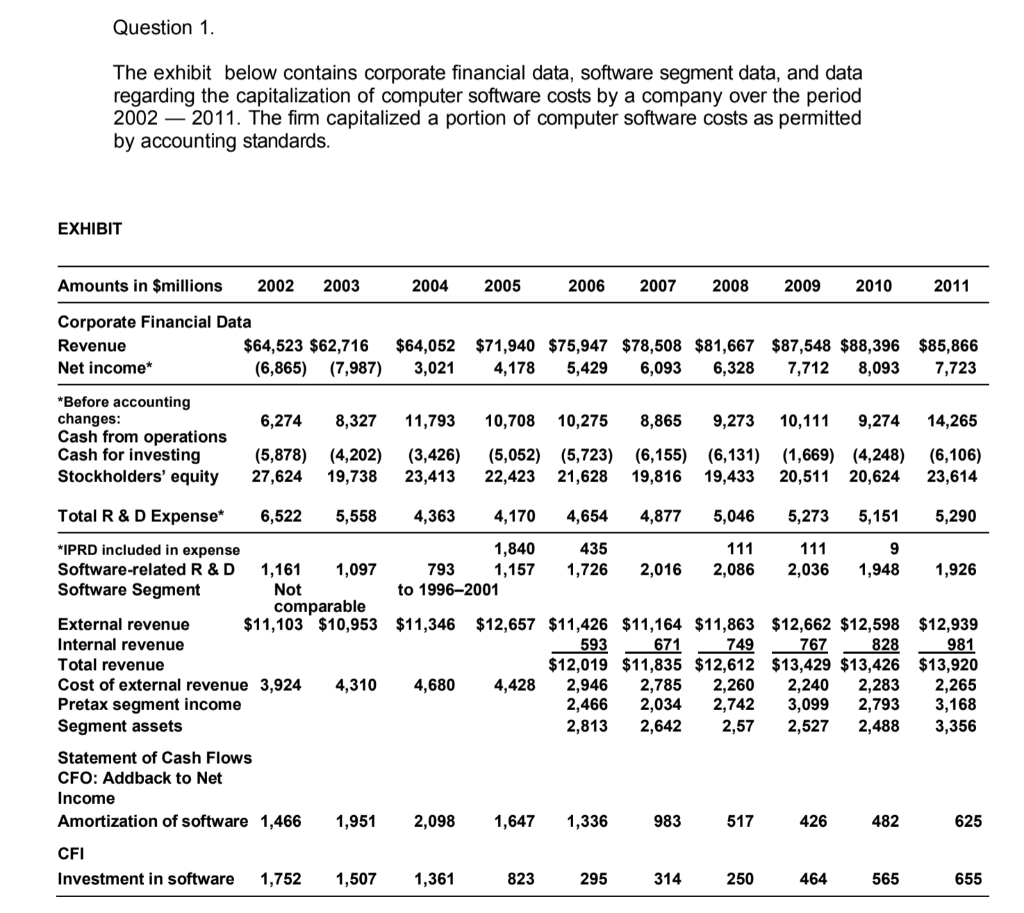

Use the information provided to answer the following questions. 1. Compute the effect on Companys net income of software capitalization for the years 2002 - 2011. Assume a 35% tax rate. 2. Compute the effect of software capitalization on the firms: (i) Cash from operations (ii) Cash for investment for the years 20022011. Discuss the effect of capitalization on the trend of both cash flow measures. 3. Compute the companys total spending on computer software (whether expensed or capitalized) over the period 2002 2011. Compute the percentage of spending that was capitalized each year. 4. Compute the year-to-year percentage change in the companys software segment external revenues for 20022011. Discuss the trend over that time period. 5. Compute the gross profit and gross profit percentage for external software revenues for 2002 2011. Discuss the trend in segment profitability over that period. 6. The company started disclosing total software revenues in 2006. Compute the pretax profit margin for the total software revenues for 20062011. Discuss the trend in segment profitability over that time period. 7. Compute the return on assets for the firms software segment over the 2006 2011 period. Discuss the trend in segment ROA over that period. Explain how the level and trend of segment ROA are affected by its accounting policies on R&D. 8. Discuss how the capitalization of software affectsROA in (i) Years with large - capitalized amounts (ii) Years with small - capitalized amounts 9. Compute the total R&D expenditures (including amounts capitalized) over the period 20022011 and compute total expenditures as a percentage of total Corporate revenues.

very very urgent

Question 1. The exhibit below contains corporate financial data, software segment data, and data regarding the capitalization of computer software costs by a company over the period 2002 - 2011. The firm capitalized a portion of computer software costs as permitted by accounting standards. EXHIBIT Amounts in $millions 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Corporate Financial Data Revenue $64,523 $62,716 Net income* (6,865) (7,987) $64,052 3,021 $71,940 $75,947 $78,508 $81,667 $87,548 $88,396 $85,866 4,178 5,429 6,093 6,328 7,712 8,093 7,723 6,274 8,327 11,793 10,708 10,275 8,865 9,273 10,111 9,274 14,265 *Before accounting changes: Cash from operations Cash for investing Stockholders' equity (5,878) 27,624 (4,202) 19,738 (3,426) 23,413 (5,052) (5,723) (6,155) (6,131) 22,423 21,628 19,816 19,433 (1,669) (4,248) (6,106) 20,511 20,624 23,614 Total R & D Expense* 6,522 5,558 4,363 4,170 4,654 4,877 5,046 5,273 5,151 5,290 *IPRD included in expense 1,840 435 111 111 9 Software-related R&D 1,161 1,097 793 1,157 1,726 2,016 2,086 2,036 1,948 1,926 Software Segment Not to 1996-2001 comparable External revenue $11,103 $10,953 $11,346 $12,657 $11,426 $11,164 $11,863 $12,662 $12,598 $12,939 Internal revenue 593 671 749 767 828 981 Total revenue $12,019 $11,835 $12,612 $13,429 $13,426 $13,920 Cost of external revenue 3,924 4,310 4,680 4,428 2,946 2,785 2,260 2,240 2,283 2,265 Pretax segment income 2,466 2,034 2,742 3,099 2,793 3,168 Segment assets 2,813 2,642 2,57 2,527 2,488 3,356 Statement of Cash Flows CFO: Addback to Net Income Amortization of software 1,466 1,951 2,098 1,647 1,336 983 517 426 482 625 CFI Investment in software 1,752 1,507 1,361 823 295 314 250 464 565 655 Question 1. The exhibit below contains corporate financial data, software segment data, and data regarding the capitalization of computer software costs by a company over the period 2002 - 2011. The firm capitalized a portion of computer software costs as permitted by accounting standards. EXHIBIT Amounts in $millions 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Corporate Financial Data Revenue $64,523 $62,716 Net income* (6,865) (7,987) $64,052 3,021 $71,940 $75,947 $78,508 $81,667 $87,548 $88,396 $85,866 4,178 5,429 6,093 6,328 7,712 8,093 7,723 6,274 8,327 11,793 10,708 10,275 8,865 9,273 10,111 9,274 14,265 *Before accounting changes: Cash from operations Cash for investing Stockholders' equity (5,878) 27,624 (4,202) 19,738 (3,426) 23,413 (5,052) (5,723) (6,155) (6,131) 22,423 21,628 19,816 19,433 (1,669) (4,248) (6,106) 20,511 20,624 23,614 Total R & D Expense* 6,522 5,558 4,363 4,170 4,654 4,877 5,046 5,273 5,151 5,290 *IPRD included in expense 1,840 435 111 111 9 Software-related R&D 1,161 1,097 793 1,157 1,726 2,016 2,086 2,036 1,948 1,926 Software Segment Not to 1996-2001 comparable External revenue $11,103 $10,953 $11,346 $12,657 $11,426 $11,164 $11,863 $12,662 $12,598 $12,939 Internal revenue 593 671 749 767 828 981 Total revenue $12,019 $11,835 $12,612 $13,429 $13,426 $13,920 Cost of external revenue 3,924 4,310 4,680 4,428 2,946 2,785 2,260 2,240 2,283 2,265 Pretax segment income 2,466 2,034 2,742 3,099 2,793 3,168 Segment assets 2,813 2,642 2,57 2,527 2,488 3,356 Statement of Cash Flows CFO: Addback to Net Income Amortization of software 1,466 1,951 2,098 1,647 1,336 983 517 426 482 625 CFI Investment in software 1,752 1,507 1,361 823 295 314 250 464 565 655Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started